Buying or Selling businesses in Bangladesh

If you intend to acquire or sell a business, it is imperative that you hire M&A law firm with the appropriate credentials and experience. The acquisition of a business and the execution of an exit strategy are crucial milestones, and our corporate attorneys have a history of guiding our clients with expertise.

Whether you are building your business through acquisitions, acquiring a distressed business from an administrator, or selling your business to a trade buyer, private equity firm, or to management, we make it a priority to understand your objectives and priorities so that we can deliver a deal that is tailored to your specific goals and circumstances.

We frequently represent both purchasers and sellers, and our corporate team has extensive knowledge of the challenges faced by both parties. As part of the Euro- South Asian network, we have access to attorneys and other professional advisors throughout Europe and Asia, enabling us to offer seamless cross-border M&A services.

Transactional Structures (equities versus assets):

In addition to the various transaction types (trade sales, MBOs, EOTs, etc.), there are two primary methods to sell/buy a business. These are an asset sale, in which all (or a substantial portion of) the business’s assets and contracts are transferred to the buyer, and a share sale, in which the buyer acquires shares in the corporation that owns the business.

If the business is owned by an individual or partnership, the transaction must be structured as an asset transfer (unless the business is first incorporated). If the business is operated by a limited liability company, the buyer and seller will typically concur on whether a share sale or an asset sale will occur.

When choosing between these options, both buyer and vender face advantages and disadvantages, including the following:

Continuity:

- Share sale – the legal entity carrying on the business remains the company, and little will have changed externally. This also means that extant trading contracts are more likely to be unaffected (although some contracts contain termination clauses or require notice in the event of a change in ownership).

- Asset sale — the purchaser will become the operating company. Consequently, the transfer of particular assets may require additional steps (such as the registration of real estate transfers with the land registry and the transfer of domain names) to be “perfected.” Additionally, all existing contracts must be assigned (which frequently requires the consent of the respective consumer or vendor).

Liability

- Share sale – the company retains all of its existing liabilities, which must be factored into the purchase price by the buyer. As a result, the buyer will be eager to obtain sufficient assurance regarding the exposure (via due diligence and contractual protections). An underlying liability will remain with the company even if neither the buyer nor the vendor was aware of it.

- Asset sale – unless the buyer expressly agrees to assume the seller’s existing liabilities (which will typically require the consent of a third party), the seller’s existing liabilities will typically remain with the seller.

Employees

The treatment of employees differs significantly between the sale of shares and the sale of assets. In the event of a share transaction, the employer does not alter. The personnel will transfer to a new employer upon the sale of an asset. This is typically the result of law’s automatic operation and is extremely difficult to avoid.

The Transfer of Undertakings (Protection of Employment) Regulations (commonly referred to as TUPE) stipulate that not only do employees automatically transfer to the new owner of a business, but they do so as if they had always been employed by the buyer, meaning that the buyer assumes all existing liabilities of the seller.

Assets

Assuming that the assets of a business belong to the company, when the shares are transferred to the buyer, the assets will remain under the ownership of the company, even if the buyer and/or seller were oblivious of them.

Sale of assets – each asset must be transmitted to the buyer. The parties are permitted to “cherry-pick” the assets they wish to acquire, and the agreement between the buyer and vendor must specify which assets are being sold and which are being retained by the seller.

VAT

On the transfer of shares, no value-added tax is imposed.

Asset sales are not subject to VAT if the transfer is of a “going concern.” If this condition is not met, then the transfer of the assets may be subject to VAT.

Stamp Duty

Share transactions are subject to a 0.5% stamp duty on the purchase price.

On the transfer of the vast majority of assets, no stamp duty is due. Land is the most obvious form of asset for which stamp duty is payable upon transfer.

There are also a number of common elements in a business sale, regardless of whether the transaction involves the transfer of shares or assets.

In each instance, the buyer will want to conduct due diligence investigations to ensure that it understands what it is purchasing and to support this effort with contractually binding provisions pertaining to the business and its assets (known as warranties and indemnities).

Price and payment terms must also be negotiated and agreed upon by the parties. Notably, the parties may wish to agree on a mechanism to modify the purchase price to reflect the financial position of the business at closing (for example, a stock take or clarification of the cash, debt, and working capital position). They may also consent to an increased or decreased purchase price based on the business’s future performance.

Tax Issues on buying a company in Bangladesh

Depending on whether the transaction is a share sale or an asset sale, the tax treatment for both parties may differ. Typical tax issues involve structuring the acquisition vehicle and determining how to use retained earnings in a tax-efficient manner to finance a portion of the purchase price. Frequently, tax issues arise in relation to the purchase price structure, especially with deferred consideration and the use of promissory notes or consideration shares in the acquirer.

We have extensive experience with these matters and work closely with tax advisors and accountants to ensure that the transaction is tax-efficient.

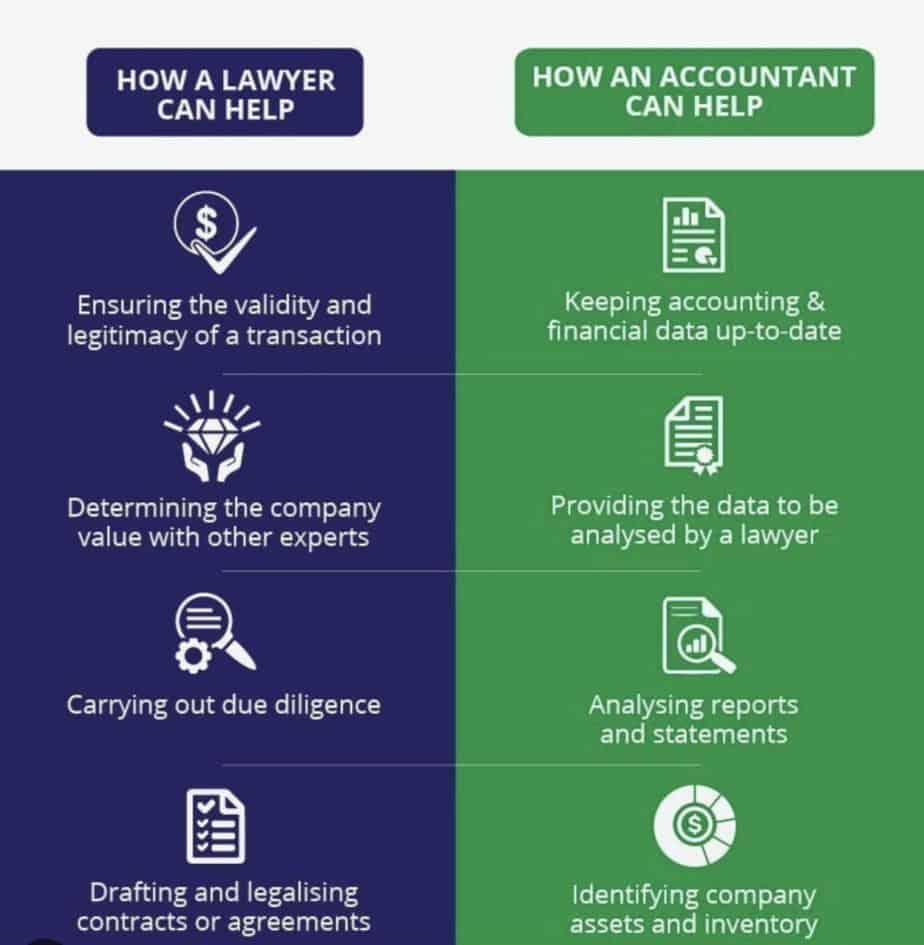

How can Tahmidur Rahman Remura Wahid assist as a law firm in Bangladesh?

In addition to our corporate team’s expertise in advising on M&A transactions, we also provide corporate support from our real estate and labor attorneys. Please contact a member of the corporate team if you have any questions or are seeking for information on business purchases or any other corporate law matter.

Purchasing or Selling a Company in Bangladesh

If you are selling or buying a business or only a portion of its assets, or if you are selling or buying partial or complete shares in a company, we can assist you with the entire process.

Whether your transaction is large or small, involves the sale or purchase of assets, shares, or a combination of both, our experienced Sydney business attorneys can guide you through the entire process, from due diligence to completion.

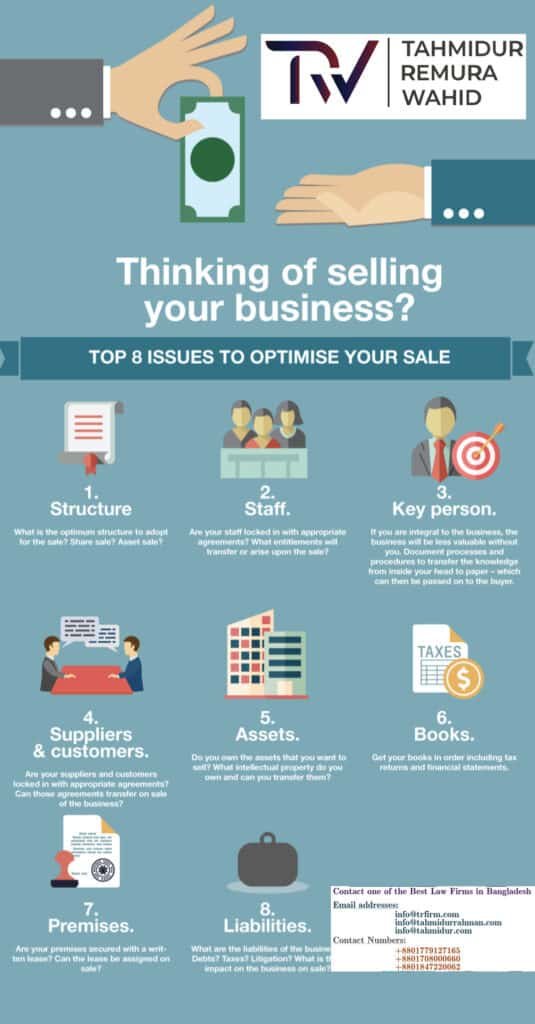

Whether you are buying or selling a business or company, there are numerous factors to consider, and we can assist you with:

What is being marketed and bought?

- Overall business, including its goodwill and assets

- A portion of the business Company’s assets, consisting of a 100 percent shareholding in the company

- Some of the company’s shares were sold.

We are able to assist you with any of the above commercial transactions. Buying or selling a business can be a life-altering experience. Therefore, it is reassuring to know that all legal aspects of the transaction can be managed by skilled and seasoned legal professionals who will always act in your best interests. We advise you to contact our Sydney business attorneys as early as possible in the sale or purchase process to ensure that we are able to assist you with this significant life event.

Undertaking Due Diligence:

Due Diligence is an essential component of any business transaction, especially if you are the buyer. Due diligence is the investigational procedure by which a buyer mitigates the risk of acquiring a business or company that may not be viable. Due diligence generally involves:

- Verifying the banking and financial position of the business or the company and the value of the business or the company;

- reviewing the material contracts associated with the business(es), including lease(s) or ownership of premises (if any);

- verifying the corporate ownership structure, ownership of business assets, including IT and intellectual property rights;

- verifying the employees and suppliers of the business or the company, including by communicating with them; inquiring about the business or company’s employees and suppliers;

- inquiring about the business or company’s employees and suppliers

- In all of the aforementioned situations, the vendor must reasonably cooperate with the buyer to provide requested information for the buyer’s due diligence investigations.

As part of the process of conducting due diligence, consider the following:

What pertinent characteristics should I search for?

Aspects such as the business operation and its model, the legal structure, obtaining independent financial advice about the business’s financial success, and many others should be considered.

When should I conduct my homework?

After you and the vendor have negotiated contract terms, but prior to signing the sale of business contract, you should conduct your due diligence.

Can a law firm assist with my due diligence?

Yes. Our commercial law team can advise you throughout the entirety of a transaction, particularly in regards to the legal interests of the business. Please note, however, that we cannot provide you with financial advice.

What is Loyalty?

The goodwill of a business is a unique asset and a crucial factor in retaining existing consumers and attracting new ones, thereby maximizing the company’s revenue and profits. When purchasing a business, the vendor sells and the buyer purchases the following significant assets:

Stock; Equipment; and Goodwill:

As the business’s infrastructure and inventory are tangible assets, its only intangible asset is its goodwill. Goodwill may consist of the business’s identity, associated intellectual property such as trademarks and patents, customer list or database (client books), or something similar.

Capital Raising:

Our experienced commercial attorneys at Ivy Law Group have the knowledge and resources necessary to assist you with your proposed capital raise endeavor, as well as determining which form of capital raise will work best for you and your business.

Here is a table summarizing the key stages and considerations involved in buying and selling a business in Bangladesh:

| Stage | Description |

|---|---|

| Pre-Sale | – Engage appropriate advisers: Tax, financial, and legal advisers should be appointed before initiating sale discussions. |

| – Confidentiality Agreement (NDA): Ensure a signed NDA is in place to maintain confidentiality during negotiations and even if the deal falls through. | |

| Heads of Agreement | – Important document detailing sale inclusions, exclusions, price, payment structure, pre-conditions, warranties, and indemnities. |

| – Include Non-Disclosure Agreement (NDA) terms to maintain confidentiality. | |

| – Confirm any periods of exclusivity for completing the sale. | |

| Due Diligence | – Vendors provide detailed information through questionnaires and due diligence specialists may be hired to investigate the business. |

| – Due diligence can impact warranties and indemnities and may lead to revised offers or withdrawal if discrepancies are found. | |

| The Contract of Sale | – Tailored agreement including sale price, completion arrangements, warranties, tax covenants, limitations on claims, and non-disclosure of confidential information. |

| – Consider provisions for ongoing contracts and staff transfer. | |

| Warranties/Indemnities/ | – Purchaser wants extensive warranties, while the vendor wants qualified warranties to avoid claims. |

| Disclosure | – Ensure given warranties are accurate, and limitations on potential liabilities are negotiated. |

| Share or Asset Sale | – Decide whether to sell shares or assets of the company. |

| – Share sale transfers ownership of the company, while asset sale involves selling specific business assets. | |

| – Asset sale is more common due to lower risks for the buyer, but share sales may be simpler and cause less interruption in business operations. | |

| Key Considerations | – Determine the need for due diligence and access to records and personnel. |

| – Establish robust confidentiality obligations for shared information. | |

| – Identify conditions precedent for the transaction, such as employee transfers, lease agreements, regulatory approvals, and contract assignments. | |

| – Consider pre-emptive rights in share sales and clearly list included and excluded assets in the sale agreement. | |

| – Determine the need for regulatory approvals and potential impacts on licenses and permits. | |

| – Address the continuity of business operations from existing premises and associated lease agreements. | |

| – Manage the transfer or retention of crucial employees and handle complex employee management during a business sale. | |

| – Assess the need for contract or license assignment or novation and consider any “change of control” provisions. | |

| – Determine the payment terms, potential adjustments to the purchase price, treatment of debtors, and release of guarantees. | |

| – Address the handling of email addresses, contact numbers, and social media accounts. | |

| – Obtain tax advice regarding duty, GST, and other tax implications. | |

| – Define warranties required from the seller, covering various aspects of the business. |

Forms of Capital Fundraising

Debt Capital

Capitalization through debt – also known as the bank (or family and acquaintances). This prevalent and well-known method of capitalization is known as debt capital. This is equivalent to obtaining money.

Equity Capital

Equity capital enables you to raise more capital than you could via a loan or security. However, this type of capital raise requires you to transfer a portion of your business in exchange for growth capital. Typically, angel investors and/or venture capitalists supply the funds required to raise equity capital. Due to the diverse requirements and restrictions pertinent to businesses under these regimes, prudence is essential for these forms of capital raising.

Other types

Crowd-Sourced Funding is a new and popular method of raising capital through online intermediaries, in which online investors raise the capital your business requires for a minuscule portion of your business.

Do I require a law firm for a capital raise?

Several legal requirements must be satisfied during a capital raise matter, and numerous legal documents and contracts must be drafted in relation to the capital raise. Tahmidur Rahman Remura Wahid Law Group strongly advises that you seek the assistance of one of our seasoned business and commercial attorneys for assistance with this process.

Are you planning to buying, selling or registering a Private limited company in Bangladesh?

Company formation and registration at Tahmidur Rahman Remura: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman, The Law Firm in Bangladesh – The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering a Private Limited Company in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS