Corporate Tax in Bangladesh in 2024 Under $2(20) of the Ordinance, a "company" means a company as defined in the...

Corporate Tax in Bangladesh in 2024 Under $2(20) of the Ordinance, a "company" means a company as defined in the...

How to get VAT registration certificate in Bangladesh Every business in Bangladesh must have a unique Business...

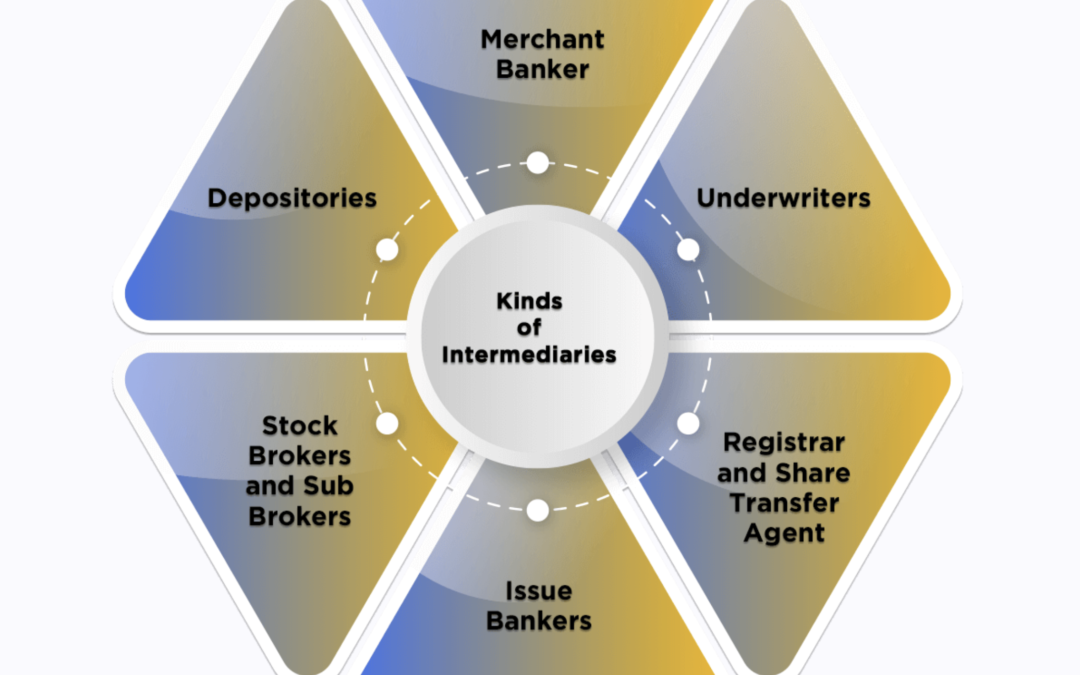

Issue Management for IPO in Bangladesh: How to start a Public Issue A Lead Manager at a commercial or investment bank...

Provident Fund Laws: What Is the Difference Between a Provident Fund and a Pension Fund? Key Differences between...

Procedures To Get Tax Exemption Certificate in Bangladesh A tax exemption is the reduction or elimination of a...

This article will explain in details about formation and registration of a Private Limited Company in Bangladesh as...

How to take foreign loans in Bangladesh in 2023 | Step by step process of getting loan from foreign entities11 Jan...

Procedure of Foreign Investment in Bangladesh 2020| Law, Policy, Direct, Angel, Rules, Policy- Everything you need to...

Mergers and Acquisitions in Bangladesh - Efficient steps in 2023 - M&A ProcessTahmidur Rahman Director and Senior...

Bangladesh Business Law - Top Commercial Law Firm in Dhaka BangladeshBusiness Visa in Bangladesh | Types and...

How to do Tax Submission in Bangladesh | Complete Overview of Income Tax, Customs Duties, VAT.Tahmidur Rahman, Senior...

Regulations of Microcredit & Financial Institutions in Bangladesh Tahmidur Rahman, Senior Associate 5 Aug...