How to do Tax Submission in Bangladesh | Complete Overview of Income Tax, Customs Duties, VAT.

Tahmidur Rahman, Senior Associate

Table of Contents

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

Tax Submission in Bangladesh:

What are the process of Tax Submission in Bangladesh ( Personal Income Tax, Corporate Income Tax, Custom Duties etc.) and what are the rules and regulations that relate to specific custom duties, supplementary duties, regulatory duties and their relationships with HS code and brand valuation and how to deal effectively with the issue? This post in details will provide a complete overview of Tax Submission in Bangladesh and will hopefully answer to your quries in regards to Tax Law in Bangladesh.

Taxation in Bangladesh

In Bangladesh, the history of income tax submission dates back to 1860 when British rulers introduced it in this country under the title of the Income Tax Act, 1860. Many changes have occurred since then. Recently, taxation facilities have become one of the Bangladeshi business organization’s important and complex compliance issues. Tax levy and taxes were updated by the promulgation of the Finance Act almost every year. Tax facilities in Bangladesh are usually regulated by the 1984 Income Tax Ordinance.In Bangladesh, legal aid related to VAT, tax and customs is high in demand. Because of its complexity, particularly for businesses, new investors and entrepreneurs understanding the various formalities involving taxation is a big challenge.

With income tax in particular, different statutory requirements for e.g. income advance tax, source tax deduction, tax exemptions, tax rebate, procedures for filing annual tax returns along with their assessments, etc., and their correlation, which can be found difficult without proper knowledge. Here one by one, we will explain the procedures and regulations in regards to Tax Submission in regards to Bangladeshi Law.

Income Tax in Bangladesh

One has to pay his or her income tax at the end of each fiscal year, and a number of Bangladesh taxpayers are doing the job quite successfully.But there are also many clashes with filing their tax returns because they have little or no idea of the process.Things seem to be rather difficult, particularly for the first time people who pay taxes.

Are you actually Suppose to Pay Income Taxes? Are you in the Bracket? Find out whether you are actually eligible for Tax Submission in Bangladesh First!

In accordance with the stipulation set out in the Finance Act, if any person earned more than Tk 220,000 during the 2013-14 income year, he / she must send his / her income return along with the source(s) of income. Nonetheless, the total non-taxable income limit will be Tk 275,000 for women and senior taxpayers aged 65 and above, Tk 350,000 for physically challenged mentally handicapped workers, and Tk 400,000 for war injured freedom fighters serving in the gazette.

The following person must also submit his / her income tax return, however, if he / she did not earn much more than the maximum limit, if he / she:

(i) resides in a municipal corporation or paurashava or divisional headquarters (HQ) or district headquarters and owns a motor vehicle including a jeep / microbus or is a member of a VAT registered club;

(ii) runs a business or profession licensed and operates a bank account;

(iii) has registered as a doctor, dentist, lawyer, income tax practitioner with a recognized professional body;

(v) is a candidate for an office of any paurashava, city corporation, or a Member of Parliament;

(vi) assessed to tax for any of the three years immediately preceding the income year;

(vii) participates in a tender floated by the Government, semi- Government, autonomous body or a local authority. In addition, any registered company/Non-Government Organisation (NGO) shall file a return of its income or the income of any other person for whom the company/NGO is assessable to the authority.

