Put Option in Contract Agreement in Bangladesh

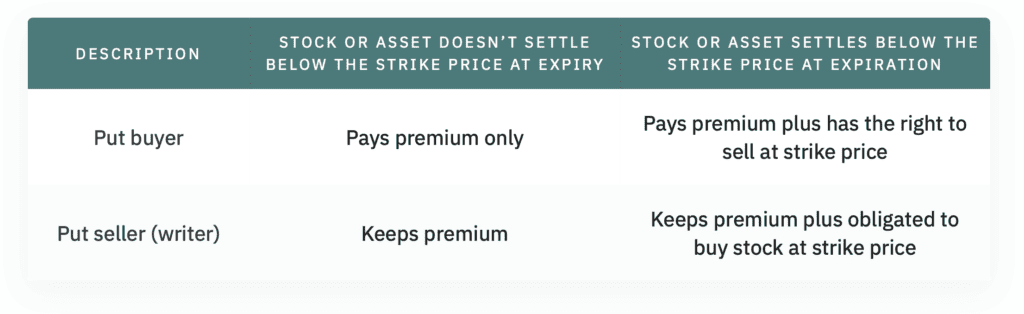

- Put options confer the right, but not the obligation, to sell a predetermined quantity of the underlying security at a predetermined price within a predetermined time frame.

Put options are available on a vast array of assets, such as equities, indexes, commodities, and currencies.

Changes in the price of the underlying asset, the option strike price, time decay, interest rates, and volatility influence put option prices.

Put options appreciate as the price of the underlying asset declines, as the price’s volatility increases, and as interest rates fall.- Put options lose value as the price of the underlying asset rises, as the underlying asset’s volatility decreases, as interest rates rise, and as the option’s expiration date approaches.

| Put options | Call options |

| Buyers who believe the underlying asset will fall Gives the buyer the right (not obligation) to sell the underlying asset at the strike price Intrinsic value = put strike price – underlying stock’s current price | Buyers who believe the underlying asset will rise Gives the buyer the right (not obligation) to buy the underlying asset at the strike price Intrinsic value = underlying stock’s current price – call strike price |

What Does Put Option Mean?

A put option (or “put”) is a contract that grants the option buyer the right, but not the obligation, to sell—or sell short—a specified quantity of an underlying security at a predetermined price within a specified time period. The strike price is the predetermined price at which the holder of a put option may sell the underlying security.

On numerous underlying assets, including stocks, currencies, bonds, commodities, futures, and indexes, put options are transacted. Contrast a put option with a call option, which grants the holder the right to purchase the underlying security at a specified price on or before the option contract’s expiration date.

How Put Options Operate

The value of a put option increases as the price of the underlying stock or security falls. In contrast, a put option loses value as the underlying stock’s price rises. As a consequence, they are typically employed for hedging or for speculation on downward price movement.

Frequently, investors utilize put options in a risk management strategy known as a protective put, which is used as a form of investment insurance or hedging to ensure that losses in the underlying asset do not exceed a certain threshold.

In this strategy, the investor purchases a put option to mitigate adverse risk in a portfolio holding. The investor would sell the stock at the put’s strike price if and when the option is exercised. If the investor does not already own the underlying stock and exercises a put option, a short position in the stock is created.

Aspects That Influence a Put’s Price

In general, the value of a put option declines as the option’s expiration date approaches due to time decay. As the option’s expiration date approaches, time decay escalates because there is less time to realize a profit from the trade. When the time value of an option expires, the intrinsic value remains. The intrinsic value of an option equals the difference between the strike price and the price of the underlying stock. In the money (ITM) refers to an option that has intrinsic value.

Out-of-the-money (OTM) and at-the-money (ATM) put options have no intrinsic value because exercising the option provides no benefit. As an alternative to exercising an out-of-the-money put option at an undesirable strike price, investors may short-sell the stock at the current higher market price. In the absence of a bear market, however, short selling is typically riskier than the purchase of put options.

The option’s premium reflects time value, also known as extrinsic value. If the strike price of a put option is BDT 2000 and the underlying stock is trading at BDT 1900, the option has an intrinsic value of BDT 100.

However, the put option could trade at BDT 135. The additional 35 represents time value, as the underlying stock price may fluctuate before the option expires. Put spreads may be created by combining various put options on the same underlying asset.

There are numerous considerations to bear in mind when selling put options. When contemplating a trade, it is crucial to grasp the value and profitability of an option contract; otherwise, you risk the stock falling below the point of profitability.

Where to Invest in Options

Options, including put options and many others, are transacted through brokerages. Some brokers provide options traders with specialized features and benefits. There are numerous brokers who specialize in options trading for those interested in options trading. It is essential to find a broker who meets your investment requirements.

Options Other Than Exercising a Put Option

The purchaser of a put option is not required to retain the option until its expiration. As the price of the underlying stock fluctuates, the option’s premium will fluctuate to reflect the most recent price changes. Depending on how the option’s price has changed since it was purchased, the option buyer can sell their option to either mitigate loss or realize a profit.

Likewise, the option writer can perform the same action. If the underlying price is greater than the strike price, they may take no action. This is because the option may expire worthless, allowing them to retain the entire premium. But if the underlying price is approaching or falling below the strike price, the option writer may simply buy the option back (thus exiting the position) to prevent a large loss. The profit or loss is calculated by subtracting the premium collected from the premium paid to exit the position.

Illustration of a Put Option

Assume an investor purchases a one-month put option with a $425 strike price on the SPDR S&P 500 ETF (SPY), which was trading at $445 in January 2023 . They paid a premium of $2.80, or $280 ($2.80 100 shares or units), for this option.

If units of SPY decline to $415 prior to expiration, the $425 put will be “in the money” and will trade at a minimum of $10, which is the intrinsic value of the put option (i.e. $425 – $415). The exact price of the put would hinge on a number of variables, the most significant of which would be the amount of time left until expiration. Assume the $425 put is trading at $10.50 per contract.

Since the put option is now “in the money,” the investor must choose between (a) exercising the option, which would grant the right to sell 100 shares of SPY at the strike price of $425, or (b) selling the put option and pocketing the profit. Consider two instances: (i) the investor owns 100 SPY units; and (ii) the investor does not own any SPY units. (The calculations below ignore commission costs, to keep things straightforward).

Consider the scenario where the investor exercises the put option. If the investor already owns 100 units of SPY (let’s presume they were purchased at $400) and the put was purchased to hedge downside risk (i.e. it was a protective put), then the investor’s broker would sell 100 SPY shares at the strike price of $425.

This trade’s net profit can be calculated as:

Put Purchase Price = [(SPY Sell Price – SPY Purchase Price) – (Put Purchase Price)] The quantity of shares or units

Profit = [($425 – $400) – $2.80)] × 100 = $2,220

What if the investor did not own SPY units and bought the put option as a speculative investment? In this case, exercising the put option would result in the short sale of 100 units of SPY at the strike price of $425. To terminate the short position, the investor could repurchase 100 SPY units at the current market price of $415.

This trade’s net profit can be calculated as:

(Short Sell Price of SPY – Purchase Price of SPY) – (Put Purchase Price) The quantity of shares or units

Profit = ($425 – ($415 – $2.80) × 100 = $720

Exercising the option, (short) selling the shares, and then repurchasing them sounds like a complicated process, not to mention the additional costs of commissions (due to the multiple transactions) and margin interest (for the short sale). However, the investor has a simpler “option” (for lack of a better term): Simply sell the put option at the current market price to generate a profit. Profit calculation in this situation:

[Enter Sell Price minus Buy Price] Shares or units outstanding = [$10.50 – $2.80] × 100 = $770

There is an important point to make here. Selling the option instead of going through the relatively complex procedure of option exercise yields a profit of $770, which is $50 more than the $720 profit generated by exercising the option. Why the disparity? Because selling the option enables the acquisition of the time value of $0.50 per share ($0.50 100 shares = $50). Therefore, the majority of long option positions with value prior to expiration are sold instead of being exercised.

The utmost loss on an option position for a buyer of put options is limited to the premium paid for the put. If the underlying stock price fell to zero, the utmost gain on the option position would occur.

Protective Puts:

Purchasing and selling puts:

Examples and strategies

Similarly to call options, there are specific strategies for put options. And it is common practice to combine them with call options, other put options, and/or existing equity positions. Included among the most prevalent strategies are protective puts, put spreads, covered puts, and bare puts.

Safeguard places

A protective put (also known as a married put) provides protection against price declines for the securities you own. How so? You continue to hold on to your existing shares (long position) while also holding put options, which can be viewed as an insurance policy (or a hedge) against price declines.

For instance, suppose you purchased 300 shares of XYZ technology company at $75 per share in addition to three put option contracts with a strike price of $70, a premium of $1 per share, and an expiration date six months in the future.

After four months, the market price per share falls to $50. You will only lose $1,800 if you exercise the put option and sell your stock at the $70 strike price ($5 per share multiplied by 300 shares equals $1,500, plus the $300 premium cost, or 3 contracts x 100 x 1).

What if the price of the stock declines further, to $35 per share? Since you can sell your stock at the strike price of $70, your losses are still limited to $5 per share, or $1,800. This is known as your utmost loss.

Without a put options contract, the loss would be greater because there is no limit. For example, if the price fell to $50 per share, you would lose $7,500, and if it fell to $35 per share, you would lose $12,000.

What occurs if the price per share of the stock increases? Assume that the same technology stock appreciates to $90 per share. That is $20 per share above your strike price, so you would not exercise your put option; instead, you would allow it to expire.

(However, since you purchased the options contract, you will forfeit the $300 premium: $1 per share multiplied by 300 shares.)

You will instead sell your stock at the market price, resulting in a $4,200 profit. ($15 multiplied by 300 shares, minus the premium cost of $300).

Since the growth potential of a stock is infinite, the profit potential of a protected put is also infinite, minus the premium paid.

Compared to Exercising an Option

Since exercising an option will result in a loss of time value, higher transaction costs, and additional margin requirements, the vast majority of long option positions with value prior to expiration are liquidated by selling rather than exercising.

Developing Put Options

In the previous section, we discussed put options from the buyer’s or investor’s perspective. We now turn our attention to the put option vendor or put option writer, who has a short put position.

In contrast to a long put option, a short or written put option requires the investor to take delivery of the underlying stock or purchase shares at the strike price specified in the option contract.

Assume a bullish investor believes SPY, which is presently trading at $445, will not fall below $430 in the next month. By writing one put option on SPY with a strike price of $430, the investor could collect a premium of $3.45 per share ( 100 shares, or $345).

If SPY remains above the $430 strike price over the next month, the investor would retain the $345 premium collected since the options would expire void. This is the utmost profit possible on the trade: $345, or the collected premium.

If SPY falls below $430 prior to the option’s expiration in one month, the investor is obligated to purchase 100 shares at $430, regardless of whether SPY falls to $400, $350, or even lower. No matter how far the stock falls, the put option writer is obligated to purchase the shares at the $430 strike price, meaning they incur a theoretical risk of $430 per share, or $43,000 per contract ($430 100 shares).

The maximum gain for a put writer is limited to the premium collected, while the maximum loss would be realized if the underlying stock price fell to zero. Thus, the gain/loss profiles of the buyer and seller of puts are diametrically opposed.

Is Purchasing a Put the Same as Short Selling?

Purchasing puts and selling short are both adverse strategies, but there are significant distinctions between the two. The maximum loss of a buyer of a put is limited to the premium paid for the put, and purchasing puts does not require a margin account and can be conducted with limited capital. Short selling, on the other hand, carries a theoretically unlimited risk and is substantially more expensive due to costs such as stock borrowing fees and margin interest (generally, short selling requires a margin account). Therefore, short selling is regarded as riskier than buying options.

Should I invest in In-the-Money (ITM) or Out-of-the-Money (OTM) puts?

It depends on variables such as your trading objectives, risk tolerance, capital, etc. In-the-money (ITM) puts are more expensive than out-of-the-money (OTM) puts because they grant the right to sell the underlying security at a higher price. However, the lower price of OTM puts is offset by the reduced likelihood that they will be profitable by expiration.

If you don’t want to spend too much on protective puts and are willing to tolerate the risk of a small portfolio decline, OTM puts may be the way to go.

Can I lose the entire premium that I paid for my put option?

Yes, you can lose the entire premium you paid for your put if the underlying security’s price does not trade below the strike price by the time the option expires.

If you are new to options and have limited capital, you may want to consider writing puts.

Put writing is a sophisticated option strategy intended for seasoned traders and investors; strategies such as writing cash-secured puts require a substantial amount of capital. If you are new to options and have limited funds, put writing is a hazardous endeavor that is not advised.

The Conclusion

Put options permit the holder to sell a security at a fixed price, even if the security’s market price has fallen. This makes them useful for both hedging and speculative trading strategies. Put options are among the most fundamental derivative contracts, alongside call options.

Put options can be a useful method to hedge against downside risk if the market declines, but they come with additional risks and complexity. Unlike stock trading, put option trading requires the investor to be correct on three levels: the underlying asset, the direction, and the timing, as all options contracts have an expiration date.

“Risk management is also important,” explains Cummings. “Many new investors avoid risk management techniques, such as entering trailing stop loss orders, to lock in profit on the upside and protect their premium on the downside.”

Are you planning to register a private limited company in Bangladesh?

Company formation and registration at Tahmidur Rahman Remura: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman, The Law Firm in BangladeshRemura: The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering a Private Limited Company in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS