Company Registration in Bangladesh: A Comprehensive Guide

Registering a company in Bangladesh is a crucial step for investors looking to start a business or expand their operations in the country. Bangladesh offers a favorable environment for company registration procedure in bangladesh, and most businesses prefer to be registered as private limited liability companies due to the legal protection and limited liability they offer.

In Bangladesh you can do proprietorship company registration in bangladesh, private limited company or if you are a foreign entity then you can incorporate your fully owned subsidiary, branch or liaison office in Bangladesh by hiring suitable company registration consultants in bangladesh.

This article from our esteem partners aims to provide a detailed overview of the company registration process in Bangladesh, requirements, and post-registration formalities in Bangladesh for private limited company incorporation in Bangladesh.

Pre-Registration – What You Need to Know

Before diving into the company registration process, it’s essential to understand key facts about company formation in Bangladesh:

- Company Name Clearance: The proposed company name must be approved (cleared) before incorporation.

- Directors: A minimum of two directors are mandatory, who can be either local or foreign. Directors must be at least 18 years old, not bankrupt, and not convicted of malpractice in the past. They must own qualification shares as stated in the Articles of Association.

- Shareholders: A private limited company can have a minimum of 2 and a maximum of 50 shareholders. Shareholders can be individuals or legal entities.

- Authorized Capital: The maximum share capital the company is authorized to issue must be stated in the Memorandum of Association and Articles of Association.

- Paid-up Capital: The minimum paid-up capital for registration is Taka 1, but it can be increased after incorporation.

- Registered Address: A local address must be provided as the registered address, which must be a physical address and not a P.O. Box.

- Memorandum and Articles of Association: The company must prepare these two documents detailing the business objectives, shareholder information, and company regulations.

Considerations for Foreigners

Foreign investors planning to register a company in Bangladesh i.e a foreign company registration in bangladesh, should take note of the following points:

- Bank Account Opening: A bank account must be opened in the name of the proposed company with the name clearance obtained from the Registrar of Joint Stock Companies and Firms (RJSC).

- Remote Incorporation: All incorporation formalities can be handled remotely through authorized lawyers/agents in Bangladesh.

- Foreign Directors and Shareholders: All directors and shareholders can be foreigners, and there is no requirement for any special visa if they do not plan to relocate to Bangladesh.

- Work Permit: If foreign investors plan to operate the company from Bangladesh, they must obtain a work permit.

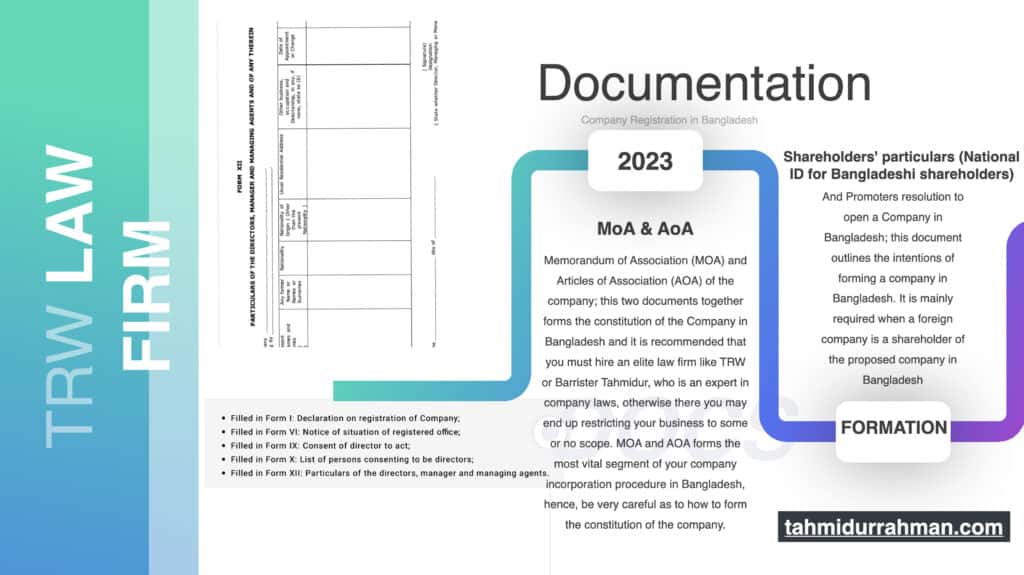

Required Documents

At first, before we get into the process of company registration in bangladesh, for company incorporation in Bangladesh, the following documents are required by the company registrar:

- Company Name Clearance Certificate

- Memorandum of Association and Articles of Association

- Shareholders’ particulars (National ID for Bangladeshi shareholders)

- Directors’ particulars (including Tax Identification Number)

- Registered Address

- Signed Form IX and Subscriber Page

- For foreigners: Copy of passport of shareholders and directors.