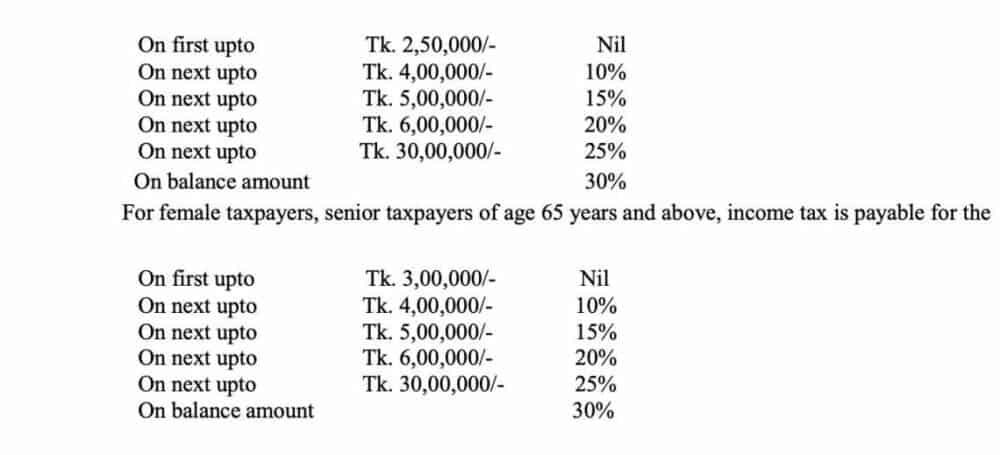

The tax rates during the assessment year 2014-15 for individual taxpayer other than female, taxpayers of 65 years and above, differently able person, retarded employee and gazetted war-wounded freedom fighter are as follows:

Income Tax Submission in Bangladesh

The income tax return is something that people are required to submit each year by November 30. And by that time, you will have to update your employment, property, and income tax data through a form. The main reason is that the data submitted for a fiscal year may vary from the information submitted a year earlier.

A taxpayer has to notify the state on its current status after using a TIN. Punitive measures are also in place to avoid taxes.

Every income tax payer is entitled to receive income tax return form free of charge from tax offices or NBR i.e. National Board of Revenue website. In addition, NBR has launched online tax calculator on www.nbrtaxcalculatorbd.org to promote the assessment of their taxes by assessees. Additionally, for small businessmen, doctors and lawyers, NBR offers spot assessment. Anyone who invests Tk 1000,000 as initial capital shall pay Tk 4000 and pay Tk 2000-4000 as income tax to those doctors and lawyers who have practiced their profession for 5-10 years.

For Tax Submission in Bangladesh, each assessee shall deposit the amount to the govt after assessing the amount of income tax. Exchequer by pay order, challan treasury or online via www.nbrepayment.gov.bd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned.

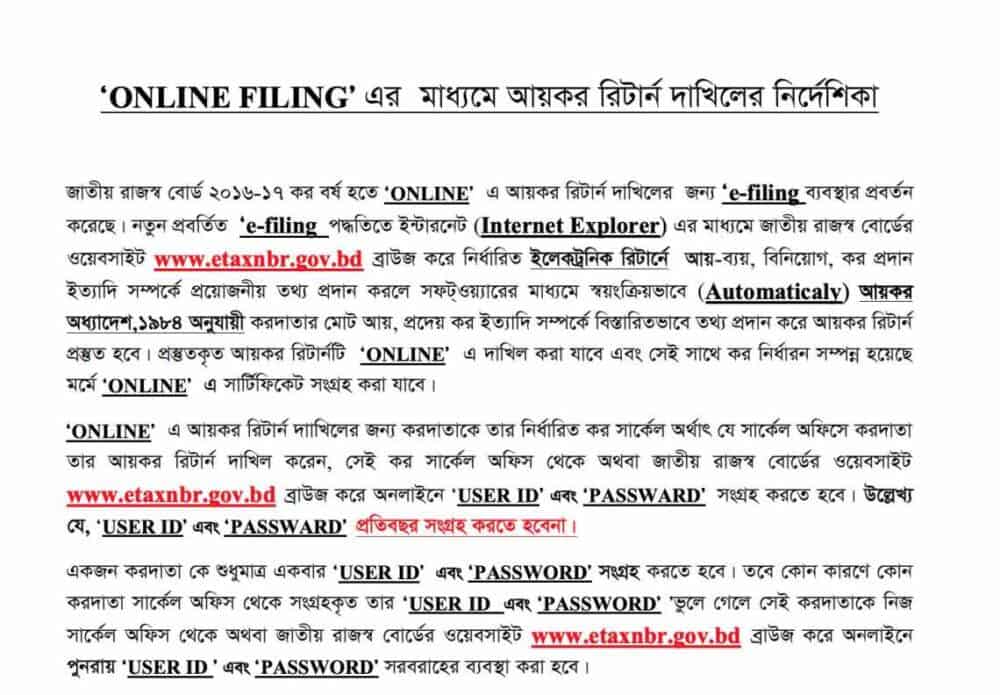

For details of filing system, click here or in the image below-

Time limit to submit the tax return in Bangladeh

Income Tax exemption in Bangladesh

Many individual classes enjoy tax holidays. For example, if you own savings certificates, invest in the stock market and have life insurance, a certain amount of your income tax will be waived.

