Issue Management for IPO in Bangladesh: How to start a Public Issue

A Lead Manager at a commercial or investment bank is in charge of organizing a specific credit or bond issuance. This bank will recruit additional lending institutions or underwriters to form the syndicate, negotiate terms with the issuer, and monitor market conditions. The Lead Manager is also known as the Syndicate Manager, the managing underwriter, or the lead underwriter.

The lead manager negotiates with the borrower or issuer, evaluates market circumstances, and forms the syndicate that lends money or underwrites the issue. Also known as syndicate manager, managing underwriter, or lead underwriter.

In a syndicate, an underwriting business reports directly to the managing underwriter. A syndicate is a group of underwriters who work together to place a new securities issuance with investors. Every syndicate is a temporary arrangement. The lead manager is allotted the second-largest portion of the new issue for placement. A lead manager is sometimes known as an arranger.

Issue Management and Underwriting

Issue management efforts are a crucial component of a merchant banking operations. As issue manager, a merchant Bank oversees the Initial Public Offering (IPO), right offers, and repeat issues of shares and debentures. It also allows an issuer to place shares with public/institutional investors prior to the IPO. Issue management activities include preparing prospectuses (for IPOs and repeat offerings) and right offer documents (for right offers), submitting them to the Bangladesh Securities and Exchange Commission, and receiving their approval. RIL also provides logistical and other help in the collection of money applications, the review of application forms, the formation of a lottery in the event of oversubscription, and the distribution of allocation letters and reimbursement warrants, where applicable.

Issue management refers to the administration of business securities that are regularly sold to the public and existing shareholders on a rights basis. Merchant bankers and top managers must manage issues effectively. In Bangladesh, merchant bankers with the necessary professional skills and expertise manage capital concerns. One of their responsibilities is to manage issues. Factors such as the massive growth in the number and scale of publicly traded firms, as well as the complexity that arises as a result of the ever-increasing BSEC standards, have all contributed to merchant bankers’ increasingly crucial position in recent years.

In Bangladesh, public issues are one of the most common methods of generating capital from a large number of investors. During this process, a firm distributes a prospectus to the general public, inviting them to purchase its shares by paying the share application money. It is a method of issuing convertible shares or securities in the primary market to entice new investors to subscribe.

The Sources of Fund Available to a Business in Bangladesh:

Initial Public Offering in Bangladesh:

For Unlisted Companies An unlisted company is a public corporation whose shares are not listed on a stock market or traded on any recognized stock exchange. It can also enter the primary market through an initial public offering. An initial public offering (IPO) is the first time an unlisted company offers its shares to the public.

As a result, the IPO process serves as a watershed moment for any unlisted firm, allowing them to raise cash through public subscriptions. However, this method is significantly riskier than a Further Public Offering because a company joins the market for the first time by releasing a prospectus.

Advantags of a Pu

Further Public Offer:

Further Public Offer for Listed Companies Further Public Offering occurs when a publicly traded firm makes a sale offer or issues new shares to the public in order to raise funds.

FPO refers to a firm that has previously been listed and has completed the IPO procedure and plans to issue shares to the general public. It is done to encourage future public investment. FPO is less riskier than an Initial Public Offering because investors are already aware of the company’s success and have a good understanding of its growth prospects.

Offer for Sale

Offer for Sale In collaboration with the BOD, shareholders may offer a portion of their holdings to the general public. The prospectus of a firm is referred to as its LOI. Furthermore, the Company’s shareholders refund any expenses incurred in connection with the offer. Consequently, any dividend paid or declared on these shares is paid to the transferee.