Procedure for Company Registration in Bangladesh

The company registration process in Bangladesh involves the following steps:

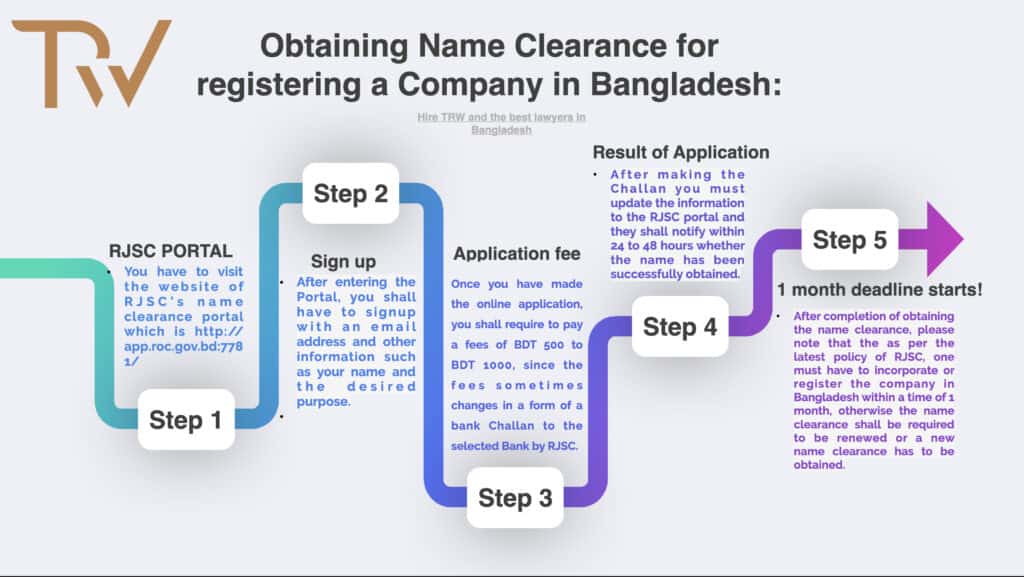

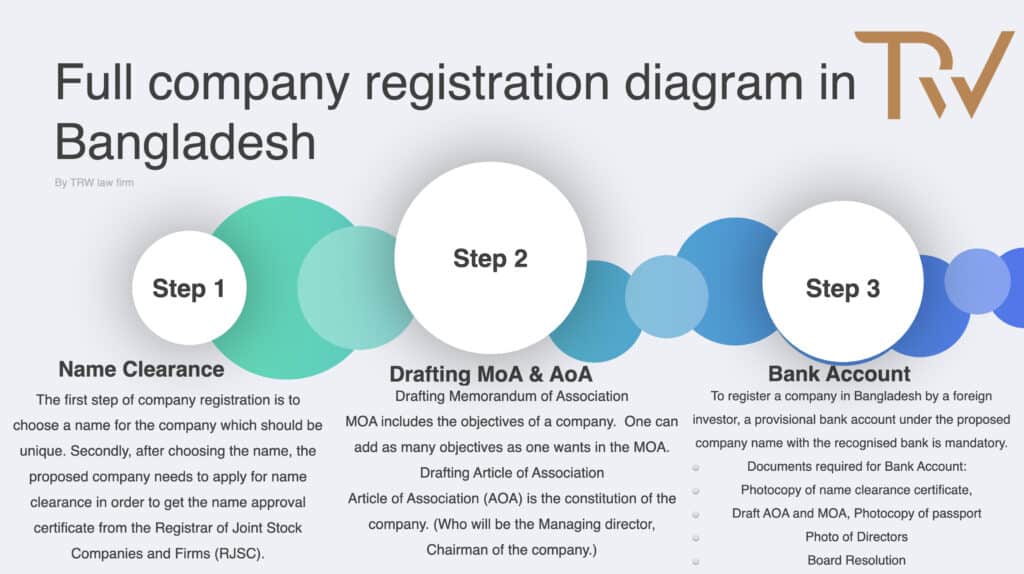

Step 1: Name Clearance

- Select a desired company name and apply for name clearance on the Registrar of Joint Stock Companies and Firms (RJSC) website.

