Shark Tank Bangladesh

Shark Tank in Bangladesh is a television show that need no introduction. We’ve all witnessed the business negotiations between the Sharks and their pitchers. These negotiations are simple to understand for someone with a commerce background or who has studied how businesses are built and run, but for someone who does not have a degree in commerce or accounting and is a layman in the business world, the concepts and terminologies used in the show can be difficult to understand most of the time, which is where this article comes in. It is my endeavor to break down the show’s nits and bits so that even the average viewer can grasp them.

History and background of Shark Tank Bangladesh

Let us begin by discussing the show’s history and context. “Shark Tank” debuted in the United States in 2009 and rapidly became a hit show. This show is originally based on an international show called “Dragon’s Den,” which aired in 2005 in Britain, and is again based on a Japanese show launched in 2001, “The Tigers of Money.” When it comes to “Shark Tank,” the format has been successfully adopted in numerous nations, including Canada, the United Kingdom, Australia, and even Bangladesh.

Concept of Shark Tank in Bangladesh

This show’s popularity stems primarily from its theme. It’s a reality TV show in which aspiring entrepreneurs, known as “pitchers,” take risks to gain money by inventing something new or providing a service that others demand. They are frequently portrayed as people who generate new ideas and take risks to make those ideas a reality, as opposed to businessmen, who are typically more concerned with managing existing firms and optimising old systems. In the show, they offer their company ideas or goods to a panel of affluent investors, known as “sharks.”

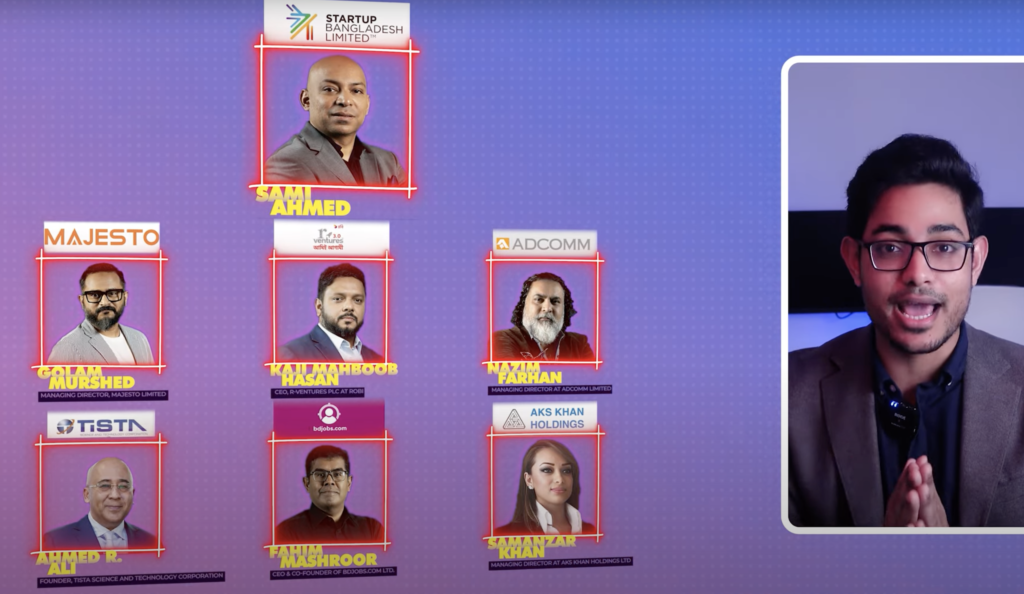

The show has five sharks who are accomplished businesspeople. These entrepreneurs are looking for investments in exchange for a share of their company’s equity. The show offers an opportunity for ambitious entrepreneurs to seek investment capital and experience to help them expand their enterprises.

Pitchers typically have 2-3 minutes to present their ideas or business models to the sharks, and it is only during this pitching time that they must tell the sharks how much money/investment they are looking to raise from them and what equity stakes they are willing to give the sharks in exchange for that investment. This provides sharks an indication of the company’s valuation.

Let’s understand the different terminologies used in the previous text.

• Equity refers to the ownership stake in a corporation.

• Equity stake refers to the percentage of ownership granted to an investor.

• Valuation is the estimated worth of a firm.

Let’s use an example to better grasp this.

Mr. X appears on the television and gives a fantastic pitch about his firm, ABC, which creates breathable fabric shoes. Mr. X tells the sharks that he wants to raise BDT 50,00,000/- for a 20% equity investment in his company.

If we consider that Mr. X has 100% equity in his company, which means he owns 100% of the company’s shares or stocks, he is asking the sharks to invest fifty lakh BDT in his company, and in exchange for that investment, he will give them a 20% equity stake, which means the shark who invests fifty lakh BDT in ABC will become a 20% shareholder in the company. As a result, once the transaction is completed, Mr. X will lose 20% of his ownership yet retain 80% of the shares or stocks. If the value of giving 20% shares of Mr. X’s firm is 50 lakh, then by basic multiplication, the value of 100% shares of ABC’s company is 2.5 crore, which is the company’s current valuation.

When the pitcher finishes pitching, sharks begin asking questions of the pitchers, and the significance of these inquiries cannot be stressed. These questions assist sharks in determining the risks and potential benefits of an investment. Sharks invest their hard-earned money, therefore it is critical to make informed selections.

Questions that you might expect from Sharks in Bangladesh –

These questions appear like this:

What is your sales and profit margin?

Sharks frequently inquire about the financial performance of the business. They inquire about current sales numbers and profit margins to assess the company’s revenue and profitability.

What are your plans for growing the firm with this investment?

When entrepreneurs seek finance, sharks want to know how the money will be used to expand the business. They inquire about the precise strategies and projects that will be sponsored with their investment.

Tell me about your background.

Sharks frequently inquire about the entrepreneur’s expertise and qualifications, as well as their personal relationship to the business idea.

Sharks pay close attention to the pitcher’s background because they want to know who they will be working with. It is not always just about the business; it can also be about the entrepreneur who runs it. They want to make sure the pitcher is dedicated and competent of pushing the business to the next level.

Many times we have seen on the show that the sharks were not moved by the pitch; they were not interested in the business either, but then they asked about the background of the entrepreneur and got so impressed by the qualifications, the life history of the entrepreneur, or the future and vision of the entrepreneur that they got convinced of the fact that although the pitcher’s business is not profitable now, it is not big enough, but the pitcher has the potential.

Similarly, we’ve seen numerous situations where the pitcher produced a wonderful pitch, but when the sharks began interrogating him, he was unable to provide a suitable explanation, and as a result, he was unable to close the deal. There is a phrase that goes, “Unless there is a skilled rider on the back of the horse, even the fastest horse cannot win the race,” and these lines are appropriate for this presentation.

Finalising a deal on Shark Tank.

After listening to the pitch, the sharks grill the pitcher until they are pleased. They extend an offer to the pitcher. This offer could be the same as what the pitcher requested, or it could be something else.

Let us comprehend this by an example:

In response to the invitation to offer, Mr. X is asking 50 lakh BDT for a 20% ownership in his company ABC.

• A shark can agree to Mr. X’s requirements and offer 50 lakh BDT for a 20% ownership, keeping the firm valuation at 2.5 crore.

• A shark can present Mr. X with three different offers:

- It could have a lower value. The pitcher has the choice of declining the offer or counter-offering the shark. It is now up to the shark to accept the counteroffer, decline it and stick with their initial offer, or make a new offer with a different valuation. Mr. X invited Sharks to invest 50 lakh BDT in his firm ABC for a 20% equity stake, valuing it at 2.5 crore BDT. After the pitch, the sharks asked several questions and discovered that revenues and scalability did not match the firm valuation; thus, the company was overvalued. Sharks say, “Okay, I’ll give you 50 lakh BDT for 33% of the equity stake.”

This bid lowers the company’s valuation because the Sharks’ offer values the company at 1.51 crore. Following this, the pitcher may remark that 33% is a lot to give, so how about 50 lakh at 25% stake? With this counter offer, the pitcher attempts to negotiate at a higher valuation of 2 crore, and this is how negotiations take place in the program, and once the negotiations are completed, a deal may or may not occur.

2. Sharks can offer both stock and credit. Shark offered 30 lakh taka for a 20% stake and gave the remaining 20 lakh as credit for 5 years at 10% interest per annum, which means that not only is the company now undervalued by Shark at 1.5 crore, but Mr. X also has to return 20 lakh after 5 years along with the interest amount, so he must return 30 lakh taka. This type of offer can now take many different forms and combinations. Again, the pitcher must decide whether to accept or counteroffer this make.

3. The shark can agree to the pitcher’s valuation or undervalue it with his offer, while also charging a royalty fee. Shark offers to invest 50 lakh for a 20% interest in ABC, but imposes a BDT. 20 royalty fee on each shoe sale. This means that whenever ABC sells a shoe, the shark will get 20 bdt from the sale. This royalty charge can be in perpetuity, or until ABC sells shoes. BDT. 20 will be credited to Shark on each sale, or it can be for a set period of time, such as five years, which means ABC will not be obligated to pay a royalty fee to the shark after five years, or it might be until a particular agreed-upon amount is recovered. Let’s assume Shark proposes a royalty of BDT. 20 on each pair of shoe sales until I receive 20 lakh bdt. ABC will no longer be obligated to pay the shark any royalties after the sum of 20 lakh BDT has been paid. There can be numerous permutations and combinations of this. Again, the pitcher has the option of accepting the offer or countering.

The show focuses on how successfully you can negotiate a contract. On the one hand, sharks see a scalable business and want as many stakes as they can in it because the more stakes they have, the more profit they will make, whereas pitchers look for big investments and the sharks’ expertise but do not want to lose too many stakes in their company, so in a way, this show teaches us a lot about negotiations and their power.

Legal Terms in Shark Tank Bangladesh

- A contract is a legally binding agreement between two or more parties that defines the terms and circumstances of their relationship.

- Patents, trademarks, copyrights, and trade secrets are examples of intellectual property (IP) legal rights that protect creative works.

- A non-disclosure agreement (NDA) is a legal contract that describes the secret information that parties intend to disclose with one another for specific purposes but not with other parties.

- Liability refers to the legal accountability for one’s conduct or debts.

- Corporate governance is the set of rules, policies, and processes that direct and regulate a firm, and it frequently involves the interaction of a company’s management, board of directors, shareholders, and other stakeholders.

- Compliance: Ensuring that a company adheres to all applicable laws, regulations, and industry standards.

- Arbitration is a way of resolving disputes outside of the judicial system in which a neutral third party issues a binding ruling.

- A lawsuit is a legal action brought by a plaintiff against a defendant based on a complaint or petition.

- Tort is a civil wrong that causes suffering or loss for which the aggrieved party may seek compensation.

- Indemnity is the legal responsibility to compensate another party for certain losses or damages.

- Force Majeure: A contract clause that excuses a party from carrying out its contractual duties owing to unanticipated occurrences beyond its control.

- Regulatory Compliance: Adherence to laws, rules, and regulations established by government authorities that apply to a particular industry.

- Antitrust laws govern and prohibit anticompetitive behavior in the marketplace.

- Due diligence is the process of thoroughly studying and verifying the specifics of a commercial deal or investment.

- Corporate veil: A legal concept that distinguishes a corporation’s acts and liabilities from those of its shareholders, thereby protecting personal assets.

- A power of attorney is a legal document that empowers one person to act on behalf of another in legal problems.

- A preliminary injunction is a court order that restricts specific actions or activities until a legal dispute is resolved.

- Bankruptcy is a legal position that occurs when a person or business is unable to repay their debts, prompting a court-supervised process.

- The statute of limitations is a legally determined time limit within which legal procedures must be launched.

- Regulatory Compliance: Adherence to laws, rules, and regulations established by government authorities that apply to a particular industry.

A handshake deal is not a deal.

As we all know, a handshake transaction is not a deal unless it is formalized with paperwork specifying the parties’ rights and duties. The same is true for this show. Following the handshake agreement, the Sharks must complete paperwork, which requires them to conduct due diligence on the pitcher’s company. Before the presentation starts, the sharks have no idea who will pitch them or what the business will be about.

It is during the pitch that only sharks get to know about the company and their business, and it is upon the beautifully presented pitch and after looking at the numbers of sales and scalability that sharks decide to invest in the business. However, there is a possibility that the pitcher might have lied or disclosed some facts that can harm the business, so sharks need to perform due diligence to check if all the facts that were told by the pitcher align perfectly.

This show’s popularity stems primarily from its theme. It’s a reality TV show in which aspiring entrepreneurs, known as “pitchers,” take risks to gain money by inventing something new or providing a service that others demand. They are frequently viewed as individuals who generate new ideas and take risks to make those ideas a reality, as opposed to a businessman, who is typically more concerned with managing existing firms and optimizing established processes. In the show, they offer their company ideas or goods to a panel of affluent investors, known as “sharks.” The show has five sharks who are accomplished businesspeople. These entrepreneurs are looking for investments in exchange for a share of their company’s equity. The show offers an opportunity for ambitious entrepreneurs to seek investment capital and experience to help them expand their enterprises.

