Payments Trends and Cross-border transactions

Each transaction consists of two components: receipts and payments. This is the accounting golden rule. The same applies to international transactions. For example, a buyer makes payments to a seller, who then receives payment for the transaction. On the other hand, an importer transfers funds to a bank for international transfer to the supplier. Thus, a transaction occurs.

It is commonly believed that hundi circumvents legal transactions. In order to conceal money laundering, formal channels can also facilitate illicit transactions by over-invoicing imports and under-invoicing exports. It is possible to conduct international transactions without the assistance of banking channels.

These are accomplished through two channels: current transfers and financial or capital transfers.

Foreign Exchange Regulation Act of the country defines current account transactions as –

(i) receipts and payments due in connection with foreign trade, other current business including services, and normal short-term banking and credit facilities in the ordinary course of business;

(ii) receipts and payments due as interest on loans and as net income from investments; and

(iii) moderate amounts of amortisation of loans or for depreciation of direct investments.

Capital account transaction is a transaction for the creation, modification, transfer, or liquidation of a capital asset, including but not limited to securities issued in capital and money markets, negotiable instruments, non-securitised claims, units of mutual fund or collective investment securities, commercial credits and loans, financial credits, surety bonds, guarantees, deposit account operations, life insurance, personal capital movements, and real estate.

The taka is theoretically freely convertible for current account transactions. It means that regulator approval is not required for transactions on current accounts. However, insiders hold differing opinions; under general authority, banks are permitted to execute transactions within the indicative limit.

To exceed the authorization, central bank approval is required. Despite the fact that ease of doing business is a topic that is frequently discussed, discord is caused by contradictory perspectives in business transactions.

Open are transactions under capital account for inward investments such as direct investments and portfolio investments. Other transactions require government authorization.

As Taka is not convertible for outward remittances on capital account transactions, the central bank monitors every transaction under current account. Every import payment is subject to documentary proof by the entry of corresponding goods; each export shipment must be accompanied by incoming payments.

Every outbound transfer must be reported to the central bank. All of these measures are intended to prevent capital transfers disguised as current payments. It is debatable whether the monitoring system produces effective results.

Ongoing international efforts are made to address obstacles and frictions in cross-border payments.

For the next phase of work under the G20 Roadmap for Enhancing Cross-Border Payments, the Financial Stability Board (FSB) published a report in February 2023 detailing actions to be taken on payment system interoperability, legal, regulatory, and supervisory frameworks, and cross-border data exchange.

Prior to the G20 Roadmap’s 2027 deadline, the FSB makes it clear that much work remains to be done to improve the cost, speed, accessibility, and transparency of cross-border payments.

What to expect in future about cross border transactions

The Taka is presumed to be fully convertible for capital account transactions. In this situation, it is questionable whether a monitoring framework is required. Such a monitoring mechanism is disregarded by the central banks of countries with a convertible capital account framework. They simply gather data to generate various macroeconomic reports.

If current account transactions were fully convertible in the true sense and capital account transactions were partially convertible, the demand for shadow transactions would have decreased. Consequently, a framework for monitoring cross-border transactions would have been superfluous.

For money to be transferred under the guise of current accounts through banking channels or shadow channels, foreign currency inflows are required. Balance of payments displays incoming and outgoing funds. Exports account for more than fifty percent of total inflows, followed by wage remittances.

Exporters are required to submit regulatory declarations regarding their exports of goods, for which payments must be repatriated within four months of shipment date. In the absence of repatriation, exporters may face regulatory actions and be denied policy supports such as cash incentives, bond facilities, low-interest loans, etc. The use of autopilot for the repatriation of export profits is effective.

In addition to the export of physical goods, international service delivery according to mode 1 of the GATS is considered an export of services.

Consultancy, law, engineering, accounting, and information technology are a few examples. The central bank permits service exporters to retain a significant portion of their foreign currency inflows to cover expenses, as the service industry is deemed a promising sector.

Despite this, the sector has yet to demonstrate a significant position in international transactions.

There are complaints that service exporters do not properly repatriate earnings. According to industry insiders, the underlying reason is that service exporters require outward remittances for which required tax payments impose an additional cost burden.

Sendings from Bangladeshi expatriates are the second largest source of foreign income. It is not required that non-residents send their earnings abroad. Non-residents may use the income in their home country. We are all aware that the majority of residents in megacities like Dhaka come from rural and urban areas.

There are white collar, blue collar, and red collar jobs, among others. People who fall under the white category typically save money and invest in capital goods, such as real estate. They occasionally send money to their village of origin. Frequently, others send money. But income generated in megacities is not required to return to its earners’ origins.

The same is true for non-residents, who send modest amounts of money home. Only blue collar workers consistently send money home.

The demand for international transactions conducted through shady channels generates alternative foreign exchange markets. The foreign exchange rate for incoming remittances is higher than that for export receipts. A higher rate for wage receipts indicates that the remittances are exchanged for transfer in another manner.

Now comes the question of which fund is sent overseas by adjusting wage remittances. Unquestionably, restrictions on outward remittances and relevant formalities result in shadow markets.

Not generally permissible for which specific approval is required are payments of this nature. It is true that where there is a demand, a market will form. If demand is eliminated, the market will cease to exist.

If we see other countries alongside Bangladesh, in Europe, changes will be compelled by regulators, such as instant euro payments in the EU. In light of the slow market adoption of technology to process instant euro payments, the Commission proposes to implement the so-called Instant Payments Regulation.

This would require payment service providers that offer euro credit transfers to offer instant euro payments at the same or a lower fee than that applicable to euro credit transfers that are not instant.

In accordance with the G20 Roadmap’s priorities, global regulators and market participants will work to advance payment system interoperability, including interlinking arrangements for payment systems that reduce reliance on intermediaries by allowing banks and other payment service providers to transact directly.

Additionally, domestic advancements will allow the focus to shift abroad. For instance, in the United States, the Federal Reserve anticipates launching the FedNow Service, a new instant payment service that would allow consumers and businesses to settle payments almost instantly through deposit accounts with banks that maintain a master account at a Federal Reserve Bank.

The Federal Reserve has stated that, at launch, the FedNow Service will only support domestic payments between US depository institutions; however, if access is expanded to non-US financial institutions in the future, the service could be used to facilitate cross-border payments.

Central bank digital currencies

More than 114 countries, representing over 95% of global GDP, are examining the potential benefits of central bank digital currencies (CBDCs) – a digital representation of fiat currency issued by a central bank. A few nations, including the Bahamas and Jamaica, have already implemented CBDCs, whereas the majority are still in pilot or research stages.

Despite the fact that some CBDCs are based on blockchain or distributed ledger technology (DLT), many jurisdictions are investigating a variety of alternative technologies.

What are the implications of these developments for Bangladesh? A digital taka (e-taka) could make the payment system more efficient and affordable. Currently, it takes 30 minutes and a surcharge of 100 taka to transfer 1 lac taka via the real-time gross settlement service between 10 a.m. and 3 p.m.

In Europe, payment processing takes only 10 seconds and costs €0.002 per transaction (equivalent to 20 paisa in Bangladesh). An e-taka will also save hundreds of billions of taka in printing costs. For instance, it costs eight taka to print a one thousand taka note and nearly two taka to mint a five taka coin.

The most significant advantage of e-taka, however, is that it will enable the government to track its expenditures for development and other operational services.

Therefore, it will be extremely difficult, if not impossible, for public officials who take advantage of stealing and accumulate physical money because it takes the government time to identify them (often they are identified right after their retirement) to steal public e-money.

Similarly to how the introduction of the electronic government procurement (E-GP) system has increased the quality and competitiveness of public project bidding, the mandatory use of e-taka in public works will make the system more transparent and combat corruption.

Concept of Digital Taka

A digital taka can provide unanticipated benefits in our personal lives.

For instance, parents will be able to track where their children spent their money, thereby reducing misuse. In addition, digital currency can be programmed to exclude certain transactions. A diabetic patient, for instance, may not be able to purchase unhealthy food with digital taka or digital currency. We can also track the expenditure of our zakat and sadaqah contributions.

All these advantages come at the expense of our highly valued privacy in Bangladesh. As a result, it is believed that the CBDC will be most successful in China, where Chinese citizens are most accustomed to being monitored by their government.

In conclusion, CBDCs can theoretically be extremely potent in the sense that they can displace credit cards and banks. However, this will defeat the purpose of the system.

Despite the fact that the new competition from CBDCs is likely to make banking services cheaper, faster, and more equitable. Whether digital currency is administered by private banks or a central bank, the greater concentration of digital currency will make the system more susceptible to cyberattacks.

China invented paper currency in the seventh century and monopolized the issuance of currency in the eleventh century. It is therefore not surprising that the People’s Bank of China is the first major central bank to introduce an e-currency.

In the coming years, the Fed, the ECB, and other central banks will likely issue their own CBDCs. CBDCs could serve as an effective countermeasure to cryptocurrencies and have the potential to become the predominant medium of exchange.

Numerous CBDC projects emphasize domestic retail. However, international standard-setting organizations such as the Bank for International Settlements (BIS) are promoting the use of CBDCs to facilitate international payments. Solving the interoperability problem between initiatives is crucial.

What to expect form Central bank digital currencies in 2023

Changes will be compelled by regulators, such as instant euro payments in the EU. In light of the slow market adoption of technology to process instant euro payments, the Commission proposes to implement the so-called Instant Payments Regulation.

This would require payment service providers that offer euro credit transfers to offer instant euro payments at the same or a lower fee than that applicable to euro credit transfers that are not instant.

In accordance with the G20 Roadmap’s priorities, global regulators and market participants will work to advance payment system interoperability, including interlinking arrangements for payment systems that reduce reliance on intermediaries by allowing banks and other payment service providers to transact directly.

Additionally, domestic advancements will allow the focus to shift abroad. For instance, in the United States, the Federal Reserve anticipates launching the FedNow Service, a new instant payment service that would allow consumers and businesses to settle payments almost instantly through deposit accounts with banks that maintain a master account at a Federal Reserve Bank.

The Federal Reserve has stated that, at launch, the FedNow Service will only support domestic payments between US depository institutions; however, if access is expanded to non-US financial institutions in the future, the service could be used to facilitate cross-border payments.

Stable-coins:

Stablecoins, in contrast to CBDCs, are privately issued DLT-based cryptoassets that include a mechanism to minimize price fluctuations and “stabilize” their value.

Their objective is to create an alternative form of low-risk digital unit that businesses and consumers can use directly. The most prevalent potential stabilisation method is the collateralised stablecoin model, which achieves stability by linking the currency to a reserve of stable real assets, such as fiat currencies or commodities.

Alternate options include crypto-collateralized stablecoins (where a reserve is comprised of other cryptocurrencies) and uncollateralized stablecoins (which do not have any reserve but instead use central bank-like monetary policy to maintain a fixed price by controlling supply with algorithms which respond to market conditions).

Since the failure of Libra/Diem, global regulators have been closely monitoring stablecoin market developments, and the collapse of USD Terra last year has heightened their concerns.

This has prompted several jurisdictions, including the United Kingdom, to prioritize the creation of a regulatory framework for stablecoins over other cryptoassets in their draft Financial Services and Markets Bill.

In addition to the regulatory framework for cryptoassets and security tokens that will be implemented in 2020, Japan is currently implementing a framework for the issuance and distribution of stablecoins.

In contrast, the EU’s new Markets in Crypto-Assets Regulation (MiCA) will introduce a comprehensive new regulatory framework for the issuance and sale of all cryptoassets, as well as significant additional requirements for the sale of stablecoins.

In the United States, a number of bills to regulate stablecoin issuers have been proposed, each imposing variations of bank-like requirements (such as FDIC insurance, chartering framework, and liquidity requirements), but none have reached the floor of the US Congress for a vote.

What follows?

The EU’s MiCA will be formally adopted in 2023, with some of its provisions becoming applicable in 2024. It is also anticipated that the Financial Services and Markets Bill will be passed in 2023. With the introduction of these regimes, stablecoins can be utilized in more conventional consumer and wholesale settings.

Additionally, there will be additional legislative and regulatory changes in additional jurisdictions.

In the United States, we anticipate the introduction of new legislation and the continuation of debate on the appropriate regulatory framework for stablecoin issuers, including how to address uncollateralized or algorithmically-stabilized stablecoins such as USD Terra and the extent to which stablecoin issuers may be regulated like banks.

Operational resilience

Increasing digitalization of customer experiences, increased automation of internal processes, and increased use of third-party service providers all make businesses more susceptible to technological disruptions and hence Operational resilience is extremely important for companies in 2023.

Due to the financial, reputational, and societal consequences of high-profile IT failures, operational resilience (or ensuring the continuity of essential business services) remains a top priority for boards, regulators, and customers.

Bangladesh’s achievements over the course of this 50-year partnership with World Bank have vastly surpassed the initial World Bank assessments conducted in the early 1970s.

Since this initial emergency credit, the World Bank has committed approximately $39 billion in funding from the International Development Association (IDA) in the form of grants, interest-free loans, and concessional credits to assist the country in developing its indigenous strategies to address its most pressing development challenges.

With approximately $15 billion in ongoing programs, Bangladesh has the largest IDA program in the world at the present time. The World Bank is also the largest development partner for Bangladesh.

Bangladesh has made remarkable progress in numerous areas, but three strategic development decisions it has made over the years have yielded the greatest returns: investing in people, empowering women, and preparing for disasters and adapting to climate change.

Bangladesh quickly realized that investing in people is equally as important as investing in infrastructure. In 1972, the life expectancy was less than 50 years, whereas a newborn today is expected to live over 70 years. The fertility rate has decreased from 6,1 births in 1971 to merely 2,1 births in 2018. The vast majority of children attend school.

The strategy for reducing poverty in Bangladesh centered on the empowerment of women.

In 1991, Bangladesh had one of the lowest levels of female education attainment. Bangladesh was one of the first developing nations to achieve gender parity in secondary school enrollment, thanks to a pioneering school stipend program for poor rural girls, which was replicated in Mexico, Cambodia, and other nations.

In 1970, only 17 percent of lower secondary school enrollment was made up of females; this number has since increased to more than half. Hundreds of thousands of rural women were employed by its thriving ready-made garment industry. The female labor force participation rate rose from 21 percent in 1990 to 35 percent in 2021, an increase of 73 percent.

Bangladesh has met the challenges of being severely impacted by natural disasters and climate change by becoming a leader in climate adaptation and disaster preparedness.

Since independence, a network of embankments, cyclone shelters that function as primary schools during normal weather, early warning systems, and forestation have reduced cyclone-related fatalities by a factor of one hundred.

The numbers tell the tale: More than 300,000 people were killed by Cyclone Bhola in 1970, while Cyclone Sidr in 2007 claimed 3,363 lives and Cyclone Mora in 2017 claimed only 18 lives.

In response to a request from the G20, the FSB published a consultation in October 2023 titled Achieving Greater Convergence in Cyber Incident Reporting.

| Question | Answer |

|---|---|

| 1. What is Open Finance? | Open Finance is a financial services ecosystem that uses open APIs (Application Programming Interfaces) to enable third-party developers to build applications and services around financial institutions. It aims to increase competition, innovation, and access to financial services for consumers and businesses. |

| 2. How is Open Finance related to cross-border transactions? | Open Finance can facilitate cross-border transactions by providing a seamless and secure platform for exchanging funds across different currencies and countries. By leveraging open APIs, financial institutions can connect with each other to offer new and innovative cross-border payment services. |

| 3. What are some of the challenges that Bangladesh faces in adopting Open Finance? | Bangladesh faces several challenges in adopting Open Finance, including a lack of digital infrastructure, limited financial literacy, and regulatory constraints. Additionally, there may be concerns around data privacy and security, which must be addressed to build trust in the system. |

| 4. What are the benefits of Open Finance for Bangladesh? | Open Finance can bring several benefits to Bangladesh, including increased financial inclusion, greater competition and innovation in the financial sector, and improved efficiency in cross-border transactions. Additionally, it can help to reduce transaction costs and improve access to credit for small and medium-sized enterprises. |

| 5. What role can fintech companies play in advancing Open Finance in Bangladesh? | Fintech companies can play a critical role in advancing Open Finance in Bangladesh by developing new applications and services that leverage open APIs to provide innovative solutions for consumers and businesses. They can also help to educate the public about the benefits of Open Finance and work with policymakers to create a supportive regulatory environment. |

| 6. What are some of the key regulatory considerations for Open Finance in Bangladesh? | Regulatory considerations for Open Finance in Bangladesh include data privacy and security, consumer protection, and anti-money laundering (AML) and know-your-customer (KYC) requirements. The regulatory framework must balance innovation and competition with the need for safeguards to protect consumers and maintain the integrity of the financial system. |

| 7. What are some examples of Open Finance initiatives in Bangladesh? | Some examples of Open Finance initiatives in Bangladesh include the use of mobile wallets for peer-to-peer transactions and the adoption of blockchain technology for cross-border remittances. Additionally, the central bank of Bangladesh has established a fintech innovation lab to promote the development of innovative financial services solutions. |

| 8. How can cross-border transactions be made more efficient in Bangladesh? | Cross-border transactions can be made more efficient in Bangladesh by leveraging digital technologies such as blockchain and open APIs. Additionally, streamlining regulatory processes and reducing transaction costs can help to facilitate cross-border transactions and increase their volume. |

| 9. How can Open Finance contribute to financial inclusion in Bangladesh? | Open Finance can contribute to financial inclusion in Bangladesh by providing new and innovative financial services that are accessible to underserved populations. For example, mobile banking and digital wallets can provide low-cost and convenient financial services to those who may not have access to traditional banking services. |

| 10. What is the outlook for Open Finance in Bangladesh? | The outlook for Open Finance in Bangladesh is positive, as the government and financial sector stakeholders recognize the potential benefits of the ecosystem. However, there are still challenges to be overcome, including regulatory barriers and the need for greater investment in digital infrastructure. With the right policies and investments in place, Open Finance has the potential to transform the financial sector in Bangladesh and improve the lives of millions of people. |

The FSB’s proposals include recommendations to address the obstacles to achieving greater international convergence in cyber incident reporting, work on establishing common terminologies related to cyber incidents, and a proposal to develop a standard format for exchanging incident reports.

The purpose of the EU’s new Digital Operational Resilience Act (DORA) is to establish uniform requirements for the security of network and information systems of companies operating in the financial sector, including cryptoasset service providers, as well as any critical third parties that provide them with information communication technologies services.

Following its exit from the EU, the United Kingdom has introduced the Financial Services and Markets Bill, which includes provisions to regulate cloud service providers and other critical third parties that provide services to UK-regulated firms and financial market infrastructures.

Under the proposed legislation, HM Treasury would have the authority to designate certain service providers as “critical,” and UK regulators would be granted new direct oversight authority over designated service providers, who would be subject to new minimum resilience standards.

In the absence of a general election, the Bill should be passed and signed into law by the end of the current session of Congress (expected to be in May 2023). While the United Kingdom’s proposals and DORA’s requirements share the same objectives, there are a number of differences between them, including with respect to the “critical” designation criteria and the enforcement regime.

What to expect in Operational resilience in 2023 around the globe?

Efforts to harmonize global standards at the national level will continue. The FSB is scheduled to release a revised report to the G20 in April 2023. This report will include expectations for financial authorities’ oversight of financial institutions’ reliance on critical service providers, such as “Big Tech” and fintech firms.

Once in effect, the requirements of DORA and the new UK regime for contracting with payment service providers will impose a significant legal burden on businesses that provide payments technology.

The implementation of a new incident reporting mechanism by DORA, including a requirement that “major” incidents be reported to competent authorities within strict timeframes, will necessitate substantial process investments.

In the United States, we anticipate the banking agencies to finalize their 2021-proposed guidance on “third-party risk management,” which will establish supervisory expectations for risks posed by third-party relationships as well as higher standards for providers of “critical services.”

The guidance requires, among other things, that covered institutions conduct due diligence, provide ongoing oversight of a third party’s information security programme and information systems, and assess the third party’s ability to continue providing services during a disruption event.

Additional global regulators will launch comprehensive regulatory regimes to ensure that financial institutions have appropriate internal governance and control frameworks surrounding the use of ICT, including the use of third-party technology providers.

We are also likely to see a rise in regulatory enforcement actions related to operational disruptions; TSB Bank plc was recently fined £48.65 million by UK financial regulators for operational risk management and governance failures related to its IT upgrade program.

Similarly, the same technology disruption events are likely to result in civil claims and litigation, whether for contract breach, negligence, or data breach.

Multiple jurisdictions have implemented open banking regimes, permitting third-party payment service providers (TPPs) to initiate payments or access account information on behalf of their customers. Regulators anticipate that firms will fulfill their regulatory obligations while competing on the basis of quality and value.

Some jurisdictions have taken this concept a step further, applying it to other types of accounts and financial products as part of a broader “open finance” initiative.

Open Finance

Multiple jurisdictions have implemented open banking regimes, permitting third-party payment service providers (TPPs) to initiate payments or access account information on behalf of their customers.

Regulators anticipate that firms will fulfill their regulatory obligations while competing on the basis of quality and value.

Some jurisdictions have taken this concept a step further, applying it to other types of accounts and financial products as part of a broader “open finance” initiative.

Developing comprehensive legislative frameworks for such initiatives is time-consuming, but essential for ensuring that TPPs are regulated to provide clarity around I security, consent, data use, privacy, and ethics, and to build customer trust.

In the context of Open Banking, the recast EU Payment Services Directive’s rules on TPP access, strong customer authentication, and secure communication standards may provide a blueprint for expansion in the European Union.

The Consumer Financial Protection Bureau (CFPB) in the United States is in the process of developing a proposal for an Open Banking rule that would give consumers more control over their financial data by allowing them to access and share it with other providers.

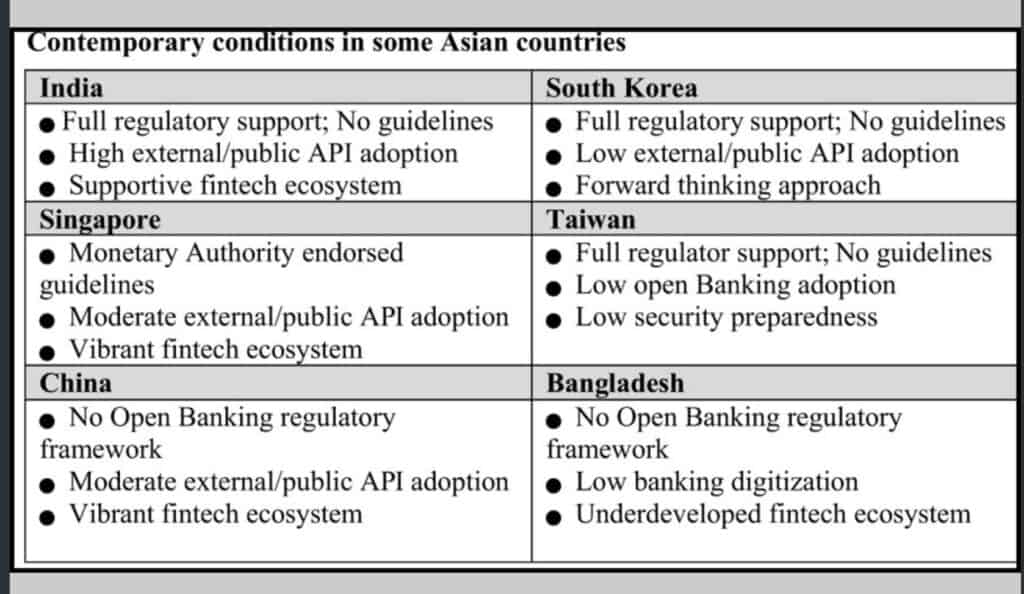

The concept of Open Application Programming Interface (API) for use in the banking industry i.e open finance has emerged as one of the most significant developments over the past few years. Open banking entails making the APIs accessible to third parties (financial technology companies), who can use the shared consumer data to create innovative products and services, as well as to generate offers and discounts based on consumer spending habits.

The API will allow the company’s software to access information from another company’s software. When we order an Uber, the Google Maps API allows us to track our car’s journey to the pickup location.

Without these APIs, if you want to share the information in your bank account with another organization, you must give them your login credentials. These new APIs will allow you to safely and securely share your bank account information without disclosing your password.

The objective of Open Banking regulations is to transfer account information ownership from banks to customers. It enables individuals to securely share transaction information with other banks and third parties.

The fundamental aspect of open banking is that customers are not required to share their data with third parties. When you sign up for a service, each provider will ask for your permission to access your information.

The system will then send a request to your bank, which will then process the request and share your information. You may also revoke your consent at any time. The rules only apply to online-accessible accounts, and you must connect your online banking to the third party for it to obtain your data.

It is ultimately your decision whether or not to share your information. Under Open Banking, however, your financial information will be more secure than ever before. All banks, apps, businesses, and other third parties operating within the Open Banking framework are evaluated according to the highest privacy and security standards.

Here are a few real-world examples of how the customer could benefit:

- Customers can obtain better deals on credit cards, loans, and mortgages by comparing them across multiple financial institutions and third parties based on their individual circumstances.

- Gain a comprehensive perspective of accounts in a single location.

- Monitor multiple bank accounts and credit cards for fraud with ease.

- Utilize a unified platform to efficiently and safely manage your finances across multiple services and providers, from banking to online shopping.

- Open banking is not limited to developed nations; many markets around the world have sought to adopt similar principles with the ultimate goal of enhancing customer financial outcomes.

The rule is intended to promote competition by making it simpler for consumers to “walk away” from their current providers and transfer their financial data to other providers via application programming interfaces (APIs).

Future of Open Finance in 2023

There will be a renewed emphasis on open finance and the development of more innovative use cases. With web 3.0 and metaverse applications raising a new set of legal and regulatory questions, consumers will receive payment services through channels that are novel.

Following a consultation in 2023 , the publication of a new framework for Open Finance in the EU is scheduled for the second quarter of 2023.

In Bangladesh’s banking industry and open finance, there are numerous supply difficulties. The cost of providing financial services is disproportionately high to the price of the product. Open Banking is the only remedy for this issue.

Despite digitization and open source, industries such as retail, transportation, food and beverage, education, etc. are experiencing significant disruptions. However, the trend will have a much greater impact on the financial services industry, whose business models are on the verge of digital transformation.

Multiple parties are involved in Open Finance, and it is unclear who should be responsible for data protection and security and who owns customer data. It will be difficult to determine who owns all of this information, as it will continue to flow from screen to screen. In the future, accelerating data ownership and customer privacy will be crucial.

The evolving landscape of banking presents both challenges and opportunities. Our banks should collaborate with other service providers to enrich and streamline the customer experience.

As the Open Banking community continues to expand throughout 2023, new obstacles and opportunities will emerge. Banks must continue to prioritize data privacy, cyber security, and customer protection throughout the implementation phase. However, the benefits Open APIs offer to customers and banks will drive their growth and adoption.

The CFPB is expected to issue a proposed Open Banking rule later this year in the United States. Significant issues remain unresolved, including the rule’s applicability to non-banks as well as privacy and data security concerns.

Smaller banks have urged the CFPB to phase in a ban on “screen scraping,” in which a third party uses a customer’s login credentials to access their account information, because they lack the technological resources to build a library of APIs.

Hire a Competent law firm for your cross border transactions in Bangladesh:

Tahmidur Rahman Remura Wahid TRW Associates is comprised of competent Barristers and Advocates with expertise in multiple legal fields, allowing them to provide the required services to a high degree and allowing clients to acquire all necessary and supplementary legal services under one roof.

The Barristers, Advocates, and attorneys at Tahmidur Rahman Remura Wahid TRW in Mohakhali New DOHS, Dhaka, Bangladesh have extensive experience assisting clients with all sort of licensing matters. For questions or legal counsel, please contact us at:

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, 330 High Holborn, London, WC1V 7QH

Email Addresses:

info@trfirm.com

info@tahmidur.com

info@tahmidurrahman.com

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817