For this purpose, income tax lawyers suggest savings tools as they are most risk-free and can be found at the National Savings Bureau, post offices, and banks.

Punishment for infringement of the tax rules in Bangladesh

In addition, an assessee shall be guilty of an offense punishable by imprisonment for a term that may extend to one year or a fine or both if he / she refuses to provide the return of income in due time without reasonable cause. In addition, the DC of Taxes will impose fine Tk 10 percent of the last estimated amount, but not less than Tk 1000, and will also impose fine Tk 50 late on each day.

Therefore, a person will be guilty of an offense punishable by imprisonment that may stretch to five years but may not be less than three months or fine or both if he disguises the information or intentionally gives false details of his earnings in regards to tax submission in Bangladesh .

The established income tax collection schemes are soft, complicated, time-consuming and are not yet taxpayers ‘ trouble-free. In this regard, the entire system of tax management should be effectively structured to prevent tax evasion.

Where to complain in regards to Tax Submission in Bangladesh

If you have a service allegation or other tax-related issues, you can file a written appeal to the tax commissioner detailing the problems.

The prosecutor must hold a hearing on it after receiving the petition, leading to its settlement.

If not, with his or her issues, the taxpayer should petition a jury. The person still has the option to move to the High Court as a last resort remedy in the event of a further failure to substantiate the complaint.

And last but not least, a taxpayer will know that whatever service they get is not safe. In fact, a taxpayer gets the services by paying money.

Value Added Tax (VAT) in Bangladesh | Tax Submission in Bangladesh

All goods except those listed in the VAT Act’s First Schedule and all services except those specified in the Second Schedule are taxable goods and services. Originally, a comprehensive list comprising the list of services subject to VAT was the Second Schedule of the VAT Act. The First and Second Schedules now list respectively statutory exemptions to goods and services. The third schedule lists the goods and services subject to additional duties (SD) and their relevant statutory rates.

Rates of Vat in Bangladesh

Most of the countries that implement VAT worldwide operate a single standard VAT rate. Appendix 1 indicates certain countries ‘ VAT rates with the year in which they launched VAT. In regards to Tax Submission in Bangladesh, country’s VAT legislation provides a standard rate of 15 percent for home consumption goods and services in line with best international practice and a zero rate for exports. Under the rule, all taxable goods and services manufactured and sold for sale in the country are subject to VAT at 15%. For all goods and services to be exported and deemed to be exported from the country, a rate of 0 percent applies. In practice, however, there are some other rates that emerged from different methods

Registration of VAT in Bangladesh

All importers, zero-threshold exporters and suppliers (manufacturers, dealers, wholesalers, retailers) of all taxable goods and services with an annual turnover limit of BDT 60 millions (BDT 6 million, equivalent to US$ 80,400) and above are required to be registered under VAT. The VAT law requires a divisional VAT office to issue a certificate of registration within 2 (two) working days of receiving a request.

Businesses below the threshold can opt for voluntary registration of VAT in Bangladesh, in line with international practice. The amount of VAT collected shows that the majority of VAT registered persons are optionally or voluntarily registered.

One of the reasons is that while the threshold has undergone upward revision quite a few times over the past 20 years, those with their existing threshold within voluntary VAT registration could not escape the net once the threshold was increased due to administrative convenience as well as external pressure.

The study of different VAT regimes, particularly those of developing countries, suggests that in a simpler procedure, despite the distortionary effects of the different treatment between undertakings above and below the threshold, many countries tax undertakings differently and at a much lower rate.

This is done primarily because of the administrative and compliance costs, equity and competitive advantages and disadvantages of the economically involved parties. In Bangladesh, this is no exception. Section 8 of the Act provides that undertakings whose annual turnover is below the VAT threshold and for which VAT registration has not been made compulsory are entitled to pay turnover tax @ 3% of declared and approved annual turnover without the possibility of claiming input tax credit. Nevertheless, most of the taxable products listed and a number of items are not eligible for turnover tax as they are required to register VAT.

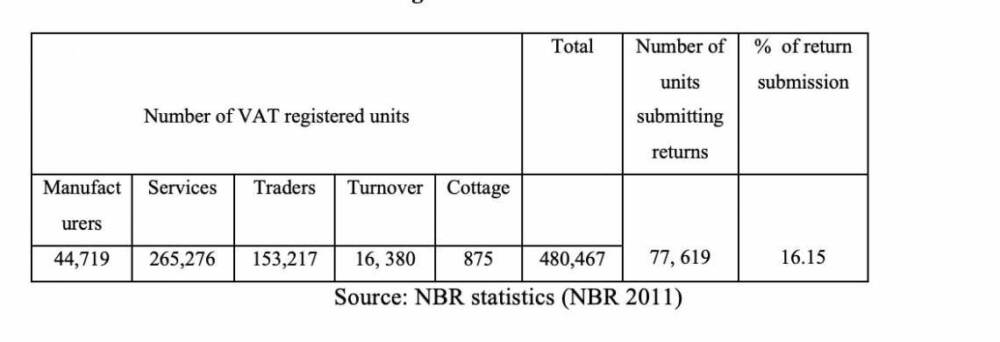

The number of businesses registered under VAT system is 480,467, which is glaringly poor as compared to the number of total businesses in the country. According to the economic census of 2001 and 2003 the total number of businesses in different sectors was 3,674, 971 of which 1,127, 613 were registered with the trade licensing authorities

Vat Filling in Bangladesh | Vat Submission in Bangladesh

Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. The Bangladesh VAT filing scenario shows a huge difference between what’s being taught in the book and what’s being done.

Although Return should be the core of all VAT activities in an ideal VAT system, namely tax liability, input tax credit, drawback, and revenue statistics, VAT returns were not given the importance they deserve in Bangladesh. Return filing rate is very low. According to the latest statistics, out of 480,467 registered VAT-payers, the number of returning units in 2009-2010 was only 77,619, i.e. 16.15% (NBR, 2011).

One of the reasons for weak return filing is that VAT is obtained at sources in the case of firms with more than 70% (estimated) registered individuals, such as construction firm, procurement provider. The lack of a culture of voluntary tax compliance is another reason for the unsatisfactory rate of return submission. Due to the lack of successful compliance, the situation is further compounded.

Until now, there has been no significant VAT system automation in Bangladesh. Although most VAT commissioners have data processing units with the VAT Information Management System (VIMS) computer program in place, returns are not processed systematically.

“TR Barristers in Bangladesh is Considered as one of the leading firms in Tax Law in Dhaka, Bangladesh”

Custom Law in Bangladesh

Bangladesh is implementing the Harmonized Commodity Coding System. Import ProceduresDocuments required for importation include a letter of credit authorization form, a lading or airway bill, commercial invoice or packing list, and origin certificate. For certain imported items or services, the relevant government agencies require additional certifications or import permits related to health, safety or other matters. For the public sector, reduced documentation requirements are applicable.

Foreign companies must obtain permission from the Chief Import and Export Controller and submit the following documents: photocopies of an import registration certificate; photocopies of invoices, lading bills and import permits duly certified by the bank; a copy of the General Index Register (GIR) certificate; a certified copy of the last tax order; name and description of each impairment.

The following documents must be submitted by private sector importers: certificate of affiliation to a registered chamber of commerce and local industry or professional association established in Bangladesh; proof of payment of renewal fees for import registration certificates (IRC) for the tax year; copy of tax identification number (TIN) certificate; three copies of previou proof of payment.

A new Custom Law in Bangladesh

A new customs law is likely to soon be put in parliament under which the government will have to digitalize the associated environment, said National Revenue Board (NBR) officials.

The new draft law also implements various measures in line with global trends to promote the clearance of goods planned for export and import from ports to encourage international trade, they said.

“In view of international best practices, we have drafted the new law. The latest one is more up-to-date and more pragmatic, “a senior official of the NBR said, trying to remain unnamed as he was not allowed to speak to the media.

The new law includes various measures to promote faster trade, followed by advanced economies.

One of the clauses is the Advance Cargo Declaration, which provides companies with the ability to request customs-related import documentation prior to the arrival of goods in ports.

Under a mechanism called Post Clearance Audit, the new law will also open up the scope for compliant businesses to quickly clear goods.

According to the draft, compliant and honest traders will receive a green channel for importing and exporting goods as authorized economic operators.

Subscribe to our Awesome Newsletter.

Basis Membership Process in 2025

Basis Membership Process for Software companies in Bangladesh What is Basis? In 1997, the Bangladesh Association of Software & Information Services (BASIS) had just 18 charter members as it began its future. Since its founding, BASIS, the national trade...

ইসলামে বাবার সম্পত্তি ভাগের আইন ২০২৫ এ

ইসলামে বাবার সম্পত্তি ভাগের আইন প্রত্যেক মুসলিমের উত্তরাধিকার আইন বিষয়ে জানা প্রয়োজন। মুসলিম আইনে কুরআন, সুন্নাহ ও ইজমার ওপর ভিত্তি করে মৃত ব্যক্তির রেখে যাওয়া সম্পত্তি তার উত্তরাধিকারীদের মধ্যে বণ্টন করা হয়ে থাকে। এভাবে বণ্টন করাকে ফারায়েজ বলা হয়। পবিত্র কোরআনে...

ভরণপোষণ সংক্রান্ত আইন ২০২৪

ভরণপোষণ সংক্রান্ত আইন ভরণপোষণ সংক্রান্ত বিধিবিধান জানার আগে ভরণপোষণ কি সেটা আমাদের জানা দরকার। ভরণপোষণ হচ্ছে মানুষের জীবনধারণের জন্য প্রয়োজনীয় খাদ্য, বস্ত্র, বাসস্থান, চিকিৎসা, ইত্যাদি মৌলিক চাহিদা। একজন সক্ষম এবং উপার্জনক্ষম ব্যক্তি তার স্ত্রী, নাবালক ছেলে-মেয়েদের...

Guide to Export from Bangladesh as a Foreign Investor

Guide to Export from Bangladesh as a Foreign Investor A Comprehensive Guide to Export from Bangladesh as a Foreign Investor: Because it generates much-needed foreign revenue, Bangladesh's export industry is vital to the country's economic expansion. In light of this,...

মুসলিম বিবাহ বিচ্ছেদ আইন ২০২৪

মুসলিম বিবাহ বিচ্ছেদ আইন ২০২৪ বাংলাদেশে ৩ ধরনের বিবাহ হয়ে থাকে- এক হচ্ছে মুসলিম বিবাহ ও বিবাহ বিচ্ছেদ (নিবন্ধন) আইন অনুযায়ী কাজি অফিসে নিবন্ধন হয়। ২য়টি হচ্ছে হিন্দু বিবাহ নিবন্ধন আইন অনুযায়ী যেটাকে Traditional marriage এর category তে পড়ে এটা হিন্দু...

ওয়ারিশ সম্পত্তি ক্রয় বা বিক্রয় ২০২৫ সালে

ওয়ারিশ সম্পত্তি ক্রয় বা বিক্রয় ওয়ারিশ সম্পত্তি বা পৈত্রিক সম্পত্তি ক্রয়ের আগে তিনটি ডকুমেন্ট দেখে নিবেন। তিনটি ডকুমেন্ট না থাকলে ক্রয় বায়নাপত্র লেনদেন করবেন না। ওয়ারিশ সম্পত্তি কেনার আগে গুরুত্বপূর্ণ ডকুমেন্টসঃ ১) ওয়ারিশ সনদ পত্র। ২) পারিবারিক ভাগবন্টন...