Promissory Note and Bill of Exchange

Bills of exchange and promissory notes are written pledges between two parties that confirm the completion of a financial transaction. Bills of exchange are more commonly employed in foreign trade than promissory notes are in domestic trade.

A negotiable instrument is a written commercial document that contains an order for money to be paid on demand or after a particular period of time. Bills of exchange, promissory notes, and cheques are the three sorts. In some cases, the bill of exchange is used in conjunction with a promissory note. The primary distinction between a Bill of Exchange and a Promissory Note is that the former bears a command to pay money, whilst the latter bears a promise to pay money.

Acceptance is a key distinction between the two business instruments; bills of exchange must be accepted in order to be effective. A promissory note, on the other hand, does not require any type of acceptance. So, when working with these two, one should be aware of their significance and characteristics.

What exactly is a Promissory Note?

A promissory note is a form of negotiable instrument that contains a written promise to pay in full. These are duly signed and stamped by their drawers, stating that they will pay a particular sum of money to the holder on a specific day or on demand. Promissory notes, which are used by debtors to borrow from creditors, may not be accepted by a creditor after they have been drawn.

Hence, they have the following characteristics.

- Written promises to repay a debt.

- The drawer or promisor must sign.

- The payment date is set in stone.

- Both the promisor and the promisee agree on a sum of money to be paid.

For settlement, the legal currency of the relevant country is used.

It involves the two parties listed below:

Drawer/Maker:

The debtor who promises to pay a certain amount to its creditor.

Drawee:

A creditor who has been promised a certain amount of money on a specific day.

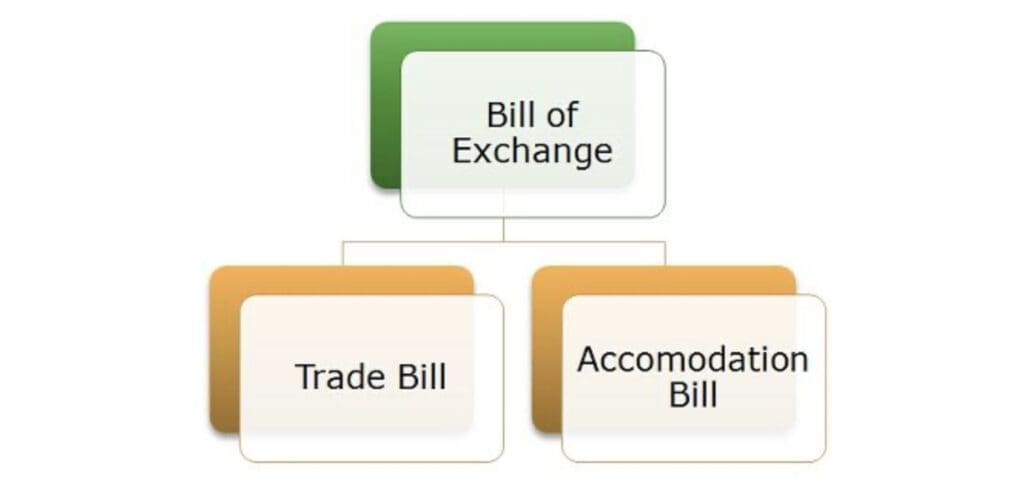

What exactly is a Bill of Exchange?

A bill of exchange, which is a written note legally bonded and duly stamped and signed by its drawer, is also a negotiable tool. It directs that a certain sum of money be paid to the holder of this instrument on demand or within a specified time limit. These are usually payments for products and services that must be accepted by a debtor in order to be valid. It has the features listed below.

- It must be properly dated.

- Contains a payment order.

- The drawer/maker’s signature is required.

- A drawee must accept the bill.

- The payment order and amount should be specified.

- It has to be delivered to the appropriate payee.

It involves the three parties listed below:

Drawer:

The person who receives payment from the issuer of this instrument.

Drawee:

A person who must pay the applicable sum.

Payee: This is the person who gets payment and, in most cases, is the same as the drawer.

What is the difference between Promissory Notes and Bills of Exchange?

While promissory notes, bills of exchange, and cheques have some similarities, they are separate from one another. Despite the fact that they are financial instruments with a documented pledge to pay.

Comparison Chart

| BASIS FOR COMPARISON | BILL OF EXCHANGE | PROMISSORY NOTE |

|---|---|---|

| Meaning | Bill of Exchange is an instrument in writing showing the indebtedness of a buyer towards the seller of goods. | A promissory note is a written promise made by the debtor to pay a certain sum of money to the creditor at a future specified date. |

| Defined in | Section 5 of Negotiable Instrument Act, 1881. | Section 4 of Negotiable Instrument Act, 1881. |

| Parties | Three parties, i.e. drawer, drawee and payee. | Two parties, i.e. drawer and payee. |

| Drawn by | Creditor | Debtor |

| Liability of Maker | Secondary and conditional | Primary and absolute |

| Can maker and payee be the same person? | Yes | No |

| Copies | Bill can be drawn in copies. | Promissory Note cannot be drawn in copies. |

| Dishonor | Notice is necessary to be given to all the parties involved. | Notice is not necessary to be given to the maker. |

There are significant distinctions between bills of exchange and promissory notes, as you are now aware. Here are some of the most noticeable differences:

- A bill of exchange is a negotiable instrument produced when the debtor is directed to pay the creditor the outstanding amount within a particular time frame. A promissory note, on the other hand, is a written agreement between the drawer and the drawee in which the drawer pledges to pay a certain amount within a certain time frame.

- A Bill of Exchange involves three parties: the drawer, the drawee, and the payee. A promissory note involves two parties: the drawer and the payee/drawee.

- A bill of exchange must be accepted by the debtor in order to be considered valid. In the case of a promissory note, the drawee’s acceptance is not required.

- If the Bill of Exchange is not followed, a notice is given to all parties involved. In the case of a promissory note, no notice of dishonor is issued to the “maker.”

- In the event of a bill of exchange, no asset is kept as security. An asset can be used as collateral for a loan in specific cases, such as with promissory notes.

Bills of exchange and promissory notes are equally as important in business as cheques. These notions, which are critical for commercial transactions and financing, are, nevertheless, rarely emphasized. Bills of exchange are one of the most crucial negotiable documents when a debtor obtains products on credit.

The creditor sends the debtor a bill of exchange, asking him to pay the amount within the time range indicated.

The promissory note is similar, but it is issued by the debtor and specifies that the required amount will be paid within a specified time frame. These ideas will help you understand business in a practical way, and you will be able to apply them in your own business or at work.

| Bill of Exchange | Promissory Note |

| Definition | |

| A negotiable instrument issued to order the debtor to pay the creditor a certain sum of money within a specific date or on demand. | A negotiable instrument issued by the debtor with a written promise to pay the creditor a certain amount within a specific date or on demand. |

| Section | |

| Mentioned in Section 5 of the Negotiable Instruments Act, 1881 | Mentioned in Section 4 of the Negotiable Instruments Act, 1881 |

| Issued By | |

| Creditor | Debtor |

| Parties Involved | |

| Three parties involved i.e a drawer, the drawee and a payee. | Two parties involved i.e a drawer/maker and the payee |

| Acceptance | |

| Drawee needs to accept the bill of exchange before payment. | No acceptance required from the drawee. |

| Liability | |

| Liability of drawer is secondary and conditional. | Liability of drawer is primary and absolute. |

| Dishonouring of instrument | |

| Notice served to all the concerned parties involved in the transaction on dishonouring the instrument. | No notice served to the drawer in case of dishonouring the instrument. |

| Copies | |

| Bill of exchange can have copies. | The promissory note allows no copies. |

| Is it Payable to drawer/maker | |

| Yes, the same person can be drawer and payee. | The same person cannot be drawer and payee. |

ব্যারিস্টার তাহমিদুর রহমান রিমুরা কর্তৃক চেক ডিসঅনার মামলা সম্পর্কিত আইনী সেবা:

ব্যারিস্টার তাহমিদুর রহমান: সিএলপি একটি সনামধন্য ‘ল’ চেম্বার যেখানে ব্যারিস্টারস এবং আইনজীবীদের মাধ্যমে চেক ডিসঅনারের মামলা সম্পর্কিত সকল প্রকার আইনগত সহায়তা, পরামর্শ প্রদান করে থাকে। কোন প্রশ্ন বা আইনী সহায়তার জন্য আমাদের সাথে যোগাযোগ করুনঃ-

ই-মেইল: info@trfirm.com

ফোন: +8801847220062 or +8801779127165 ,

ঠিকানা: রোড ২৯, হাউজঃ ৪১০, মহাখালী ডি ও এইচ এস, ঢাকা।