Cheque dishonour or bounce in Bangladeshi Law in 2024 – What should you do?

What to do When Cheque Dishonour or Bounce in Bangladesh? How can you take legal actions to retrieve your money? This post provides COMPLETE OVERVIEW OF HOW TO DEAL WITH CHEQUE DISHONOURING IN BANGLADESH.

Cheque Dishonour or Bounce in Bangladesh

Currently, even a business organisation in Bangladesh like MANY OTHER COUNTRIES, without maintaining a bank account, can not operate its daily activities. Despite the massive development in the recent past in BANGLADESH OF ALTERNATIVE delivery channels such as Internet Banking, BEFTN (Bangladesh Electronic Funds Transfer Network), RTGS (Real Time Gross Settlement) and many other aspects of digital banking, people are still comfortable enough to use checks for personal and business transactions. In the case of large-scale TRANSACTIONS, the use of checks is obviously the best way in our country because of security issues.

The possibility of a check being dishonoured is significantly high due to the high number of transactions through this mode. The receiver of checks must therefore have sufficient and effective legal redress, which they can consider when faced with this situation. Recently, in a case of dishonouring the test, a well-known film actor has been accused and filing these cases is almost regular occurrences with different courts across our country. People deliberately issue checks without making funds available in their bank accounts due to a lack of integrity and ethical practice. It may only seem to be a misdemeanour, it is, in fact, a serious crime.

Cheque Dishonour or Bounce – In Laws of Bangladesh

1. The most vital LAW ENACTED TO PROVIDE LEGAL REMEDY TO SUCH A SITUATION IS THE NEGOTIABLE INSTRUMENTS ACT, 1881 (Act No. XXVI of 1881). Section 6 of this Act established what constitutes a cheque, stating that’ a bill of exchange drawn on a stated banker and not presented as payable other than on order.’ In addition, in the case of laws, a check was also known as an order on a borrower by a lender to pay the whole or part of a debt to another person.

2. If a check is not cleared because of insufficient funds or if the debtor who issued the check to the lender ordered his bank to dishonor the check or for any other reason, then the remedy will be under Section 138 of the above Act.

3. Section 138 of the Negotiable Instrument Act, 1881 makes it clear that, whenever a check is bounced, it is then accepted as correct until it is otherwise proved that an unscriptural guilt is created which involves punishment of a criminal nature which may include 01 (one) year of captivity or fine, which may extend to three times the value of the dishonoured check or both. In addition, the person who is regrettable also has a civil remedy under the same section, and in order to obtain the civil remedy, the person has to take some steps.

4. The first issue to be assessed by the court is whether the check has been presented to the bank for withdrawal within six months of the person being dismissed. If the check has been presented to the bank for withdrawal any time after it has been given to the regrettable person for six months, then the court will not allow the claim. Considering that the check has been submitted within a valid period of time and if it is dishonored, then pursuant to Section 138 of the Negotiable Instrument Act, 1881, the unfortunate person must send a written notice by registered post with acknowledgement due to the person who gave the check claiming the money back.

6. It should be remembered that the crime of dishonor of the search referred to in section 138 of the Act is considered a criminal offence. The legislation was aimed at punishing and not obtaining a due sum. Nevertheless, the section retains the possibility of restitution as the owner of the check can be paid by the court an amount of any fine recovered up to the check value. If someone wants to recover cash that has not been discovered then he or she will file a civil SUIT FOR MONEY recovery. In reality, however, it was found that filing a criminal proceeding under s.138 was the most effective way to recover money.

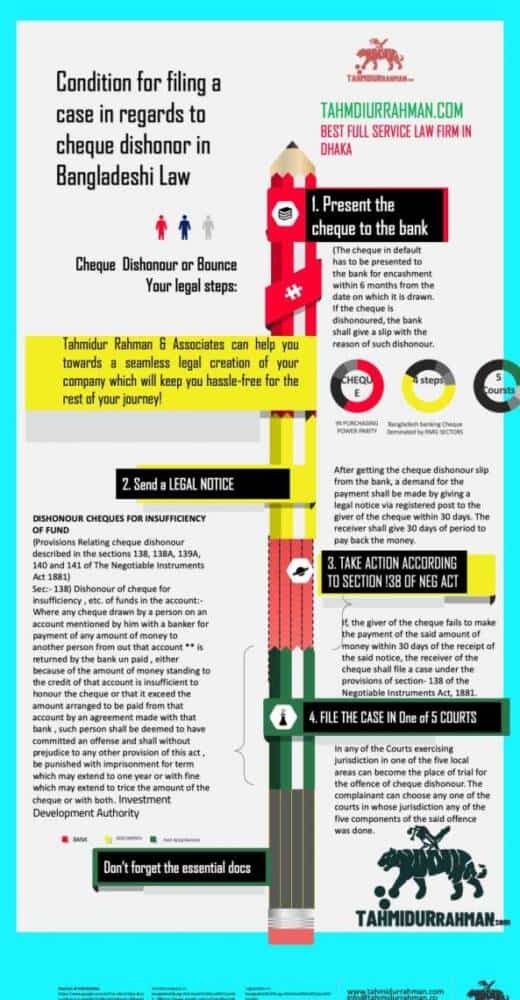

Hence the conditions for filing a case when Cheque Dishonours or Bounce in Bangladsh :

Step by Step Process for filing a case for Cheque Dishonour or Bounce in Bangladesh

The recipient of the check may file a case against the applicant under the following conditions:

(A) Submitting the check to the bank:

The default check must be submitted to the bank for encashment within 6 months from the date it is drawn. If the check is dishonored, due to such dishonour, the bank shall give a slip.

(B) Legal Notice:

Upon obtaining a check dishonor slip from the bank, the payment application shall be made by notifying the giver of the check within 30 days by registered post. The recipient will give the money back for 30 days.

(C) Implementing Section 138

Unless, within 30 days of receiving the notice, the giver of the check fails to make the payment of the said amount of money, the receiver of the check shall file a case under section 138 of the Negotiable Instruments Act, 1881.

NOW WHERE AND HOW TO FILE A CASE FOR CHEQUE DISHONOUR OR BOUNCE IN BANGLADESH

The recipient of the check may file a case against the applicant under the following conditions:

When the owner presents the check for encashment to a bank, he will bring in court the claim for check dishonor that has local jurisdiction over that bank.

The offense of check dishonor can be completed with the emphasis on certain specifics:

i) drawing of the check,

ii) presenting the check,

ii) returning the check unpaid by the drawee bank,

iv) giving written notice to the drawer of the check demanding payment of the check sum,

v) failure of the drawer to make payment within 30 days of receipt of the notice.s of receiving the notice, the giver of the check fails to make the payment of the said amount of money, the receiver of the check shall file a case under section 138 of the Negotiable Instruments Act, 1881.

Now, if the above five different acts were carried out in five different locations, one of the courts exercising jurisdiction in one of the five local areas could become the place of trial for the offense of cheque dishonour. The plaintiff may select any of the courts in whose jurisdiction any of the five components of the said offense have been made.

Essential documents you need if you would like to file a case against a dishonoured cheque in Bangladesh

- The dishonoured cheque

- Bank slip regarding cheque dishonour

- Copy of legal notice

- Postal receipt and acknowledgment letter of legal notice

- Copy of newspaper where legal notice is published, if any

- Authorization letter or power of attorney if ‘Authorized Agent’ files the case

- List of WITNESSES

- Costs of the case such as Court fee, lawyer’s fee etc.

- Government or private legal aid if unable to bear the costs of the case

- Intention to go for settlement with the offender to get the money.

CLICK HERE TO MAIL US IF YOU HAVE ANY LEGAL QUERIES REGARDING THIS

OR CALL US ON : +8801847220062 OR +8801779127165

“Tahmidur Rahman|The Legal Source is Considered as one of the leading firms in Banking Law in Bangladesh”

Telegraph Bangladesh

PENALTY FOR CHEQUE DISHONOUR or Bounce in Bangladesh:

The offender who commits the dishonor of the cheque shall be punished with imprisonment for a term of up to one year or with a fine of up to three times the value of the cheque or both.

Skyscrapers in Bangladesh

FAQ

What is a Cheque Dishonour in Bangladesh?

Dishonoured checks are ones that the bank on which they are drawn declines to honor (pay). Non-sufficient funds (NSF), which denotes that there are not enough cleared funds in the account on which the check was drawn, is the most frequent cause for a bank to refuse to honor a check. [1] A bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check are all terms that might be used to describe an NSF check. Such checks are often returned with the endorsement “Refer to drawer,” instructing the recipient to get in touch with the check’s issuer for a justification of why it wasn’t cashed.

What are the differences between cheque bounce and Dishonour?

The sole difference between a cheque bounce and a cheque dishonour is that a cheque dishonour happened because of a distinguishing signature, an incorrect date, etc. However, the reason the check bounced was because there weren’t enough funds in the drawer’s account.

Can I present the dishonoured cheque again for a second time?

Yes, even if the check was previously dishonored, you may still bring it to the bank for payment. It should go without saying that the check can only be presented in the bank once while it is still valid. The typical check’s validity term is three months.

What are the reasons for refusing a cheque in Bangladesh by a Bank?

Any major bank may refuse to honor a check if there aren’t enough cleared funds in the account to cover it. Additional justifications for not honoring a check include:

- The account holder instructs the bank not to pay the cheque, which is known as a stopped cheque; the account holder’s funds are frozen;

- the account does not actually exist because a false cheque was presented; the cheque’s date is outside the time frame allowed by law;

- the signature on the cheque does not match the signature on file of the account holder or another authorized signatory on the account;

- or the cheque is damaged.There are also further justifications for payment refusal as per Bangladeshi law.

Under Negotiable instrument is Section 138 a bailable offence?

A violation of Section 138 constitutes a non-cognizable offense. Additionally, it is an offense that is subject to bail. Section 138 violation will consist of the following elements: Drawing a check by the drawer to pay off a debt or other obligation

Is it a criminal offence when a cheque gets bounced in Bangladesh?

A violation of Section 138 constitutes a non-cognizable criminal offense. Additionally, it is an offense that is subject to bail. Section 138 violation will consist of the following elements: Drawing a check by the drawer to pay off a debt or other obligations.

Can I file cheque bounce case after 30 days under NI 138?

A complainant and/or the person holding the check in good faith are obligated under Section 138(b) of the Act to notify the accused within 30 days of receiving notification from the bank that the check or other instrument has been dishonored.