- Pay the prescribed fee for name clearance.

- After verification, RJSC will issue a name clearance certificate, which is valid for six months and can be extended if necessary.

Step 2: Drafting AoA & MoA for company registration in bangladesh

Drafting Memorandum of Association:

A limited company’s Memorandum of Association (MOA) is an essential aspect of the company registration process. A company’s objectives are included in a MOA. In the MOA, you can include as many objectives as you wish.

Drafting Article of Association:

The company’s constitution is its Articles of Association (AOA). As a result, the AOA contains all of the regulations governing how a limited company will operate, as well as who will serve as the firm’s Managing Director, Chairman, and Directors.

Step 3: Bank Account Opening and Paid-up Capital

- Open a temporary bank account in the company’s name with a scheduled bank in Bangladesh.

- Remit the paid-up capital (if foreign shareholding) to the bank account, and obtain an Encashment Certificate from the bank.

Deposit of share capital:

Following the opening of the provisional bank account, for completing company registration in bangladesh, a share money deposit will be paid from the foreign shareholder’s nation to the provisional account. As a result, the funds must be transferred from the shareholder’s person or entity account. After receiving payment, the Bangladeshi bank will provide an encashment certificate.

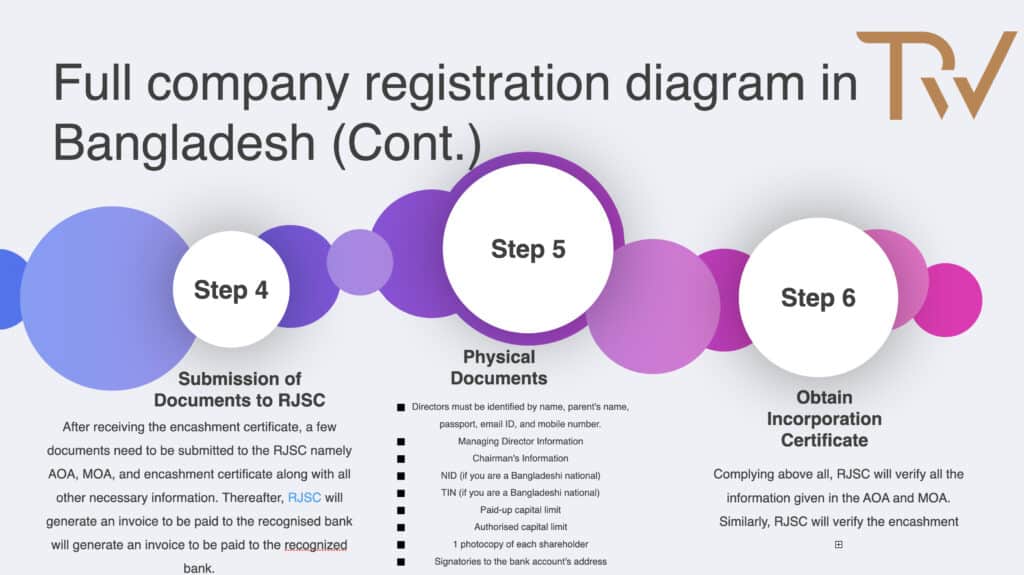

Step 4: Submit Company Information to RJSC

- Upload digital copies of the MoA, AoA, and other required documents on the RJSC website.

- Obtain the Electronic Payment Slip for registration fees and stamp duty.

Step 5: Submission of Physical Documents and required fee

- Affix non-judicial stamps on the MoA and AoA.

- Submit physical copies of the MoA, AoA, and other documents, along with the Encashment Certificate, to RJSC.

The government registration fee is determined by the company’s authorized capital. For example, if the allowed capital is 50 lakh, the government charge will be BDT 13570 (USD 160) plus 15% VAT. The government fee for company registration in Bangladesh can be found here.

Step 6: Obtain Incorporation Certificate

- RJSC officials will review the submitted documents.

- If satisfied, RJSC will issue the Certificate of Incorporation, Digital Certified Copy of MoA and AoA, and List of Directors (Form XII).

- Present the Incorporation Certificate to the bank to convert the temporary account to a regular account.

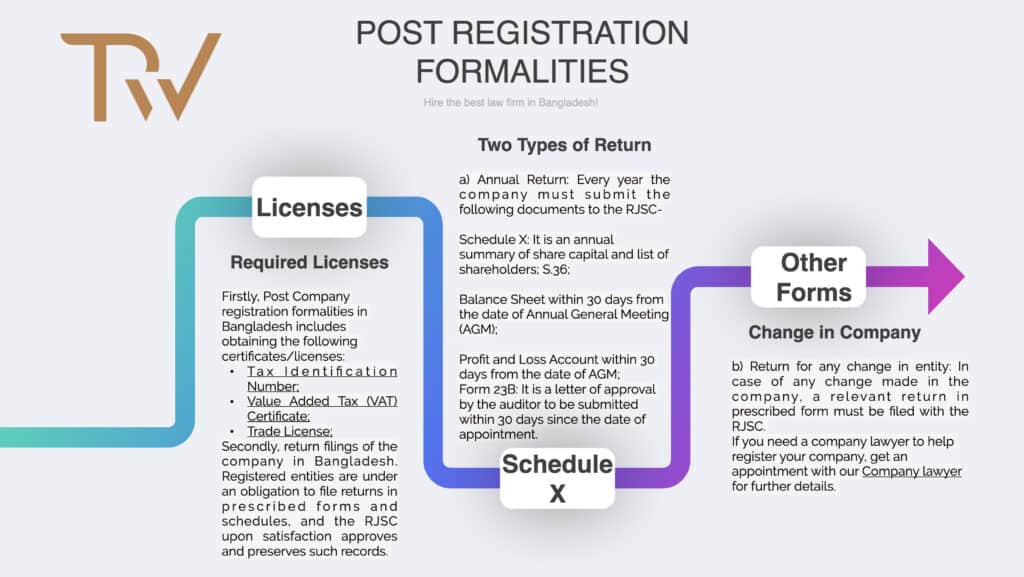

Post-Registration Formalities

After company registration, the following post-registration formalities need to be completed:

- Obtain Trade License, Tax Identification Number, and Other Licenses: Apply for a trade license and obtain a Tax Identification Number (TIN). Depending on the business activities, additional licenses may be required.

- Return Filing Requirements:

Annual Return:

Hold an Annual General Meeting (AGM) within 18 months of incorporation, and no more than 15 months between subsequent AGMs.

Regular Return:

File relevant returns for any changes in the board of directors, shareholding structure, or other significant changes.

Taxation and Company Registration in Bangladesh:

Corporate Tax Rate | Applicable Companies |

|---|---|

| 25% | Publicly traded companies (listed companies on the stock market) |

| 30% | Non-publicly traded companies (private companies limited by shares) |

| 37.5% | Publicly traded banks, insurance, and financial institutions other than merchant banks |

| 40% | Non-publicly traded banks, insurance, and financial institutions |

| 40% | Publicly traded mobile network operators |

| 45% | Non-publicly traded mobile network operators |

| 45% | Publicly traded cigarette manufacturers |

| 45% | Non-publicly traded cigarette manufacturers |

| 25% | One Person Company (OPC) |

| Taxation Process | Annual Income Tax Return Deadline |

| File income tax return annually | Usually on 15th January of the next year following financial closing (usually July-June). |

| Additional Tax Information | |

| What is the Corporate Tax on profit? | Corporate tax on its profit Minimum tax usually @ 0.06% of gross revenue to be paid |

| How to Inject paid-up capital to the company’s bank account? | By cheques or any other instrument |

| Are there any transparency requirement? | The company should adequately explain debit-credit in the bank statements |

Please note that besides the corporate tax rates mentioned above, there are several tax exemption facilities available for companies based on the nature of their business and location. Additionally, one-person company registration in Bangladesh has been officially launched, allowing individuals to incorporate a company on their own.

FAQ about Company Registration in Bangladesh:

| FAQ | Answer |

|---|---|

| What is a Private Limited Company? | A Private Limited Company is a type of company that restricts the right of share transfer, limits the number of members to fifty, and prohibits public invitation to subscribe to shares or debentures. |

| How to incorporate a private limited company? | The process of company registration in bangladesh involves obtaining name clearance, drafting required documents, opening a temporary bank account, submitting documents to RJSC, and obtaining the incorporation certificate. |

| Are there any minimum shareholders required to form a company? | Yes, a minimum of two shareholders is required to form a private limited company. |

| Are there any minimum directors required to form a company? | Yes, a minimum of two directors is required to form a private limited company. |

| Is there any requirement of a resident/local director to operate a foreign company in Bangladesh? | Generally, there is no requirement for a resident/local director, but one director must be physically present to open a bank account. |

