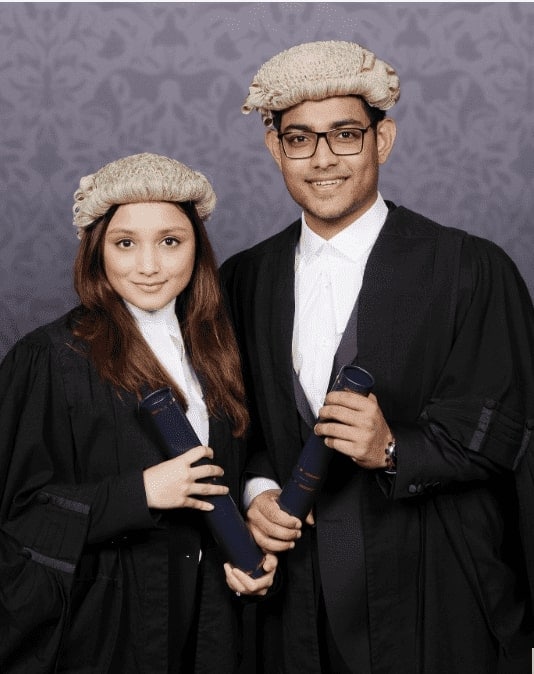

Elite law firm in bangladesh

In banking disputes, courts have typically sided with consumers and granted them relief.

Banks and financial institutions that provide consumers with financial services must deal with a variety of claims involving:

- Enforcement of arbitration clauses in credit card contracts for consumers.

- Disputes regarding the bank or financial institution’s fees, interest rates, and other contractual terms.

- Reverse redlining and discriminatory credit practices.

- The protection of customer data and other cybersecurity concerns.

- Insurance protection

- Lien validity.

- Contracts for loan modification and forbearance.

- Fraudulent debt management or the fraudulent management of the customer’s funds.

- Court proceedings initiated under various statutes, including the Consumer Protection Act, the Banking Ombudsman Scheme, the Insurance Regulatory Development Authority Act, the RBI Notifications, Regulations, and Circulars, etc.

- Arbitration that is unlawful or biased in consumer disputes.

Recognised by the world leaders

Regarded as the Best Banking law firm in Bangladesh

IFLR 1000 2023 Ranking

Legal 500 Best law firm.

ITR World Tax Law Firm

Leading our field, serving your world.

In Banking disputes in which banks have acted contrary to the guidelines, circulars, or notifications of BB, the decision has favored the consumer. In one instance, the respondent had accumulated deposits at a bank that subsequently merged with the petitioner bank. However, upon the maturity of the deposits, the petitioner bank refused to pay interest to the respondent because the deposited amount had not been renewed within the BB-mandated time frame.

The National Commission was of the opinion that banks must notify depositors of any policy decision that could deny or limit the interest that is to be paid on deposits. Thus, it was determined that the consumer (depositor) would be entitled to interest and compensation from the bank if the bank only returned the principal amount to the depositor without interest.

In numerous other decisions, courts have demonstrated a propensity to favor individual consumers when granting relief. According to the Supreme Court, a bank may be held liable for an unauthorized withdrawal and ordered to reimburse the consumer with interest and costs.