Corporate Income Tax in Bangladesh

Corporate income tax is an important source of revenue for a government. Bangladesh’s national parliament proposed and approved a national budget, and the National Board of Revenue (NBR) of Bangladesh publishes the Finance Act every year in order to update tax rules and regulations and accelerate tax revenue.

While one can understand that the essence of many updates in tax laws has been the Government’s excessive tax collection target, certain recent tax law updates appear extremely aggressive for honest taxpayers. In July 2019, the Finance Act 2019 was published, and it added a new section 30B “Treatment of disallowances” to the Income Tax Ordinance.

Section 30B is unquestionably one of Bangladesh’s most aggressive and unfair tax collection measures. Before we get into section 30B, let’s go over section 30 “Deduction not admissible in certain circumstances” briefly and simplify the likely consequences. This section discusses specific business expense limits, compliances, and rules.

Some of the points in this section are logical, while others are highly debatable. The following are some examples of contentious compliances:

- Perquisites (house rent, conveyance etc) (house rent, conveyance etc.) given to an employee in excess of Tk 550,000 per year

- A royalty or fee for technical services that exceeds 8% of the disclosed net profit

- Overseas travel costs that exceed 1.25% of the disclosed turnover

Without a doubt, all of the expenses listed above are legal and reasonable for any business anywhere in the world.

All of these expenses are taxable income for an entity, and tax is payable at a regular rate if they exceed the limit set in Section 30 of the IT Ordinance 1984. Until the Finance Act of 2018, all entities treated those inadmissible expenses as part of their taxable income.

Income from business or profession

According to Finance Act 2019, new Section 30B of the IT Ordinance 1984 states that any amount of disallowances made under Section 30 shall be treated separately as “Income from business or profession” and tax shall be payable thereon at a regular rate.

It applies regardless of whether a business is assessed under Section 82C or whether a loss or profit is computed under the regular “Income from business or profession” section. As a result, even a losing business will be required to pay additional tax.

In a country like Bangladesh, where a minimum tax is already in place and all entities, including loss-making ones, are required to pay income tax based on turnover/gross receipts, the additional tax under Section 30B appears to be a penalty rather than a direct tax.

Corporate Tax refund in Bangladesh:

So, in this simple example, a loss-making company is entitled to a tax refund in Bangladesh.

In 2011, X had to pay a minimum tax of Tk 60 in 2018, but with the addition of Section 30B, his tax liability has increased to Tk 260.

The treatment of disallowances under Income Tax Ordinance 1984 Section 30B has a significant impact on tax liability. Disallowances occur when an expense exceeds the specified limit or for any violation of the law.

Section 30 of the ITO 1984 also addresses expense heads that differ by industry. Previously, any disallowance was calculated using u/s.

Section 37 of the IT Ordinance 1984 required that 30 be added to regular business income and taxed after deducting any losses. Following the passage of the Finnace Act 2019, all disallowances under Section 30 are treated separately as business income and taxed directly. The amount payable cannot be compared to the minimum tax liability or adjusted in any way.

Loss:

This will result in an additional cash outflow as a tax charge on top of the regular minimum tax for that year. This treatment results in a significant tax penalty for a business entity.

Business requirements vary by industry, and a standard expense limit is illogical. Furthermore, charging tax directly to an expense violates tax principles. In general, this move is not business-friendly because it worsens the situation for loss-making companies.

Direct income tax should be charged on income rather than expenses, according to basic tax principles. However, the newly added provision acts as a penalty measure, which should not be used to collect revenue.

What is the policy regarding foreign investor income tax in Bangladesh?

The Income Tax Ordinance, 1984 (as amended annually by the Finance Act) and a number of Statutory Regulatory Orders govern the income tax regime (SROs).

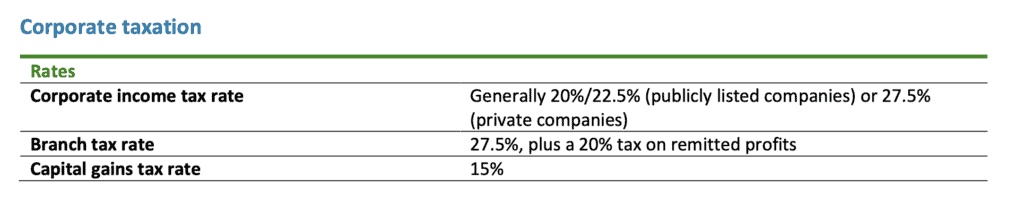

Over the past several decades, the government has gradually reduced the general Corporate Income Tax (CIT) rate (currently, 30% for unlisted companies and 25% for listed companies, excluding certain industries).

Capital gains are subject to a separate 15% tax rate.

CIT regime is considered standard based on usual determination of taxable income and deductible expenses, but differs from other countries in the application of:

i) differentiated tax rates (whether limited liability company or sole proprietorship business, publicly-listed or not, and depending on sector); and

ii) advance/ presumptive payments. Certain forms of income in Bangladesh are presumed to be taxable.

For instance, export proceeds must be withheld at source based on FOB value. Withholding practices also apply to proceeds from services, import payments, royalties/technical license fees, dividends, and loan interest. These taxes are advanced payments and are therefore credited to the final tax liability.

There is also a turnover tax (0.6% of gross receipts excluding certain industries) that can be imposed on all companies, regardless of taxable income and potential loss, constituting a minimum obligation.

Companies in Bangladesh are required to register with the National Board of Revenue (NBR) and obtain a Taxpayer Identification Number (TIN) for income tax reporting/filing purposes.

Disallowed expenses are taxed separately under the heading “income from business or profession” at the regular tax rate. Amortization and depreciation are permitted, and pre-commencement expenses, such as feasibility studies, modeling, prototype creation, and experimental production, may be amortized at a rate of 20% using the straight line method.

Lessors of assets under a finance lease may not claim depreciation.

When the employer fails to provide mandatory information regarding that employee’s tax return filing, salary expenses for that employee are not deductible when calculating the employer’s income.

Bangladesh Corporate Taxation Rate:

For publicly traded companies, the standard rate is 22.5%. Publicly traded companies that raise more than 10% of their paid-up capital through an initial public offering are taxed at a 20% rate.

Banks, insurance companies, and financial institutions (except merchant banks) pay 40% tax, with a lower rate of 37.5% available if the company is publicly traded or received specific government approval in 2013.

Listed mobile phone companies pay 40% tax; non-listed mobile phone companies and cigarette and other tobacco manufacturing companies pay 45% tax. All other businesses (including private limited companies and foreign subsidiaries) are taxed at a rate of 27.5%.

All income, receipts, and individual transactions worth more than BDT 500,000, as well as all types of expenses and investments worth more than BDT 3.6 million, must be transferred by bank transfer; otherwise, the applicable corporate income tax rate on a taxpayer’s total income is increased by 2.5 percentage points.

If a person employs or allows a non-Bangladeshi individual to work in its business or profession at any time during the fiscal year without prior approval from the appropriate governmental authority, the employer will be charged additional tax at a rate of 50% of the total annual income tax payable or BDT 500,000, whichever is greater.

Bangladesh Surtax:

There is no surcharge.

Alternative minimum tax:

In terms of alternative minimum tax, a minimum tax of 0.6% is levied on gross receipts from all sources for any company or firm with gross receipts of more than BDT 5 million, regardless of profit or loss, where the minimum tax exceeds the corporate tax liability.

The applicable rates for manufacturers of cigarettes and other tobacco products and mobile phone operators are 1% and 2%, respectively.

For the first three income years following the start of commercial production, the rate of taxation is 0.1% on gross receipts for an industrial undertaking engaged in the manufacture of goods, and for a startup in its growth years (see “Incentives,” below).

A prescribed method is used to calculate the minimum tax applicable to taxpayers who have income from any source that is exempt or subject to tax at a reduced rate.

Dividend taxation:

Dividends paid by resident corporations are generally taxed as income at a rate of 20%. Dividend income is exempt from multi-tier taxation for both resident and nonresident shareholders.

If a stock dividend (interim or otherwise) declared or distributed in an income year exceeds the amount of any cash dividend, listed companies must pay an additional 10% tax.

Listed companies are also subject to an additional 10% tax on the total amount transferred to retained earnings, reserves, or surplus if the amount transferred exceeds 70% of net income after tax.

Capital gains:

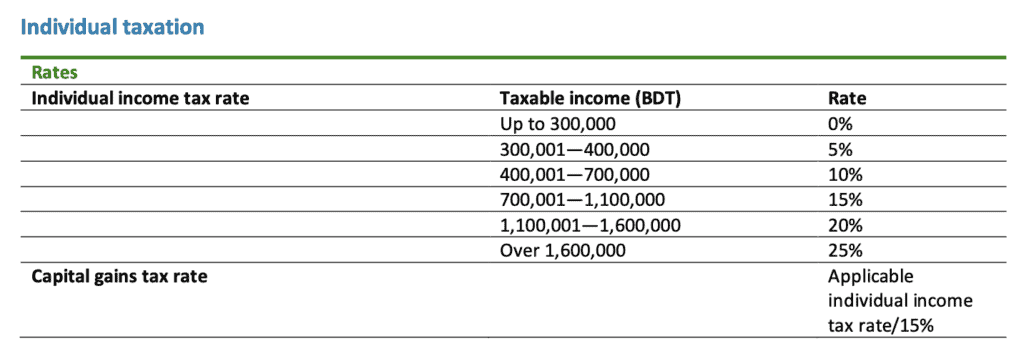

Capital gains are taxed at a 15% rate, with some exceptions.

Losses:

Business losses can be carried forward for up to six years. Loss carryback is not permitted.

Foreign tax breaks:

A resident entity may deduct foreign-source income tax from its Bangladesh tax liability. The credit is equal to the lesser of the foreign income tax paid or the Bangladesh tax payable on the foreign-source income.

Exemption from participation:

There is no exemption from participation.

Holding company regime: There is no such thing as a holding company regime.

Incentives:

Certain income, such as income from an infrastructure facility or industrial undertaking established in Bangladesh, the business of information technology-enabled services (ITES), and exports of handicrafts and industries established in an export promotion zone, are eligible for incentives if certain conditions are met. Industrial enterprises located in specific regions can benefit from area-based tax breaks.

A 10-year 100% corporate income tax holiday is available to newly established manufacturing companies in the following sectors, subject to certain conditions:

- Products relating to information and communication technology;

- Automobile manufacturing (three- and four-wheelers); • Agricultural and dairy products;

- Lighting and home appliances; • General and specialized hospitals; and

- Education and training in a professional or vocational field.

The 100% corporate income tax exemption for income derived from information technology services and ITES provided by companies engaged in cloud services, e-learning platforms, e-book publications, mobile application development services, and other similar activities has been extended until 30 June 2024.

A company that works toward the deployment or commercialization of new products and employs processes or services that are driven by innovation, development, and technology, or intellectual property, may be classified as a “startup” and be eligible for a preferential tax regime.

To qualify, the startup’s annual turnover cannot exceed BDT 1 billion in any given fiscal year, and it cannot be a subsidiary of another company holding 50% or more of its shares, or the result of an amalgamation or demerger. Startups benefit from a variety of tax breaks, including the following:

- No expense disallowance;

- Losses can be carried forward for up to nine years;

- No compliance obligations other than filing an income tax return, assuming the company meets the tax registration requirements; and

- A minimum tax of 0.1% on gross receipts.

Companies formed prior to 1 July 2017, as well as companies formed between 1 July 2017 and 30 June 2023 that fail to obtain tax registration by 30 June 2023, are ineligible for the startup regime. To be eligible, newly incorporated companies must register for tax by 30 June of the year following their incorporation.

The transfer of shares in a nonresident company is considered the transfer of an asset located in Bangladesh to the extent that the value of the transferred shares is directly or indirectly attributable to the value of assets in Bangladesh.

What is Bangladesh’s policy regarding personal income tax?

Bangladesh applies a progressive tax rate to personal income (for residents with a physical presence in the country:

i) for 182 or more days in a single fiscal year or

ii) for 90 or more days in a single fiscal year or

iii) for 365 or more days in the four preceding fiscal years), which ranges from 0% to 25%. (surcharge is payable by wealthy individuals).

Each fiscal year, the Finance Act will establish the personal income tax rate. Following are the current personal income tax rates:

First BDT 300,000 = Nil Following BDT 100,000 = 5% Next 300,000 BDT equals 10%.

The following BDT 400,000 equals 15% Following BDT 500,000 = 20% On balance = 25% Individuals who make eligible investments may be eligible for investment tax credits.

Treaties to avoid double taxation are also available to foreign nationals.

The budget for FY 2021-2023 proposes to maintain the existing rate for individual taxpayers. However, a special provision for the third gender community is introduced, as well as a proposal to set the tax-exempt ceiling for this community at 350,000.

What types of taxes and tariffs apply to imported capital equipment and raw materials?

Customs Duty (CD) specifies tariff rates of 2% to 5% for basic raw materials and capital goods, 10% for intermediate goods, and a maximum rate of 25% for final goods (mostly on domestically produced items) in general.

Regulatory Duty (RD), Supplementary Duty (SD), Value Added Tax (VAT), Advance Income Tax (AIT), and Advance Trade VAT (ATV) may be imposed in addition to CD, depending on the nature of the goods being imported into Bangladesh.

| Description | Existing 2021-2023 | Proposed 2023 -2023 | In case of failure to comply with the condition |

|---|---|---|---|

| Publicly traded company that transfers more than 10% of its paid up capital through Initial Public Offering (IPO) | 22.5% | 20.0% | 22.5% |

| Publicly traded company that transfers ten percent or less than ten percent of its paid up capital through IPO | 22.5% | 22.5% | 25% |

| Non-publicly traded company | 30.0% | 27.5% | 30% |

| One Person Company | 25.0% | 22.5% | 25% |

| Publicly traded bank, insurance and financial institution (except merchant bank) | 37.5% | 37.5% | Condition not applicable |

| Non-publicly traded bank, insurance and financial institution | 40.0% | 40.0% | Condition not applicable |

| Merchant bank | 37.5% | 37.5% | Condition not applicable |

| Company producing all sorts of tobacco items including cigarette, bidi, chewing tobacco and gul | 45% + 2.5% (surcharge) | 45% + 2.5% (surcharge) | Condition not applicable |

| Publicly traded mobile operator company | 40.0% | 40.0% | Condition not applicable |

| Non-publicly traded mobile operator company | 45.0% | 45.0% | Condition not applicable |

| Association of persons | 30.0% | 27.5% | 30% |

| Artificial juridical person and other taxable entity | 30.0% | 27.5% | 30% |

| Private university, private medical college, private dental college, private engineering college or private college solely dedicated to imparting education on ICT | 15.0% | 15.0% | Condition not applicable |

Hire the best law firm in Bangladesh to take care of your corporate taxation needs:

Tahmidur Rahman Remura Wahid TRW Associates is a full-service law firm in Dhaka that provides all types of legal and financial services, including Corporate Income Tax, Income Tax Ordinance, Tax refund, company registration, obtaining the proper licenses, drafting contracts and notices, and providing annual compliances and litigation services.

Tahmidur Rahman Remura Wahid TRW Associates is comprised of competent Barristers and Advocates with expertise in multiple legal fields, allowing them to provide the required services to a high degree and allowing clients to acquire all necessary and supplementary legal services under one roof.

The Barristers, Advocates, and attorneys at Tahmidur Rahman Remura Wahid TRW in Mohakhali New DOHS, Dhaka, Bangladesh have extensive experience assisting clients with trade licensing matters. For questions or legal counsel, please contact us at:

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, 330 High Holborn, London, WC1V 7QH

Email Addresses:

info@trfirm.com

info@tahmidur.com

info@tahmidurrahman.com

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817