Pitchers typically have 2-3 minutes to present their ideas or business models to the sharks, and it is only during this pitching time that the pitchers must tell them how much money/investment they are looking to raise from the sharks, as well as what equity stake they will offer the sharks in exchange for the investment. This provides sharks an indication of the company’s valuation.

Let us comprehend this by an example:

Mr. X provided the valuation of his company as BDT. 2.5 crore. When Shark inquired about last year’s and current year’s sales, they discovered that the company had been presented as overvalued and asked the same question to the pitcher If the sales numbers did not align with the valuation, why have you presented your company in the overvalued figure to this Mr. X says that he has received an order to manufacture 1 lakh shoes from DMart as they want to sell my shoes in their store, and this order can take the valuation of ABC to the figure Based on this information, one of the sharks closed the transaction via handshake, but during due diligence, it was discovered that the order for manufacture was only for 25,000 shoes. Now, this fact, and others like it, can have a significant impact on the shark and pitcher’s future collaboration, thus due diligence is undertaken, and the deal is closed or not.

Common words used on Shark Tank and their meaning

Some popular terms used in the program and their definitions are:

• Gross margin is the gap between revenue and cost of goods sold.

• Patent provides legal protection for an invention.

• Crowdfunding involves raising funds from a big number of people.

• Angel investors are wealthy individuals who invest in companies.

• Venture capitalists are professional investors who handle pooled cash from others.

• Royalty: Payment for using a product or idea.

• Dilution: A decrease in ownership proportion owing to new investments.

• B2B = Business-to-Business.

• B2C: Business-to-Consumer.

• D2C means direct-to-consumer.

The purpose of Shark Tank show

“Shark Tank” benefits both investors (the “sharks”) and entrepreneurs in numerous ways.

Benefits for Investors (Sharks)

Various investing alternatives.

The show introduces investors to a variety of company concepts and industries they may not have explored before, which frequently leads to profitable investments.

Brand visibility

Being a shark on the show can help raise an investor’s public visibility and personal brand. It can result in improved visibility, speaking engagements, and networking possibilities. Before Shark Tank Bangladesh, few people were familiar with Anupam Mittal (Shadi.com), Aman Gupta (Boat), and Ashneer Grover (BharatPe), but after the show, these successful businessmen appeared on numerous talk shows and podcasts, and they went viral all over the internet via YouTube shorts or Instagram reels.

Access to fresh ideas.

Investors gain access to novel products and concepts, which may be enticing to individuals trying to stay ahead in their businesses or diversify their investment portfolios. We’ve seen this happen many times: all of the other sharks decline the offer, but one shark believes in the product or idea and invests.

Expertise and mentoring

Sharks may help entrepreneurs grow and flourish by investing in their enterprises and providing them with their knowledge and advise. This mentorship role can be both personally enjoyable and financially lucrative.

Benefits for Entrepreneurs

Access to Capital

Entrepreneurs frequently require funds to establish or grow their enterprises, and “Shark Tank” provides a forum for obtaining investment cash from seasoned investors.

Exposure and Marketing

Appearing on the show can provide entrepreneurs with valuable exposure to a big audience, resulting in improved sales, brand recognition, and marketing opportunities.

Expertise and mentoring

In addition to the funding, entrepreneurs can benefit from the sharks’ business acumen and industry experience. This mentorship can help people make better decisions and overcome obstacles. This is why pitchers may accept a lower price from the shark, because the shark is delivering not only an investment but also his experience.

Validation

Getting an investment from one or more sharks can help validate an entrepreneur’s business idea, making it more appealing to other possible investors and partners.

Negotiation practice

The show’s negotiation process can be a beneficial learning experience for entrepreneurs, allowing them to hone their negotiation abilities for future business deals.

Entertainment and Publicity

Even if entrepreneurs do not land a transaction, their involvement on “Shark Tank” might pique the curiosity of the general public and other investors, resulting in prospective prospects outside of the show. We observed numerous situations where a product or idea did not excite the sharks to invest in it, but after the program, the product or idea got quite popular and finally evolved into a profitable business.

Finally, “Shark Tank” is a well-known platform that entertains while also providing genuine opportunities for businesses to gain critical funding. For entrepreneurs, it is a one-of-a-kind opportunity to learn, acquire funding, and gain exposure. Investors benefit from a varied choice of investment opportunities as well as mentoring. “Shark Tank” is a platform where dreams come true, emphasizing that with the right concept and effort, anyone can enter the business sector and be successful.