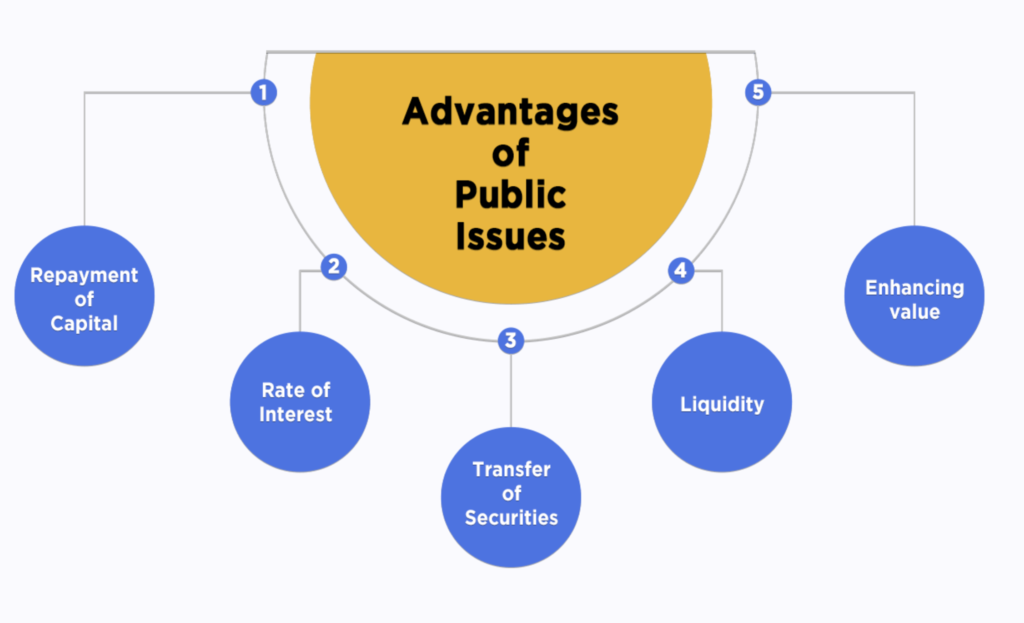

The advantages of Public Issues can be summarised as follows:

Repayment of Capital:

If a company raises capital through Public Issues, there is no need to repay the amount to the investors except when the company goes into the winding-up process.

Rate of Interest:

Unlike debentures, public issues do not provide any fixed rate of interest.

Transfer of Securities:

In comparison to debentures, the ownership of a shareholder is easily transferable in the case of public issues.

Liquidity:

As compared to any other form of securities, shares are more liquid as they can be converted into cash easily.

Enhancing value:

The goodwill of a company increases when it trades shares on a recognised stock exchange. It also increases the level of transparency and trust among the investors and the public.

In Bangladesh, the many types of intermediates necessary with a valid proof can be classed into:

Merchant Banker

Merchant Bankers are the most important intermediates of all. They support a firm throughout the process, from creating a prospectus to listing its securities on a recognised stock exchange. Merchant bankers check and verify all of the information presented in the prospectus by conducting due diligence on all of the data. Following that, they issue a certificate to the Bangladesh Bank.

Underwriters

Underwriters must subscribe to a company’s unsubscribed shares. Underwriters come into play when shares are undersubscribed.

Registrar and Share Transfer Agent

The Registrar and the Share Transfer Agent determine the basis for allotment of shares received from the public. They are also in charge of sending out share certificates and refunds.

Issue Bankers

The Issue Banker receives all applications on behalf of the Issuer Company. These applications are subsequently submitted to the Registrar and Share Transfer Agent for further processing.

Stock Brokers and Sub-Brokers

The Issuer Company pays Stock Brokers and Sub Brokers a commission for urging the public to subscribe to its shares.

The Role of a Law Firm/Advisor in the IPO Process in Bangladesh:

The IPO process in Bangladesh is complex and highly regulated, necessitating meticulous law firm strategy and implementation. A law advisor or law company can play an important part in this process by providing the following services:

• A legal firm can provide thorough due diligence services to prepare a company for the IPO process.

• A law advisor/firm can design and evaluate offering documentation, including prospectuses, to ensure compliance with securities legislation.

• A law firm can advise on compliance with Indian securities rules and regulations, such as the BSEC guidelines.

• A legal firm can help create the create Red Herring Prospectus (DRHP) in accordance with BSEC requirements.

We provide a comprehensive range of services to help your firm through the IPO process, including DRHP drafting, securities legislation compliance, and offering document drafting. Our professional team of lawyers has vast experience in IPO-related law firm concerns and can provide tailored legal assistance to meet your company’s specific needs.

TRW Law Firm takes a collaborative approach to working with clients. We recognize that going public is a huge choice for your company, and we collaborate closely with you to ensure that your firm’s aims and interests are always prioritized. Our team takes the time to learn about your company and goals before providing specialized law firm services that meet your specific requirements.

Our dedication to offering superior law firm services has earned us a reputation as one of Bangladesh’s leading legal firms for IPO-related problems. With our help, your company may effectively navigate the IPO process and achieve its objectives.

TRW Law Firm is proud to be one of Bangladesh’s leading law firms for IPO-related problems.

Our experienced lawyers have a thorough awareness of the legal and regulatory framework surrounding IPOs, and we apply this knowledge to all aspects of our work with clients. With our collaborative approach and commitment to offering great law firm services, we can guide your company through the complexities of the IPO process with comfort and confidence. Contact us today to find out how we can assist your firm reach its IPO objectives with the top lawyers in the market.