VAT Deductible at Source in Bangladesh: A Guide by Tahmidur Rahman Remura Law Firm

In Bangladesh, the Value Added Tax (VAT) Act of 2012 introduced provisions for VAT Deductible at Source (VDS). These regulations outline the circumstances under which VAT should be deducted by the recipient of a service or the person paying the price of the service or commission.

Tahmidur Rahman Remura Law Firm, a leading law firm in Bangladesh, specializes in VAT-related matters and provides comprehensive guidance on VAT Deductible at Source. In this article, we will explore the key aspects of VDS and why hiring Tahmidur Rahman Remura Law Firm can ensure compliance and optimize VAT-related procedures.

Understanding VAT Deductible at Source

According to Section 49(5) of the VAT Act-2012, VAT is payable by the recipient of a service, and if the recipient or the person paying the price of the service deducts or collects VAT at source, they must deposit it to the Government Treasury on behalf of the supplier. This provision aims to streamline the collection of VAT and reduce the burden on suppliers, ensuring proper compliance with VAT regulations.

Exemption for Sub-Contractors

One important aspect of VAT Deductible at Source is the exemption for sub-contractors. When a main contractor appoints a sub-contractor, agent, or another service provider to complete a project or service, the main contractor cannot deduct any further VAT from the sub-contractor’s bill.

This exemption applies if the project authority has already deducted VAT at source from the main contractor’s bill and provided proper evidence, such as Mushak-6.6 certificate and treasury challan, to the sub-contractor. This exemption aims to avoid double taxation and simplify VAT procedures in cases of subcontracting.

VAT Deducted at Source in Projects

VAT Deductible at Source also applies to government projects or private-level activities that resemble projects. In the case of private projects, where tendering takes place and a contractor is selected through the tendering process, VDS regulations apply.

This means that VAT should be deducted at source from the contractor’s payments, but if the contractor appoints a sub-contractor for the same project, VDS should not be deducted from the sub-contractor’s bill if proper evidence of VAT payment by the main contractor is provided. This clarification helps eliminate confusion at the field level and ensures compliance with VAT regulations.

If the prime contractor mentions the outsourcing of raw materials in its VAT documents or treasury submissions, the revenue authorities will not charge the subcontractors separately for VAT.

Several ongoing projects, such as the metro rail, the Rooppur nuclear power plant, the Bangabandhu Tunnel, and the Padma Bridge approach road, involve local firms as subcontractors or in collaborative ventures with foreign firms. The National Board of Revenue was deducting VAT from the invoices of both the general contractor and the subcontractor, resulting in double taxation.

Foreign development partners, who financed the infrastructure works, have been seeking a solution to the double taxation issue, according to Revenue Board officials.

According to the law, VAT will be applicable to any VAT-eligible company that provides non-VAT-exempt services pursuant to a contract, bid, or work order. However, the law does not specify whether VAT will apply to the bill of a contracted firm, agent, or service provider working for a VAT-eligible business.

The ambiguity led both the general contractor and subcontractors to include VAT on their invoices and vouchers.

In accordance with the most recent changes to the VAT law, hired firms or agents will not be required to pay VAT, but the primary contractor will be required to submit documentation mentioning VAT payments against outsourcing.

After several rounds of meetings with local subcontractors, the VAT law was amended once in 2020, according to an official of the revenue board’s VAT department. The lack of clarity in the law regarding VAT-paying entities led to the complications. The issue has been resolved through amendments to the finance measure.

According to industry insiders, the majority of local companies working on megaprojects are subcontractors for foreign contractors. The subcontractors supply food and lodging, labor, and other products and services. They also offer building materials.

On the invoice for these services, the principal contractor of the project pays the revenue board 5% to 10% VAT.

In contrast, revenue officials require VAT from subcontracts when separate returns are submitted. As a consequence, construction industry businesses have been dissatisfied for an extended period of time.

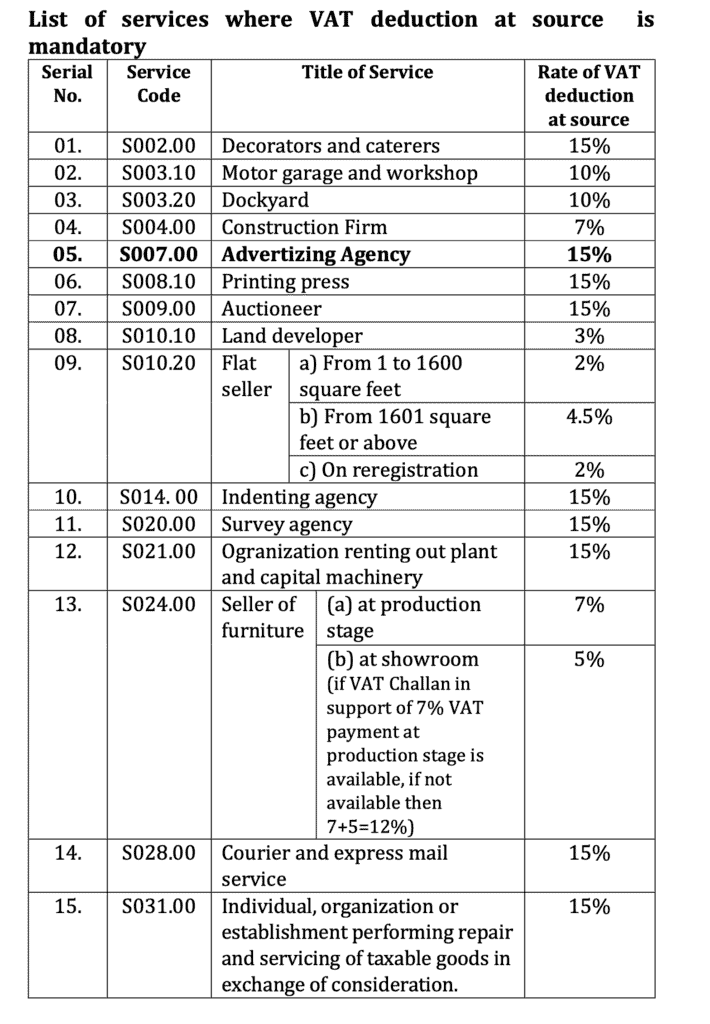

Organizations that are accountable for VAT Deduction at Source (withholding entity).

Ten distinct entities have been assigned the responsibility of deducting VAT at the source.

These include the following:

(1) Government organizations;

(2) Semi-Government organizations;

(3) Autonomous bodies;

(4) Non-Government organizations (NGOs);

(5) Banks;

(6) Insurance companies;

(7) Financial institutions;

(8) Limited company (both private limited company and public limited company but not proprietorship firm);

(9) Educational institutions (all types of educational institutions from KG, nursery to university, both public and private);

(10) Establishment with more than Taka one crore in annual turnover. (In VAT law, turnover refers to the entire amount of money received from sales during a given period, in this case one year).

When these withholding entities pay for their purchases of goods and services, they must implement the VDS rules to determine whether VDS must be deducted from the payment. If the obligation to deduct VDS remains, it must be satisfied. Despite having the obligation to deduct VDS, if it is not done, it can be recovered with 2% interest from the entity neglecting to deduct.

Moreover, the VAT Act, 1991 [Section 37Kha(Kha)] stipulates that if deducted money is not deposited to the government treasury following deduction, the Commissioner may impose a personal penalty of BDT 25,000 (Taka twenty-five thousand) on the person who deducted VDS, the person responsible for depositing the deducted amount to the government treasury, and the Chief Executive Officer of the entity.

Therefore, the employees of the negotiation, procurement, accounts, payables, audit, post-audit, etc. departments of the withholding entities must be aware of the most recent VDS provisions.

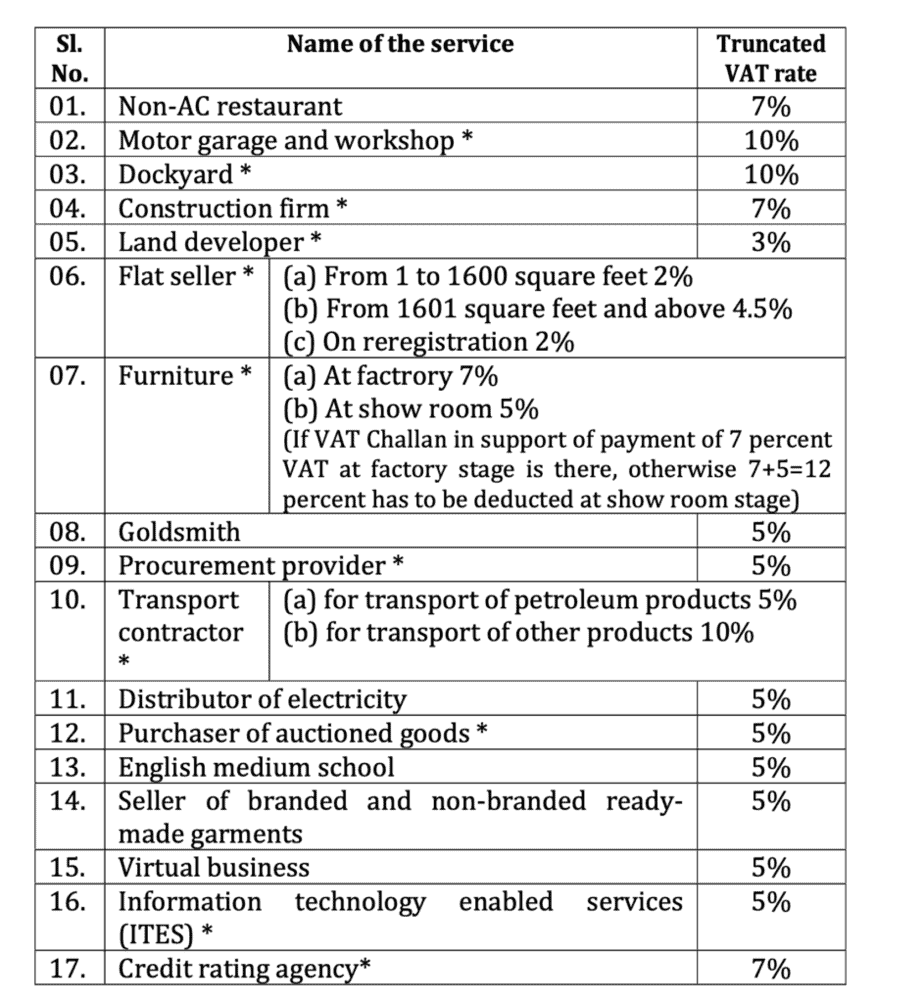

Provisions of the VDS for the Supply of Goods:

If you are presented with a bill for the purchase of a service, as previously discussed, you must adhere to the aforementioned regulations. However, if you are presented with a bill for the purchase of products, you must adhere to the provisions outlined below. If a bill for the purchase of products is presented to you, your first task is to identify the supplier.

The supply can be made by one of three parties: (a) a manufacturer, (b) a trader, or (c) a procurement provider. For the supply of these three entities, there are distinct VDS provisions that will be discussed in greater detail below. We are aware that although procurement provider is a service, in practice it provides products.

A procurement provider acquires products from one location, transports them to a withholding entity, and delivers them. Therefore, he offers the service of acquiring and transporting the products. Thus, the procurement provider service is presented to you as products.

Consequently, we will discuss procurement provider in the goods segment of this article. The following discussion is pertinent to comprehending when a supplier of products is considered a procurement provider.

Procurement provider service

The procurement provider service, which remains on the preceding list of 39 services, is a vital component of our VAT administration system. Regarding this service’s VDS provisions, confusion persists among the general public. Consequently, the provisions regarding VDS deductions for the provider of procurement services are discussed in detail below.

Notably, the definition of procurement provider has been modified to some extent during 2013-14 budgetary measures, and as a result, VDS provisions have also been modified. Please locate a detailed explanation of this below.

Difference Between Trader and Procurement Provider:

To identify procurement provider, it is necessary to distinguish procurement provider from merchant. A merchant has an establishment, which may be owned or rented, with a structure (small or large), personnel, utilities, and inventory. Typically, a procurement provider lacks such an establishment.

A trader stocks the products and then sells them; an acquisition provider does not stock. The procurement provider acquires, transports, and then supplies the client directly. A merchant sells to all types of consumers, whereas a procurement provider only supplies against competitive bid. A trader participates in a tender for the goods he handles, whereas a procurement provider may participate in a tender for any goods.

If commodities are supplied by a producer or merchant issuing a VAT Challan, then the supplier will not be considered a Procurement Provider and VAT will not need to be deducted at the source. Before deducting VAT at source, one must be certain of the supplier’s status. 5% VAT must be deducted at the source if the supplier is a Procurement Provider.

Deduction of VAT at Source on Goods Supplied by a Manufacturer or Trader:

In the interim, we have discussed which entities have been assigned responsibility for VAT decution at source. In addition, we have covered 37 services from which VDS deduction is required. We have discussed special VDS advertising agency provisions. We have discussed the VDS procurement provider provisions. Then, VDS provisions beyond these 39 services were discussed. Then, we began discussing VDS provisions regarding the supply of products.

As seen, products are supplied by the manufacturer, the merchant, and the procurement provider. In the case of the supply of products, we have also seen who is considered a procurement provider and who is not. If the supplier is deemed a procurement provider, VAT at the rate of 5% must be deducted at the point of sale. If the supplier is not deemed a procurement provider, no VAT is typically required to be deducted at the source.

In the continuation of our discussion, we noted that if a supplier of goods is also the manufacturer, and if he makes the supply by issuing a VAT Challan, he will not be considered a procurement provider, and therefore VAT will not be required to be deducted at the point of sale. Similarly, if a merchant makes a supply with a VAT Challan, he will not be considered a procurement provider, and VAT will not be required to be deducted at the source.

Examining the VAT registration certificate

In other words, if a withholding entity receives a shipment of goods, it must first ascertain whether the shipment was made by a manufacturer, a trader, or a procurement provider before making payment. Examining the VAT registration certificate

(Business Identification Number-BIN), the Taxpayer Identification Number (TIN), the trade license, the Memorandum, or any other document, and, if necessary, visiting the supplier’s business location, is required to determine whether the supplier is a manufacturer, a trader, or a procurement provider. )

This task is not difficult. Such scrutiny is not necessary while paying each and every expense. There are enlisted vendors in each entity withholding taxes. The vendors are selected in advance. When vendors are selected, it can be determined whether they are manufacturers, traders, or procurement providers.

Consider that the Sonargaon Hotel will appoint a vendor to procure a steady supply of edible oil. A solicitation has been issued for this purpose. Many organizations participated in the solicitation. There is Bangladesh Edible Oil Industries Ltd. among them. There exists Prince Bazar Private Limited.

Additionally, Rahmania Enterprise exists. Document examination reveals that Bangladesh Edible Oil Industries Ltd. is a manufacturer, Prince Bazar (Pvt) Ltd. is a trader, and Mrs. Rahmania Enterprise is a provider of procurement services.

Whenever a bill for the supply of edible oil is submitted, it could be presumed that it has been submitted by the manufacturer if Bangladesh Edible Oil Industries Ltd. is chosen in the bid. It shall not be necessary to scrutinize each and every measure. The same holds true for both the vendor and the procurement provider.

Dispositions for VAT deduction at source in the case of multiple-component supplies:

On occasion, multiple components are observed within a particular supply. However, price is mentioned entirely. There are complexities regarding the VDS deduction on such supply. So, provisions have been made so that if there is a supply with multiple components, each component must be listed separately in the bid, quotation, or invoice. Each component must be treated as a separate supply, and VDS regulations must be applied accordingly to each supply.

As an illustration, it is sometimes the case that the awarding of a contract stipulates that machinery must be installed and serviced for several years. These two components of the work have been solicited by a single bid. In such a circumstance, one component, namely the installation of machinery, must be counted as one supply, and the servicing of those machines for several years must be counted as a separate supply.

In the bid documents and invoices, the costs of both of these components must be listed separately. On these two components, separate VDS regulations must be applied.

We have concluded our discussion of the initial section. Few topics have been presented sequentially. Which entities are allowed to deduct VDS? VDS is required to be deducted from 37 services. The provisions regarding the advertising service VDS deduction.

The provisions pertaining to VDS deduction on the provider of procurement. Provisions governing VDS deductions for services beyond these 39. Provisions regarding the VDS deduction for a few additional supplies. Modifications to the VDS deduction on products. Now, we will begin discussing the second section that was previously mentioned.

Cases in which VAT deduction at source is not required (a) If any producer or manufacturer of goods supplies the goods directly to any at source VAT deducting authority issuing VAT Challan, then the seller shall not be regarded as a procurement provider, and VAT shall not be deducted at source on such supply. As an example, Bikash Bread and Biscuit Factory Limited is a biscuit manufacturer.

Manusher Jonnyo NGO has issued a request for proposals to acquire biscuits for distribution to impoverished children. The bid is won by Bikash Bread and Biscuit Factory Limited. Bikash Bread and Biscuit Factory Limited will provide biscuits to Manusher Jonnoyo NGO while issuing a VAT Challan, i.e., paying production stage VAT as a producer.

Manusher Jonnoyo NGO shall not deduct VAT at the source when making payment for the supply. The Bikash Bread and Biscuit Factory Limited must receive full payment, including VAT. There is no VAT deduction at the source. Thus, we have learned an important principle of VDS, namely that VDS is not required to be deducted when a manufacturer directly supplies products with a VAT Challan.

Supplying commodities directly:

If a trader supplies commodities directly to a source VAT deducting authority issuing a VAT Challan, he shall not be considered a procurement provider, and therefore VAT shall not be deducted at source on such a supply.

Suppose S. R. Enterprise is a commercial enterprise. S. R. Enterprise acquires soap from Unilever Bangladesh Limited and distributes it on a wholesale or retail basis, issuing a VAT Challan and remitting the correct amount of VAT at the trading stage. If such a trader supplies goods to any at-source VAT deducting authority that issues VAT Challans and pays appropriate trade VAT, such an organization shall not be considered a procurement provider, and VAT shall not be deducted from such a supply.

Suppose that Agrani Bank Limited has issued an invitation to bid for 5,000 bars of detergent. S. R. Enterprise was awarded the contract. S. R. Enterprise has provided the product to Agrani Bank by issuing a VAT Challan, i.e., by paying the correct amount of VAT. In such a circumstance, S. R. Enterprise shall not be regarded as a supplier.

Therefore, Agrani Bank will not be required to deduct VAT when paying the account for soap supply. It is important to note that the same rules apply to merchants who issue Challans considered to be VAT Challans. For example, Agora is a merchant.

Agora concerns Challan is produced by Point of Sale (POS). A Challan generated at the point of sale (POS) is deemed a VAT Challan under certain conditions.

Therefore, if such a supply is made by Agora with a POS-generated Challan to a source VAT deducting authority, the supply shall not be considered a supply made by a procurement provider, and VAT shall not be deducted at source when making payment. Here, we have learned another principle of VDS, namely that VDS is not required to be deducted at source when a supplier issues a VAT-11 for a supply of products.

Organizations enrolled under Turnover Tax issue

Organizations enrolled under Turnover Tax issue their own currency memos bearing their Turnover Tax enrollment number. If such an organization makes a supply directly to a VAT-deducting authority that issues its own cash memo bearing a Turnover Tax registration number, it will not be considered a procurement provider, and VAT will not need to be deducted at source from the payment for the supply.

It is important to note that the number of organizations subject to Turnover Tax is restricted. These institutions are minor institutions. Typically, they do not make a supply to a source-based VAT deduction authority.

Requirement to identify a Turnover Tax organization:

Nevertheless, they have the authority to supply. Therefore, individuals involved in purchase, bill payment, etc. in organizations that deduct VAT at source must be able to identify a Turnover Tax organization.

If the second digit of the 11-digit (old) Business Identification Number (BIN) is 2, the organization is subject to Turnover Tax. The phrase ‘Turnover Tax’ persists on the new 9-digit online Turnover Tax registration certificate.

Therefore, it is simple to determine the status of the supplier upon viewing the BIN. Therefore, we now comprehend another principle of VDS, namely that VDS is not required to be deducted when a supply is made by an entity enrolled for Turnover Tax and accompanied by its own cash memo bearing the enlistment number.

Organizations registered under cottage industry are required to issue their own cash memos bearing their registration number. If such an organization makes a supply directly to any at-source VAT deducting authority issuing its own cash memo bearing its enlistment number, it will not be considered a procurement provider, and VAT will not be deducted from the payment for the supply.

It is important to note that there are very few organizations listed under cottage industry. These organizations are extremely modest in size. In general, they do not make supplies to authorities that deduct VAT at the source. Nonetheless, they are permitted to make such a supply. Therefore, individuals involved in the purchase, payment of bills, etc. at any withholding entity must be able to identify a cottage industry. According to the former BIN, the second digit of the cottage industry’s eleven-digit registration number is 3. They issue their own format for payment memos. There is currently no provision for cottage industry in the online BIN.

The Role of Tahmidur Rahman Remura Law Firm

Navigating the intricacies of VAT Deductible at Source can be challenging, especially for businesses and individuals involved in complex projects or subcontracting arrangements. Hiring Tahmidur Rahman Remura Wahid Law Firm can provide several benefits in this regard.

The law firm has a team of experienced lawyers who specialize in VAT matters and have in-depth knowledge of the VAT Act-2012 and its provisions. Their expertise ensures accurate interpretation of the law and adherence to VAT regulations.

Tahmidur Rahman Remura Law Firm’s reputation for professionalism and integrity makes them a trusted partner for VAT-related matters. They provide personalized attention to clients, understanding the unique aspects of their projects or businesses and offering tailored solutions. Their emphasis on clear communication and regular updates ensures that clients are well-informed and involved in the decision-making process.

Moreover, Tahmidur Rahman Remura Law Firm’s familiarity with VAT Deductible at Source and their experience in dealing with the National Board of Revenue (NBR) enables them to provide effective guidance and representation. They can assist clients in obtaining the necessary certifications and documents, such as Mushak-6.6 certificates and treasury challans, to ensure compliance with VAT regulations and avoid any potential issues or penalties.

VAT Deductible at Source plays a significant role inensuring proper collection of VAT in Bangladesh. Understanding the regulations and complying with the requirements can be complex, especially in cases of subcontracting or project-based activities. Hiring a reputable law firm like Tahmidur Rahman Remura Law Firm can provide valuable support and guidance throughout the process.

Their expertise, personalized approach, and commitment to client satisfaction make them a reliable partner for VAT-related matters. By entrusting your VAT Deductible at Source requirements to Tahmidur Rahman Remura Law Firm, you can navigate the complexities of VAT regulations with confidence and optimize your VAT-related procedures in Bangladesh.

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, Dagenham

Email Addresses:

info@trfirm.com

info@tahmidur.com

info@tahmidurrahman.com

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817