Mutation khatian in Bangladesh In Bangladesh, mutation is a significant role in land ownership. When you acquire...

Mutation khatian in Bangladesh In Bangladesh, mutation is a significant role in land ownership. When you acquire...

Khatian correction Suit in Bangladesh Land ownership and property rights hold immense significance in any society,...

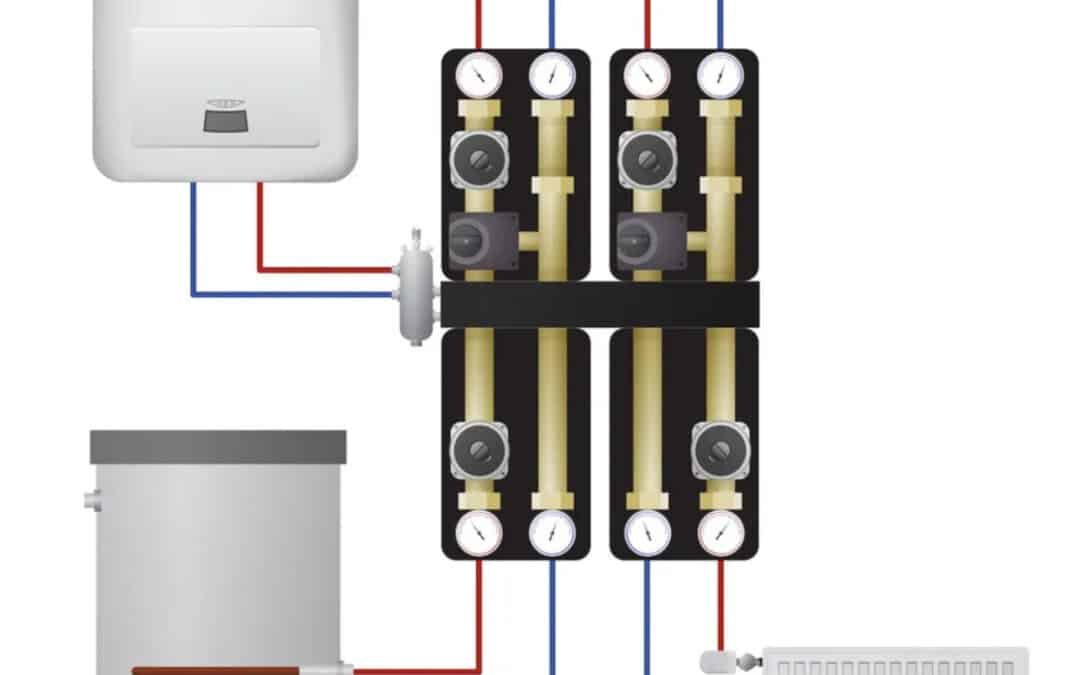

Boiler Registration Certificate for BEZA in Bangladesh In order to install and use a boiler with a volumetric capacity...

Salary Deduction and Obligation to Pay the Wages of Employees When a worker or employee work in any organization for...

Temporary Injunction suit in Bangladesh In legal disputes, time plays a crucial role in determining the rights and...

Difference between Branch Office and a Private Limited Company in Bangladesh When it comes to setting up a business...

Buying or Selling businesses in Bangladesh If you intend to acquire or sell a business, it is imperative that you hire...

Definitive Purchase Agreement: What is a Definitive Purchase Agreement? A Definitive Purchase Agreement...

Covenants and Easements in Bangladesh Since the evolution of human societies, there has been a requirement for the...

Put Option in Contract Agreement in Bangladesh Put options confer the right, but not the obligation, to sell a...

Inheritance law in Bangladesh In Bangladesh, inheritance law concerns are a contentious matter. It is impossible to...

Import and Export License and business setup in Bangladesh International trade, usually referred to as export-import...