PSO License in Bangladesh

Payment systems act as a catalyst to promote financial stability and financial inclusion. The safety and security of these systems is a primary goal of BANGLADESH BANK. As digital payment mechanisms become more popular, it is critical to ensure that payment system infrastructures are not only efficient and effective, but also resilient to traditional and emerging threats, particularly those related to cyber security.

BANGLADESH BANK has specified the essential security measures for banks and credit card issuing NBFIs’ digital payment goods and services.

It is proposed that similar guidelines be issued for Payment System Operators (PSOs), covering a robust governance mechanism for identifying, assessing, monitoring, and managing cybersecurity risks, including information security risks and vulnerabilities, as well as specifying baseline security measures to ensure safe and secure digital payment transactions. The instructions will be released soon.”

A payment system operator is a legal body in charge of running a payment system. The PSO provides services based on certain models. They outsource the majority of their payment and settlement-related tasks to numerous other organizations. PSOs include Google Pay, Amazon Pay, NPCI, Paytm, and others.

Central Bank Guidelines for PSO License

Last year, the Bangladesh Central Bank (BANGLADESH BANK) issued detailed guidelines to strengthen Bangladesh’s digital payments architecture and improve security, control, and compliance among banks, gateways, wallets, and other non-banking entities that are at the forefront of assisting the government in its goal of a ‘less-cash’ economy.

These laws apply directly to scheduled commercial banks, minor financing banks, payment banks, and NBFIs that issue credit cards.

The standards are technology and platform agnostic, with the goal of creating a better and more enabling environment for customers to utilize digital payment products in a safer and more secure manner.

Bangladesh Bank’s Board of Directors established the Bangladesh Payment and Settlement Systems Regulations-2014 (BPSSR 2014) with the goal of promoting, regulating, and maintaining secure and efficient payment systems in Bangladesh.

This ‘Approval Procedure of Payment System Operator (PSO)/Payment Service Provider (PSP)’ has been released in line with paragraphs 2 and 3 of section 5.3 of the Bangladesh Payment and Settlement Systems Regulations-2014.

Payment System Operator (PSO): According to the BPSSR 2014, a ‘Payment System Operator (PSO) refers to an entity licensed by the Bangladesh Bank for operating a settlement system for payment activities between/among participants, the principal participant of which must be a scheduled bank maintaining accounts with the Bangladesh Bank for meeting Cash Reserve Requirements.’

A PSO must have the following properties, according to the definition:

a) PSOs must be licensed by Bangladesh Bank;

b) PSOs must provide the payment services specified in their license; and

c) PSOs must not issue e-money or payment instruments in any form.

d) Transactions must be settled through a scheduled commercial bank.

PSO Qualification

- PSO must be registered under the Companies Act of 1994;

- The company’s paid-up capital cannot be less than BDT. 5,000,000/- (Five Million). However, Bangladesh Bank may adjust the minimum paid-up capital based on services and business exposure; 3. Key staff of the company must have at least three years of experience/exposure in the relevant industry.

- Application Procedure Interested institutions should submit an application to Bangladesh Bank in the specified format (Annexure-A) together with the relevant papers (a list of which is provided in Annexure-B). As application fee, a non-refundable demand draft in the amount of Tk. 25,000.00 (Twenty Five Thousand) shall be made payable to the General Manager, Payment Systems Department.

Approval Process

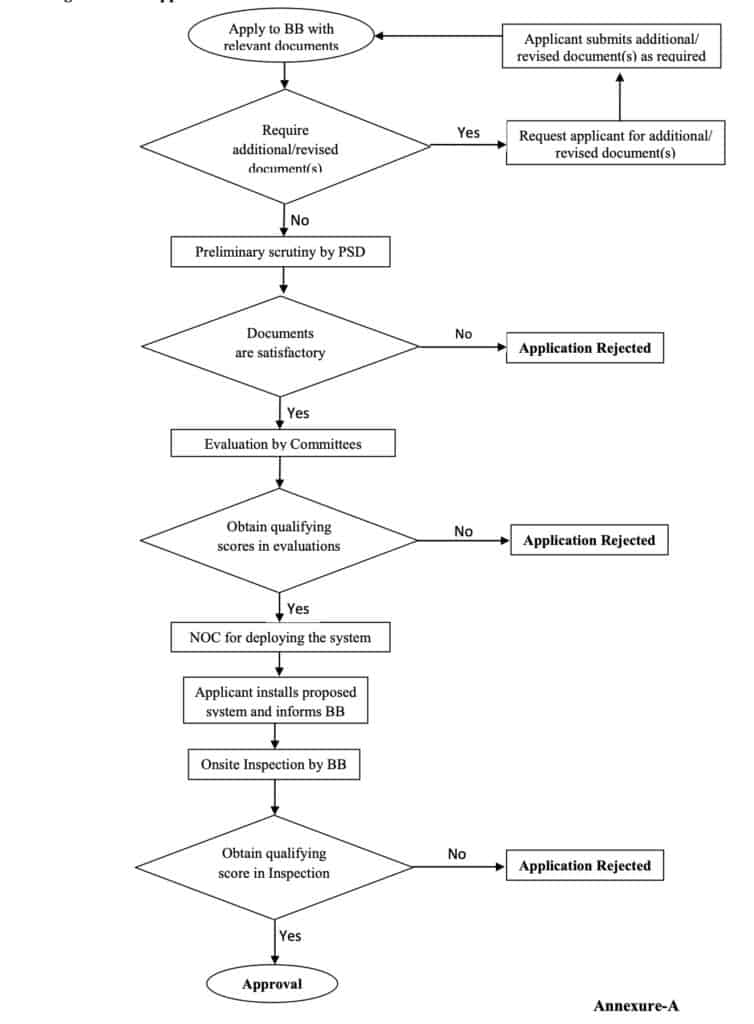

The approval procedure will be divided into two stages. PSD shall give a ‘No Objection Certificate (NOC)’ in the first phase, and in the second phase, PSD may provide final approval to the qualifying organization based on the following method.

PSD will conduct a preliminary review of the materials in Phase 1.

Phase 1:

a). Following preliminary review:

i) Bangladesh Bank may request updated or additional document(s).

ii) If the documents and/or plan are inconsistent with the requested services, Bangladesh Bank may reject the application with a written notification.

iii) If the documents are judged to be satisfactory, they will be forwarded to the evaluation committee(s).

b) The documents will be evaluated and a report will be submitted by the evaluation committee(s).

c) Bangladesh Bank will decide whether to issue or not issue NOC based on the score of the evaluation report(s). This decision will be communicated to the applicant.

Phase 2:

a) The applicant who has received NOC for deploying the system must submit a declaration in prescribed format (Annexure-C) within the stipulated period regarding the readiness of the proposed infrastructure. To conduct the onsite inspection, an onsite inspection team will be constituted.

b) Approval may be granted based on an acceptable inspection report and compliance with all NOC requirements.

Fees and Payment Options

Application Fee:

- A non-refundable pay order/demand draft in the amount of Tk. 25,000.00 (Twenty Five Thousand only) must be submitted with the application.

- A non-refundable pay order/demand draft in the amount of Tk. 1,00,000.00 (One Lac only) would be required to be submitted upon final approval.

LICENSING, REGULATION, AND Licensing:

a) Legal and Regulatory Role:

To enable the seamless operation of the payment and settlement system, a proper legal and regulatory framework is required. The Bangladesh Bank Order 1972 provides the legal foundation for Bangladesh Bank to develop a safe and secure payment system.

The Payment Systems Department establishes regulations and publishes system rules, which specify, among other things, the roles and responsibilities of payment system participants. A proposed Payment and Settlement Systems Act prepared by Bangladesh Bank is now being reviewed by the Ministry of Finance.

Bangladesh Payment And Settlement Systems Regulations (BPSSR), 2014 Electronic Fund Transfer Regulations, 2014

b) MFS (Mobile Financial Services):

Bangladesh Bank launched efficient off-branch Mobile Financial Services (MFS) in 2011 in response to the country’s omnipresent mobile phone network, big number of mobile phone users, and enhanced IT infrastructure. Within ten years, this rapidly expanding Bank-Led MFS model has grown to become the world’s largest MFS market.

Domestically, Bangladesh Bank allows cash in, cash out, person-to-person (P2P), person-to-business (P2B), business-to-person (B2P), person-to-government (P2G), and government-to-person (G2P) payment services via MFS. This service does not permit cross-border money transfers.

Local disbursement of inward foreign remittances received through banking channels, on the other hand, is permissible. With a photo and legal documentation, any adult can open an MFS account with any provider at an agent point or bank branch. In this instance, having multiple MFS accounts with the same supplier is not permissible.

- Bangladesh Mobile Financial Services (MFS) Regulations, 2022 Transaction Trend List Of MFS Providers Access To MFS For Women In Bangladesh Comprehensive Study Of Bangladesh’s Female MFS Market

- Toolkit for Women Agent Acquisition

- Manual for Women Agent Recruitment

- Tool for Choosing Female Agents

- Women Agent Training Manual

- Women’s Agent Training Guide

c) Payment System Operator (PSO) and Payment Service Provider (PSP):

Payment Systems Department (PSD) awards licenses in two major categories, according to the “Bangladesh Payment and Settlement Systems Regulation-2014 (BPSSR-2014)”: Payment Service Provider (PSP) and Payment System Operator (PSO).

It grants a PSP license to a company that facilitates payment(s) or payment processes directly to clients and settles their transactions through a designated bank or financial institution, such as an E-wallet or a Mobile Wallet.

Furthermore, PSD grants a PSO license to a company that manages a settlement system for payment activities between/among participants, the primary participant of which must be a scheduled bank or financial institution, such as a payment gateway or payment aggregator.

PSD examines market demand, business rationale, regulatory requirements, risk management systems, settlement systems, eligibility criteria, and other factors in accordance with BPSSR-2014 before granting a PSP or PSO license.

- PSO and PSP Authorized List:

- IT Consultants Ltd (PSO)

- Software Shop Limited (PSO)

- Portonics Limited (PSO) ShurjoMukhi Ltd (PSO)

- Soft Tech Innovation Limited (PSO) Walletmix Limited (PSO)

- Optimum Solution & Services Limited (PSO)

- Service Hub Limited (PSO)

- ABG Technologies Limited (PSP)

- Digital Payments Limited (PSP)

- Fingerprint Information Technology Limited (PSO)

d) Office of Regulatory FinTech Facilitation (RFFO):

With technological improvements touching every aspect of life, technical and digital breakthroughs have also influenced financial services. Disruptive revolutionary technology is having a huge impact on finance and the way we do business. With the introduction of new technological and financial solutions designed/offered by a variety of financial entities and technology enterprises, financial sectors are taking on a new dimension.

FinTech, or digital innovations, have proven to be a disruptive force in financial markets. FinTech improves efficiency, reduces risk, and expands financial inclusion. It is critical to grasp the granular components of FinTech and its ramifications in order to assess and reorient the regulatory framework effectively and respond to the dynamics of the quickly growing FinTech scenario.

In light of these considerations, a Regulatory FinTech Facilitation Office (RFFO) was established in October of 2019. This might be regarded as a key first step toward allowing additional financial sector innovators to enter the market in order to offer financial services to the general public at a reasonable cost.

OVERSIGHT OF PAYMENT SYSTEMS:

Payment Methods Oversight is a specific sort of oversight of existing and planned payment systems that is one of the most important tasks of all central banks worldwide. It enhances payment system safety, efficiency, and soundness by effectively monitoring and assessing payment systems and then advocating policy adjustments.

With the mandate of the Bangladesh Bank Order 1972, Bangladesh Bank established a number of new and digitalized payment systems and services that have become an essential part of the country’s financial infrastructure.

Effective oversight is the means of stabilizing financial infrastructure by recognizing and controlling the risks associated with payment systems. As a result, Payment Systems Oversight concentrates on the following activities:

- For monitoring, collects onsite and off-site data from systems and participants on day-to-day operations, financial flow and transaction patterns, risk exposures, risk management methods and practices, backup and business continuity plan, disruptions and disputes, and so on.

- Checks system and participant compliance with applicable laws and regulations, identifies gaps, and makes recommendations with time to follow up.

- Analyzes the flaws of systems, participants, or schemes and highlights areas that require improvement or BB intervention.

- Performs trend analysis on data from systems and participants, calculating market share for each to prioritize the segment for monitoring.

- Performs and facilitates’Self-Assessment’ of systems and participants in accordance with regulatory requirements and International Standards.

Here’s a comprehensive table summarising the Approval Procedure of Payment System Operator (PSO)/Payment Service Provider (PSP) in Bangladesh:

| Section | Content |

|---|---|

| Objectives | This procedure aims to: |

| – Define the process and required documents for PSO/PSP license application. | |

| – Establish eligibility criteria for obtaining PSO/PSP license. | |

| – Outline the approval process for PSO/PSP. | |

| Payment System Operator (PSO) | According to BPSSR 2014, a PSO is: |

| – An entity licensed by Bangladesh Bank to operate a settlement system for payment | |

| activities between/among participants, with the principal participant being a | |

| scheduled bank maintaining accounts with Bangladesh Bank for meeting Cash Reserve | |

| Requirements. | |

| Characteristics of a PSO: | |

| – Licensed by Bangladesh Bank. | |

| – Provides approved payment services. | |

| – Does not issue e-money or payment instruments. | |

| – Settlement of transactions done through scheduled commercial bank. | |

| Payment Service Provider (PSP) | According to BPSSR 2014, a PSP is: |

| – An entity licensed and approved by Bangladesh Bank that provides payment service(s) | |

| to its participants or to a payment system for facilitating payment(s) or payment | |

| processes and settling their transactions through a scheduled bank maintaining | |

| accounts with Bangladesh Bank for meeting Cash Reserve Requirements. | |

| Characteristics of a PSP: | |

| – Licensed by Bangladesh Bank. | |

| – Provides approved payment services. | |

| – May issue e-money or payment instrument under terms and conditions of its license and | |

| subsequent rules and regulations of Bangladesh Bank. | |

| – Maintains a ‘Trust Cum Settlement Account’ with a scheduled commercial bank. | |

| Eligibility | Eligibility criteria for PSO: |

| – Must be a company incorporated under the Companies Act of 1994. | |

| – The paid-up capital of the company shall not be less than BDT 5,000,000/- (Five Million). However, Bangladesh Bank may refix the minimum paid-up capital based on services and business exposure. | |

| – Key personnel of the company shall have a minimum of 3 years experience/exposure in | |

| the relevant field. | |

| Eligibility criteria for PSP: | |

| – Must be a company incorporated under the Companies Act of 1994. | |

| – The paid-up capital of the company shall not be less than BDT 200,000,000/- (Two Hundred Million). However, Bangladesh Bank may refix the minimum paid-up capital based on services and business exposure. | |

| – Key personnel of the company shall have a minimum of 3 years experience/exposure in | |

| the relevant field. | |

| – Appropriate technology infrastructure shall be maintained within Bangladesh. | |

| Application Procedure | Interested institutions should: |

| – Apply in the prescribed format (Annexure-A) to Bangladesh Bank. | |

| – Submit required documents (List given in Annexure-B). | |

| – Pay a non-refundable application fee of Tk. 25,000.00 (Twenty Five Thousand) in favor | |

| of General Manager, Payment Systems Department. | |

| Approval Procedure | The approval process is conducted in two phases: |

| Phase 1 – Preliminary Scrutiny: | |

| – PSD conducts a preliminary scrutiny of the documents. | |

| – Bangladesh Bank may ask for revised or additional document(s) if necessary. | |

| – Bangladesh Bank may reject the application with a written notice if documents and/or | |

| proposal are not consistent with proposed services. | |

| – If the documents are found satisfactory, they are forwarded to evaluation committee(s). | |

| – The evaluation committee(s) evaluate the documents and submit reports. | |

| – Bangladesh Bank takes a decision on issuing/not issuing the NOC based on the evaluation | |

| report(s) and communicates it to the applicant. | |

| Phase 2 – Final Approval: | |

| – The applicant with NOC for deploying the system submits a declaration in the prescribed | |

| format (Annexure-C) within the stipulated period, indicating the readiness of the | |

| proposed infrastructure. | |

| – An onsite inspection team conducts an onsite inspection. | |

| – Approval may be granted based on a satisfactory inspection report and if all the | |

| requirements of the NOC are met properly. | |

| Fees and Payment Method | Application Fee: A non-refundable pay order/demand draft of Tk. 25,000.00 (Twenty Five |

| Thousand only) should be submitted with the application. | |

| License Fee: A non-refundable pay order/demand draft of Tk. 1,00,000.00 (One Lac only) | |

| should be submitted during the final approval. |

Are you planning to do PSO, PSP based company or NBFI in Bangladesh?

PSO,PSP, NBFI formation in Bangladesh with Tahmidur Rahman Remura: TRW: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman Remura Wahid, The Law Firm in Bangladesh: TRW, The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and incorporating a NBFI formation in Bangladesh. For queries or legal assistance, please reach us at: