Procedures To Get Tax Exemption Certificate in Bangladesh

A tax exemption is the reduction or elimination of a person’s obligation to pay a tax that would otherwise be imposed. The tax-exempt status may provide total tax exemption, a reduction in tax rates, or impose tax on only a portion of the item. The application for a tax exemption certificate must be submitted at the start of the income year.

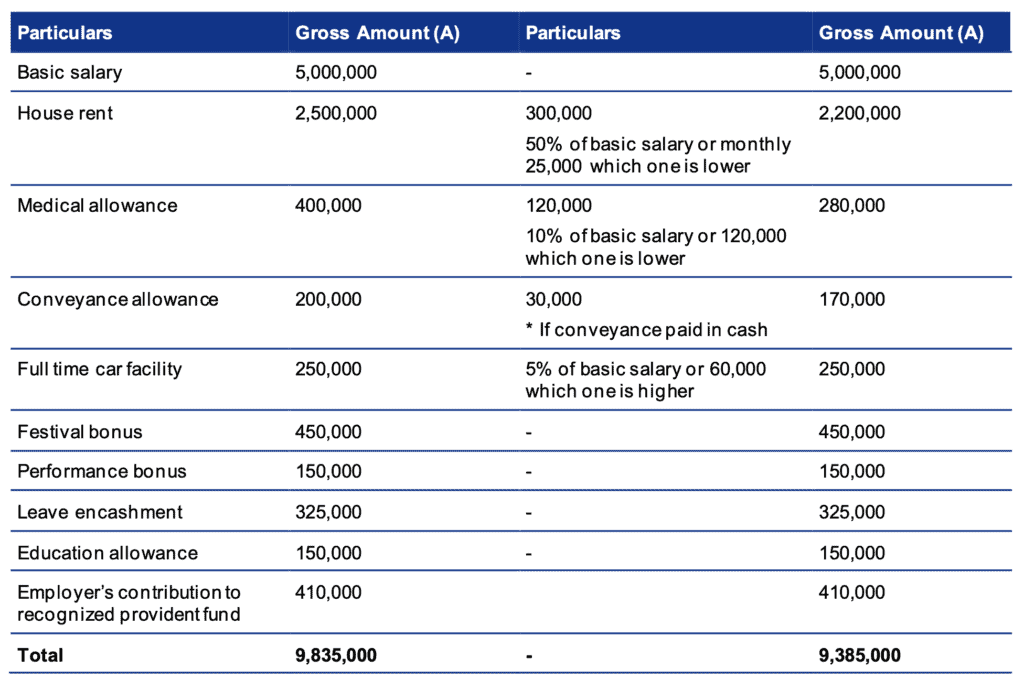

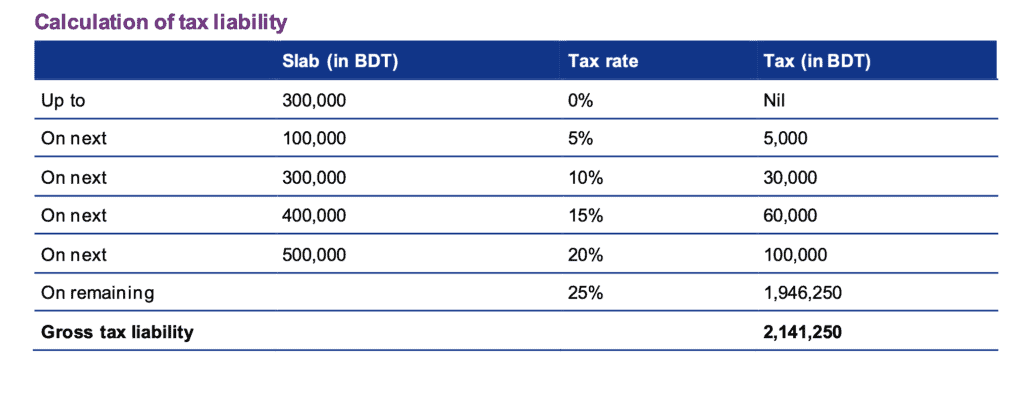

Sample Tax Calculation:

There are two primary methods to reduce your tax liability:

- By claiming deductions and credits

- By applying for tax rebates

Required document for AIT exemption certificate.

· An application in prescribe format by NBR (National Board of Revenue)

· Forwarding letter regarding documents submission

· TIN Certificate.

· Trade License;

· Business Declaration Letter;

· Statement U/S 108 Submission Copy;

· Bank Statements;

· Latest Income Tax Certificate of the Company;

· Office Rent Agreement;

· Challan of TDS on Office Rent;

· Challans of TDS on Salary;

· Statement of Forecasted Sales;

· Sales Contract;

· Projected AIT Amount Certificate;

· Business Agreement with Foreign Customer;

· Previous Tax Exemption Certificate Copy;

· List of Employees;

· Latest Annual Audit Report Copy; and

· Last Year Actual AIT Amount Certificate

Application: A format prescribed by NBR.

This letter should include the names of the documents that must be submitted along with the documents attached.

Reference:

ITO 1984, Sixth Schedule

Any income derived from the following business of a resident or non-resident Bangladeshi for the period from July 1, 2008 to June 30, 2024, on the condition that the person/entity file an income tax return in accordance with the provisions of Section 75 of the ordinance.

Business Categories that are eligible to get Tax Exemption in Bangladesh:

1. Software Development

2. Software or application customization

3. Nationwide Telecommunication Transmission Network (NTTN)

4. Digital Content Development & management

5.Digital animation development

6. Website development

7. Website services

8. Web listing

9. IT Process outsourcing

10. Website hosting

11. Digital graphics design

12. Digital data entry and processing

13. Digital data analytics

14. Geographic Information Services

15. IT Support test lab services

16. Software test lab services

17. Call center services

18. Overseas medical transcription

19. Search engine optimization services

20 Document conversion, imaging and digital archiving

21 Robotics process outsourcing

22. Cyber Security services

23. Cloud service

24. System Integration

25. e-learning platform

26. e-book publications

27. Mobile application development

28. IT Freelancing

It should be emphasized that in order to be eligible for this exemption, the tax return must be filed on a regular basis. Furthermore, in order to be eligible for these benefits, the company may need to get BASIS membership and a tax exemption certificate from the appropriate tax office on an annual basis.

General tax breaks in Bangladesh

What general tax credits are available in your country/jurisdiction?

Assignees (both resident and non-resident Bangladeshis) can obtain investment tax credits by investing in government-designated areas.

Even if they become tax residents in Bangladesh, expatriates are not eligible for tax credits or investment allowances. In Bangladesh, double taxation treaties do not apply. Income earned or derived from the Bangladesh delegation is taxed.

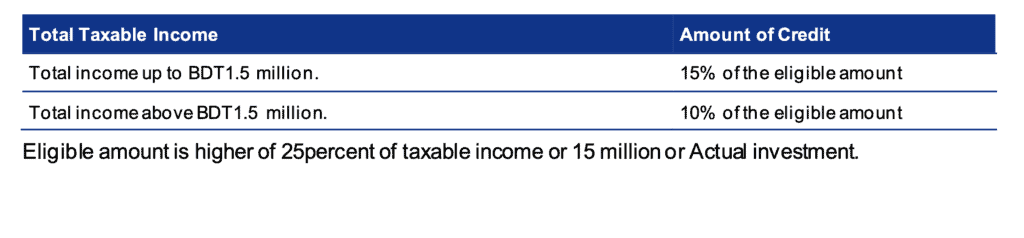

The following is how the investment tax credit is calculated: