Import and Export License and business setup in Bangladesh

International trade, usually referred to as export-import business, entails the purchasing and selling of commodities and services between nations. Because it permits the interchange of goods and services between nations, fostering economic growth and development, it is a crucial component of the global economy.

In South Asia, Bangladesh has one of the economies that is expanding the fastest, and over the past few decades, it has achieved great strides in the export-import sector.

The Bangladeshi government has been aggressively promoting the export-import sector and has put in place a number of policies and measures to promote investment and trade.

Due to this, foreign direct investment rose and will surpass $3 billion in FY2023 . To increase its competitiveness in the international market, the nation has also been working to upgrade its infrastructure, including building ports, roads, and bridges.

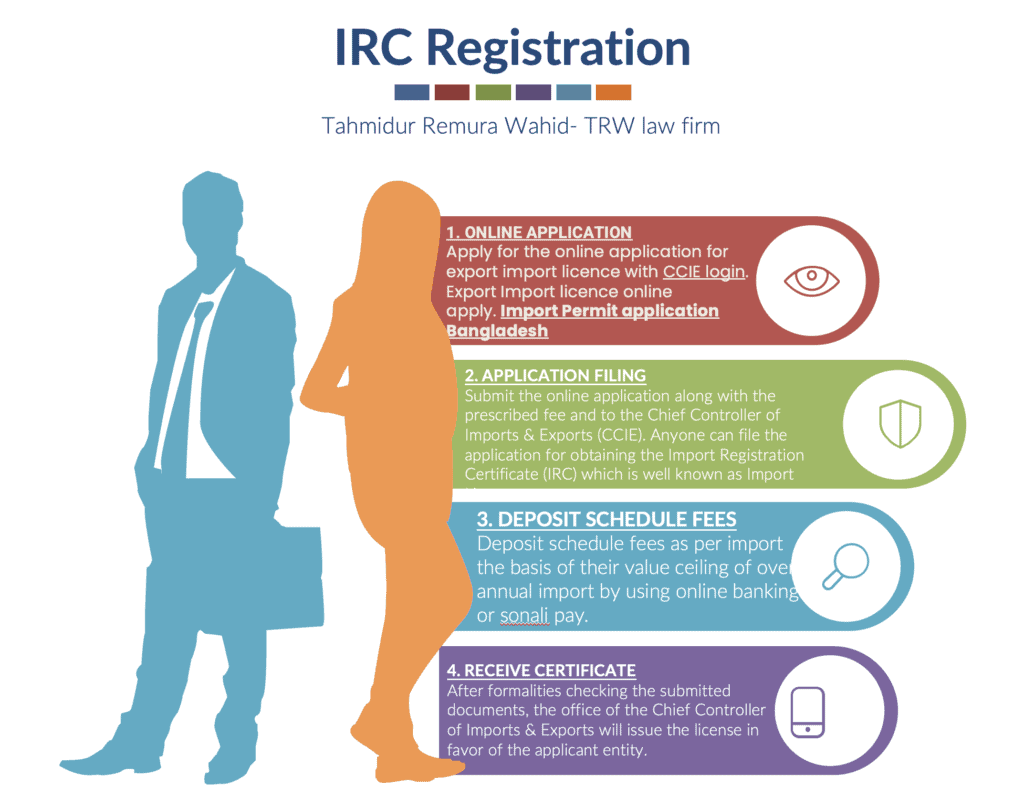

PROCESS STEPS

Step 1: Collect IRC form from office of Controller Import and Export.

Step 2: Scheduled fees may be deposited at Bangladesh Bank or specific Sonali Bank locations. Deposits for fees ought to be made under the heading 1-1731-0001-1801.

If Bangladesh Bank is unavailable, only use the branches of the Sonali Bank. Get three copies of the chalan form, fill them out, and pay the schedule cost.

| Category | Ceiling Value of annualimport | Initial Registrationfees | Annual renewal fees |

| First | Tk. 5, 00,000 | Tk. 5,000 | Tk. 3,000 |

| Second | Tk. 25,00,000 | Tk. 10,000 | Tk. 6,000 |

| Third | Tk. 50,00,000 | Tk. 18,000 | Tk. 10,000 |

| Fourth | Tk. 1,00,00,000 | Tk. 30,000 | Tk. 15,000 |

| Fifth | Tk. 5,00,00,000 | Tk. 45,000 | Tk. 22,000 |

| Sixth | Above Tk.5,00,00,000 | Tk. 60,000 | Tk. 30,000 |

Step 3: Submit the application form together with the necessary recovery documents.

- Please provide a recent passport-size photo of the applicant.

- Make copies of the entire application packet for self-submission. Submit application by 4 p.m. to the receiving room on the third floor of CI&E.

- Obtain the office entry number.

Why is export-import one of the best options for business in BD?

Export-import firms are more relevant and significant than ever thanks to the rise of globalization and the growing interconnectedness of the world. Getting involved in the export-import market has many advantages. Reasons to choose an export-import company:

Almost all of the products that are exported from Bangladesh or imported into Bangladesh are supported by a variety of groups that offer various forms of help to beginning exporters and importers.

For instance, Bangladesh Garment Manufacturers and Exporters Association (BGMEA), Bangladesh Fresh Fruits Importer Association (BFFIA), Bangladesh Chemical Importers and Merchants Association (BCIMA), Bangladesh Ceramic Manufacturers & Exporters Association (BFFEA), Bangladesh Jute Goods Exporters Association (BJGEA), Bangladesh Frozen Food Exporters Association (BFFEA), etc.

You can export a variety of non-conventional goods in addition to fresh and dried fish, including frog legs, crabs, shrimp, butternut squash seeds, betel nuts, vegetables, fruits, coconut husks, and tree roots.

Legal prerequisites

In order to start an export-import business in Bangladesh, you must adhere to a number of legal restrictions. You should keep up with the most recent laws and regulations because it’s crucial to recognize that these legal requirements vary over time.

Additionally, you must get qualified legal counsel to make sure that your company complies with all applicable national laws. The essential paperwork you’ll need to run an export-import company in Bangladesh is listed below.

Business Registration: You must apply for a Trade License from the regional government office and register your business with the Registrar of Joint Stock Companies and Firms (RJSC).

Import and Export Licenses:

Depending on the products you are importing or exporting, you might need to acquire licenses and export registration certificates (ERC) or import registration certificates (IRC) from the appropriate government bodies, such as the Bangladesh Bank, Bangladesh Tariff Commission, or the Ministry of Commerce.

Required Documents for Obtaining Import Registration Certificate

- Attested Copy of original duly attested Trade License of the company.

- Valid Attested Copy of Chamber of Commerce Membership Certificate from relevant trade association.

- A VAT registration certificate.

- Attested Copy of Joint Registered Agreement.

- Attested Copy of Company Incorporation Certificate (if Limited Company).

- Attested Copy of Memorandum of Association and Articles of Associations.

- Original copy of Treasury Challan.

- Partnership Deed in case of Partnership business.

- Copy of Financial/Bank Solvency Certificate of the company.

- Tax Clearance Certificate (TIN) of previous year of the establishment.

- An Office Rent Agreement.

- Details regarding list of employees, their salary & nationality of the company.

- Passport size photographs of the Managing Director/Entrepreneur.

- Citizenship Certificate of the directors by the Word Commissioner.

- National ID card of Managing Director of the company.

- Passport Copy & Work permit is required if the director is a foreigner.

Tax Identification Number:

To begin an export-import firm in Bangladesh, you must receive a Tax Identification Number (TIN) from the National Board of Revenue.

Compliance with International Trade Agreements: As a member of the World Trade Organization (WTO), Bangladesh is required to abide by all WTO and other international trade agreement rules and regulations.

Customs clearance:

The Bangladesh Customs Authority must clear all imported and exported goods. You must abide by customs laws, which includes paying all applicable fees and taxes.

Compliance with Labor Laws: You must abide by all applicable labor laws in Bangladesh, including those governing minimum wages, working hours, and other employment benefits.

Depending on your export-import firm, you could also require a fire service license, an environmental clearance certificate, a membership certificate from the appropriate association, etc. in addition to these documents. Always strive to maintain your paper up to date; otherwise, law enforcement may inquire.

RENEWAL OF IRC

IRC is required to be renewed every year. The required documents are:

- IRC and Last year IRC Certificate (soft copy)

- Renewal Application by the applicant

- Treasury Challan of the annual renewal fee at Bangladesh Bank or Sonali Bank Pay, Online banking ( Scan Copy)

The applicant must gather the relevant paperwork and pay the yearly renewal cost at Bangladesh Bank or Sonali Bank.

Note: In accordance with the Import Policy Order 2021-24, Nominated Banks may also renew IRC. For successive renewals, the IRC applicant must include the name of a single Nominated bank on the IRC application form.

Purchasing and Sourcing

An export-import business must carefully consider its sourcing and procurement processes. You may efficiently manage the sourcing and procurement process by taking the following actions:

Finding Suppliers:

You must locate suppliers who can deliver the appropriate goods at the appropriate cost and level of quality. A variety of tools, including online directories, trade exhibitions, and industry groups, can be used to find suppliers.

Contract negotiations are necessary after you have found a supplier to determine the supply, payment, and delivery terms.

Understanding the supplier’s capabilities, including lead times, production capacity, and quality standards, is crucial.

Managing the Supply Chain: You must oversee all aspects of the supply chain, from obtaining raw materials to producing goods and delivering them to customers. Coordination with vendors, freight forwarders, customs brokers, and other parties is required for this.

Monitoring Quality:

In the export-import industry, quality is crucial. You must keep an eye on the products’ quality to make sure they live up to the high standards set by your clients.

Managing Inventory:

You must successfully manage your inventory to make sure you have enough goods to satisfy customer demand. To monitor your inventory levels and effectively manage goods, you might need to develop inventory management methods and procedures.

Cost management:

Procurement and sourcing decisions might affect how much your products cost. To guarantee that you can give your clients competitive prices, you must efficiently control your costs. To save expenses, you might need to bargain with suppliers or explore for different sourcing possibilities.

You may successfully manage the sourcing and procurement process in your export-import business by following these procedures, which will also guarantee that you have the correct products, at the right price, and of the right quality.

Logistics

A key factor in guaranteeing the success of an export-import business is logistics management. Supply chain definition, carrier selection, and efficient document management are critical for managing logistics effectively.

Additionally, a freight forwarder can help with the handling of paperwork and customs clearance as well as the transportation of goods. Keeping track of the goods that are in stock, on order, and in transit requires inventory management, which is another essential task.

Additionally crucial is the ability to follow goods in real-time, including their position, estimated delivery window, and any potential problems that might surface. The export-import company may make sure that its logistics are effective, efficient, and match its changing needs by routinely analyzing and modifying its logistics operations.

Operations Shipping Logistics

The majority of international trade in Bangladesh happens through marine ports. Air cargo is employed in its place, nevertheless, if the exporting or importing commodity is perishable or has a short shelf life.

When importing, the exporter typically uses their own agency or a freight forwarder to deliver the product to the importer. Clothing, leather goods, and soap are examples of common things that are typically sold in harmless containers.

Specialised International Maritime Dangerous items (IMDG) containers must be used to transport dangerous items like chemicals and gas oil. Reefer or frozen containers are needed for perishable or temperature-sensitive goods. After completing the required papers, the freight forwarder delivers the container to the port authority upon arrival.

The shipping agent subsequently delivers the required paperwork to the shipping company, gets the bill of lading, and obtains the Chamber of Commerce exporter origin certificate. When the importer receives the product, he or she uses these documents to clear the product.

In Bangladesh, how can I obtain a trade license?

The nearest city corporation or city council office is where you can get a trading license. Simply gather the required information and fill out the trade license form.

A NID copy, holding tax payment receipt, company incorporation certificate, TIN certificate, and other supporting documents must be included with this form, along with the fee, which varies depending on your operational capital. For instance, the initial registration fee is Tk 5000, and the renewal fees are Tk 3000, if you want to import goods worth BDT 5 lac.

What is an export business risk factor, and how can export risk be reduced?

A. It frequently happens in the case of export business that the importer has problems paying for the commodity exported to him. In order to avoid major risk factors like importer bankruptcy, order cancellation, and currency conversion issues, it is therefore preferable for exporters to purchase credit insurance in advance. Additionally, by diversifying the export business, the risk factor may be avoided.

Contact Tahmidur Rahman Remura Wahid for your import and export license in Bangladesh:

TRW can provide the following services in order to obtain an Import Registration Certificate and your Export Registration Certificate:

TRW has a good and professional team that can efficiently pursue the IRC Certificate.

TRW’s legal experts can assist clients through consultations and meetings, and they will be asked to produce the relevant documents–NID, Trade License, Incorporation certificate, photos, MOA/AOA, and so on–in order to file for IRC. Documents for application are collected based on the type of company or establishment.

TRW legal specialists can prepare all relevant drafting of documents required to obtain IRC, which are then supplied with clients for execution. Clients execute documents, which are then returned to TRW along with the other relevant documents.

TRW then completes the application by submitting the supporting documents to the appropriate authority and coordinating with them to acquire a certified copy of the IRC.

TRW, legal professionals, have solid working relationships with government organizations such as BIDA and RJSC, which makes obtaining any certificate easy.

TRW also offers services for renewing licenses when they expire by performing the necessary measures at the appropriate time.

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, Dagenham

Email Addresses:

info@trfirm.com

info@tahmidur.com

info@tahmidurrahman.com

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817

How do I obtain ERC?

Ans: To get an Export Registration Certificate (ERC), you must submit an application in the prescribed form to the Office of the Chief Controller of Import and Export (CCI&E). You must send the following documents with your application:

Nationality certificate issued by Ward Commissioner or Union Parishad Chairman (for Bangladeshi nationals) Copy of trade license

In appropriate circumstances, income tax payment certificate from the prior year)

Valid Chamber of Commerce or Registered Trade Association membership certificate Bank solvency certificate

Photograph - 2 copies of the partnership document or incorporation certificate.

The prescribed form and other associated information are available on the CCI&E's official website. CCI&E's website address is www.ccie.gov.bd.

Is a quality assurance certificate required for export?

Ans. Yes, in most circumstances, a quality assurance certificate is required. These certificates are granted by approved offices/organizations/trade associations such as the Export Promotion Bureau (EPB), the Department of Fisheries (DOF), the Bangladesh Standard and Testing Institute (BSTI), and others.

What exactly is compliance in the export business?

Ans: In the export business, compliance involves meeting the requirements of the foreign buyer. Foreign buyers/buyer country/countries may impose special conditions on quality issues, factory working conditions, and so on. These criteria are referred to as compliance.

Do I need Bangladesh government permission to export?

Ans. Except for the restricted items specified in Annex-1 (export forbidden items) and Annex-2 (conditional export items), all products are freely exportable and do not require government approval.

As stated in Annex-2 of the Export Policy 2009-2012, conditional export products require clearance from the appropriate authority.

How can I collect money for my exported goods?

Ans: You can receive financial rewards for the items listed in Annexure-4. Simply follow the steps outlined and submit your claim to your merchant bank along with any required documentation.

I plan to buy some finished goods and then resell them at a greater price. Is it conceivable?

Ans: Yes, but only under certain conditions; for example, if your export is an entre-pôt and re-export, you must follow the rules and procedures outlined in the corresponding policy or circulars, which are included here as Annexure-3.

What exactly is GSP?

GSP stands for Generalized System of Preferences. We benefit from some preferential treatment under this system, such as duty-free or concession-free access.

In which countries do we have GSP?

Ans: We have GSP in 37 countries, including 27 EU nations and 10 others such as the United States, Canada, Japan, Norway, and Switzerland.

How an exporter export certain products. How can I help him?

Initially, an exporter requires an ERC (Export Registration Certificate) upon submission of a bank balance, membership certificate of some association, trading license, and other documents, as mentioned in response to question no. 5. He can then look for international buyers. He can obtain a buyer list from the export destination country's Export Promotion Bureau (EPB) and Bangladesh Mission.

What are RTA and BTA, and what is Bangladesh's role in these agreements?

Ans:

RTA is an abbreviation for Regional Trade Agreement. Bangladesh, for example, is a member of BIMSTEC (Bangladesh, India, Myanmar, Sri Lanka, and Thailand). BTA stands for Bilateral Trade Agreement. Although no bilateral deal has been reached, preliminary bilateral trade talks have begun with India, Pakistan, and Sri Lanka.

What is the difference between comparative advantage, competitive advantage, and absolute advantage?

Ans:

Comparative advantage: determining which activities a country/firm/individual is most efficient at (e.g., naturally available-cheap labor, inexpensive resources, better environment, etc.). Another example of how Canada has the ideal climate, trained labor, resources, and so on to efficiently make wood pulp. According to CA theory, you should grow and sell the product in which you have a comparative advantage (CA) and buy the product in which you have a lower CA.

Advantage in Competition: In competitive markets, competitive advantage is important to a form's performance. Firms or products compete with one another. For example, lower-cost, distinctive items.

Absolute advantage: A firm or product has absolute advantage if it is superior at manufacturing both items.

What are NT, MFN, TBT, and NTB?

Ans:

NT: National Treatment (equal treatment of indigenous and foreign products).

MFN: Most-Favored Nation Treatment (equal treatment of all WTO members).

TBT: Technical Barriers to Trade (WTO regulation): Ensure regulations, standards, testing, and certification.

SPS stands for Sanitary and Phytosanitary Standards. TBT supplement

Non-Tariff Barrier:

What exactly are dumping, antidumping, and countervailing duties?

Ans:

Dumping occurs when a corporation exports a product at a lower price than is generally charged in the home market.

Antidumping: Impose an export fee on dumping goods.

Countervailing duties are anti-subsidies that can be used to counteract (remedy) unfairly subsidized trade.

RoO-Rules of Origin- are used to determine where a product originates.

TRIPS-Trade Related Intellectual Property Rights-Copy Law, Patent Law, Trade Mark Law etc.