| Is there any minimum amount for the authorized and paid-up capital to be prescribed? | There is no specific limit on authorized or paid-up capital, but it is suggested to have a minimum authorized capital equivalent to USD 50,000 for legal purposes and adequate paid-up capital for business operation. |

| Are there any guidelines on reflecting company activities in the name? | There are no strict guidelines, but it is suggested to reflect the company’s activities in the name. |

| Is it mandatory to have a registered local address for the company? | Yes, a registered local address is mandatory for the company. |

| Do you provide office address? | Yes, office address services are available for company registration. |

| What documents are required for company formation? | Required documents include Memorandum of Articles and Articles of Association, directors’ resolution, consent forms, and various registration forms. |

| Whether prior permission of regulatory authority is needed for making investment? | For investment in kind, the concerned company needs to be registered with RJSC, and relevant forms and agreements must be filed with RJSC for record-keeping. |

| What is the difference between authorized capital & paid-up capital? | Authorized capital is the maximum share capital the company can issue, while paid-up capital is the amount actually paid by shareholders. |

| Whether directors need to obtain any registration before becoming directors of the company? | Directors do not need any specific registration before becoming directors. |

| Is it mandatory to appoint a company secretary? | There is no mandatory requirement for a company secretary in private limited companies. |

| What is the timeline for company formation? | The timeline for company formation may vary, but it usually takes a few weeks to complete the entire process. |

| What are the post-company formation required licenses and approvals? | Post-formation, licenses such as Tax Identification Number (TIN), Trade License, and VAT Registration Certificate need to be obtained. |

| When will a company be fully ready to operate legally in Bangladesh? | A company can start operating legally in Bangladesh after completing the registration process and obtaining necessary licenses and approvals. |

| Are there any restrictions/guidelines for altering company operation & management in the future? | Yes, any changes in company operation or management must be reported to the Company House. |

| What documents are required for bank account opening? | Documents such as the Certificate of Incorporation, Memorandum and Articles of Association, and identification documents are required for bank account opening. |

| Can a company own several businesses under different names? | Yes, a company can own multiple businesses under different names, as long as it complies with its Memorandum of Association and obtains necessary permissions if required. |

| Can a company change its business category not mentioned in its memorandum? | To carry out a different business not mentioned in the memorandum, the company needs to apply to the High Court to add that category. |

Registering a company in Bangladesh is a streamlined process that can be handled remotely through authorized agents. Foreign investors have the flexibility to operate their businesses from overseas or relocate to Bangladesh with appropriate work permits. With its investor-friendly policies and favorable business environment, Bangladesh presents attractive opportunities for both local and foreign entrepreneurs.

If you are considering company registration in Bangladesh, it is advisable to seek professional legal assistance to navigate the registration process efficiently and ensure compliance with all regulatory requirements.

Time Requirement For A Company Formation

We want to finish the registration procedure as soon as possible. Preparing papers, RJSC online filing, payment, and a physical encounter with RJSC might also affect the timeline.

| License / Approval | Particulars | Duration |

| Incorporation Certificate | MoA, AoA, and Forms | 7 Days |

| Trade License | Trade License copy with Photo | 2-3 Days |

| TAX Identification Number (TIN) | TIN is a must for all companies | 1 Day |

| VAT | VAT is a must for all companies | 7-10 Days |

| Membership from the chamber of commerce | All Export and Import companies | 5-30 Days |

| Import and Export License (IRC, ERC) | Only for Export and Import Company | 7-15 Days |

| Fire License | For all Factory and corporate | 7-15 Days |

| Factory License | Manpower Approval | 3-10 Days |

| Bostro | For cloth factory business | 7-10 Days |

| Branch Office | Branch permission for 2-5 years | 30 Days |

| BEPZA / BIDA | Branch open permission for 3-5 years | 30 Days |

Expected licensing fee In Bangladesh

The fees and costs of company registration in Bangladesh will be determined by the nature of your firm. The following table shows the projected cost of forming a company:

| Category | Nature of Business | Expected Cost (Taka) |

| A | Service and General Trading Company | Less than 60000 |

| B | Relating to Export and Import Company | Less than 120000 |

| C | Relating to Export, import and Manufacture | Less than 400000 |

| D | Branch and Representative Office | Less than 60000 |

| E | Employment and Investor Visa | Less than 50000 |

Summary for Company Registration in Bangladesh and FAQ:

Are you planning to do your company registration in Bangladesh?

Company formation and registration at Tahmidur Rahman Remura Wahid: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman Remura Wahid Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering all sorts of companies in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS