Registration of a Private Limited Company in Bangladesh

This article will explain in details about formation and registration of a Private Limited Company in Bangladesh as per the latest regulations in 2024.

It will focus on five easy steps: business name clearance, drafting required documents, opening a bank account, COMPANY REGISTRATION with the RJSC, and post registration formalities.

Moreover, it will outline essential points for foreign INVESTORS AND ALTERNATIVE WAYS TO SET UP A COMPANY IN BANGLADESH.

Private Limited Company in Bangladesh

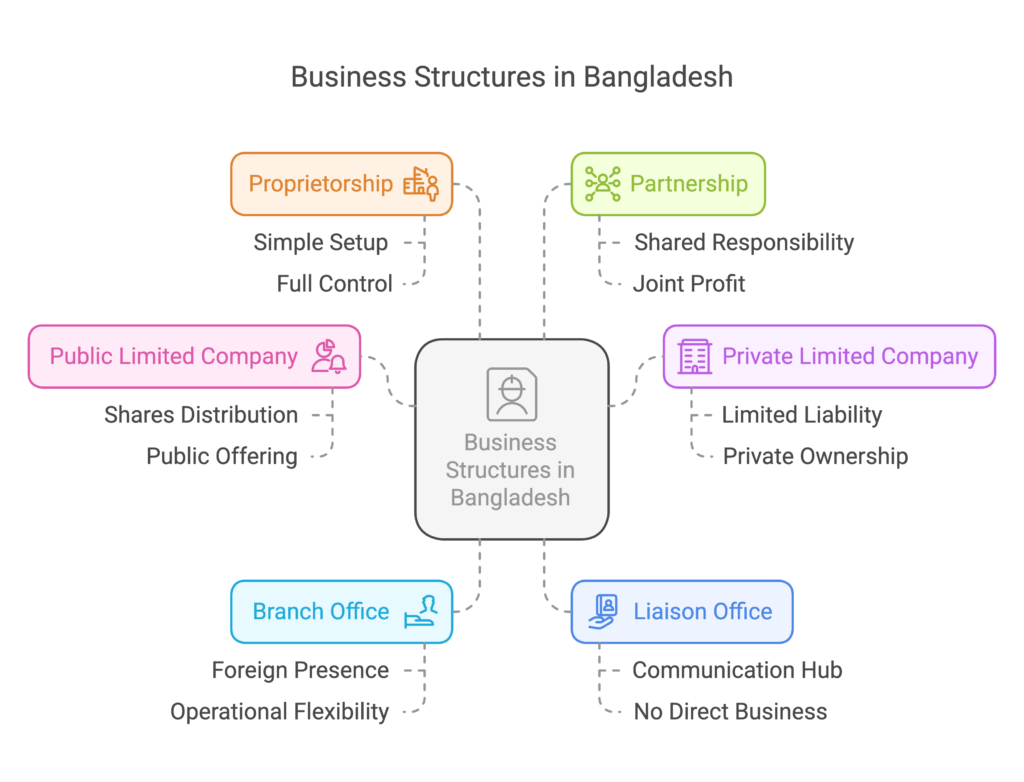

There are five ways of doing BUSINESS IN BANGLADESH:

- PUBLIC LIMITED COMPANY

- PRIVATE LIMITED COMPANY

- BRANCH OFFICE

- LIAISON OFFICE

- PROPRIETORSHIP

- PARTNERSHIP BUSINESS IN BANGLADESHREGISTRATION OF A PRIVATE LIMITED COMPANY IS THE MOST COMMON WAY OF DOING BUSINESS as PLC is a typical legal entity for Bangladeshi businesses. As per theCOMPANIES ACT 1994 Private Limited Company has the following characteristics:

- It restricts the ability to transfer shares [section 2(q)]

- The minimum number of members is 2 (two) [s. 5]; the maximum number of members is 50 (fifty), excluding employees of the Company [s. 2(q)].

- It must have at least two directors [s. 90 (2)]

- It PROHIBITS any public invitation to subscribe for the Company’s shares or debentures [s. 2(q)].

After completion of Registration of a Private Limited Company in Bangladesh, it can begin operations as soon as it is registered with THE REGISTRAR OF JOINT STOCK COMPANIES (RJSC), subject to obtaining the other licenses listed below in the post-registration section of this Report.

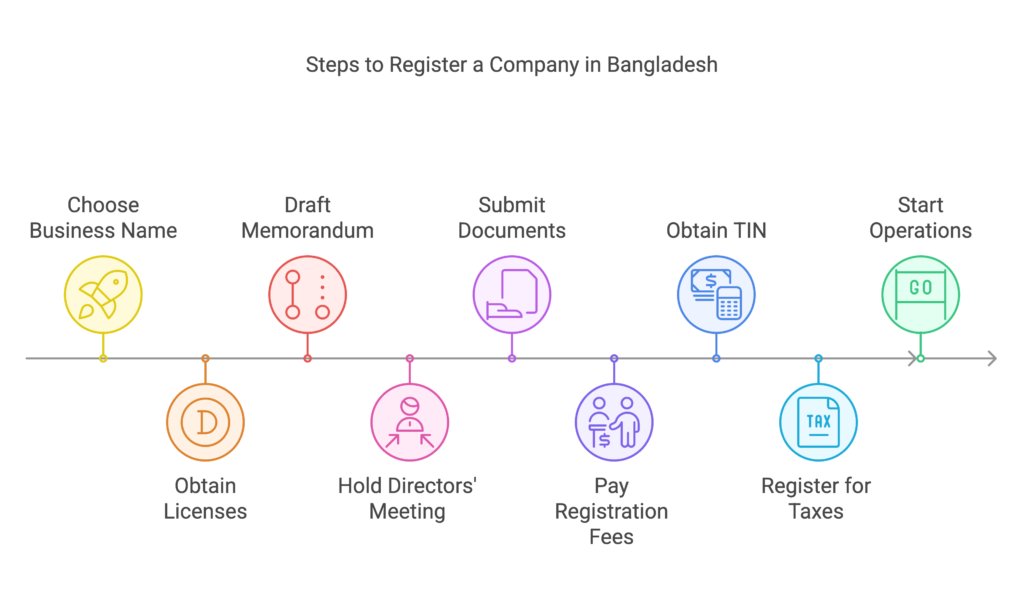

We will explain the whole thing in this article, but here is a table outlining the steps involved in forming a company in Bangladesh:

| Step | Description |

|---|---|

| 1 | Choose a business name and register it with the Registrar of Joint Stock Companies and Firms (RJSC). |

| 2 | Obtain any necessary licenses or permits for your business. |

| 3 | Draft the memorandum and articles of association for your company. |

| 4 | Hold a meeting with the directors to adopt the memorandum and articles of association. |

| 5 | Submit the memorandum and articles of association, along with other required documents, to the RJSC for registration. |

| 6 | Pay the registration fees and obtain a certificate of incorporation from the RJSC. |

| 7 | Obtain a tax identification number (TIN) from the National Board of Revenue (NBR). |

| 8 | Register for any necessary taxes with the NBR. |

| 9 | Obtain any necessary approvals or permits from relevant government agencies. |

| 10 | Start operating your business. |

Please note that this is a general overview of the process and may vary depending on the specific type of company you are forming and the nature of your business. It is advisable to seek legal and professional guidance to ensure that all necessary steps are taken and all necessary documents are properly completed and filed. Now let’s get into details!

Procedure for Registration of a Private Limited Company in Bangladesh

The 5 steps listed below correctly outlines the procedure for the REGISTRATION OF A PRIVATE LIMITED COMPANY IN BANGLADESH.

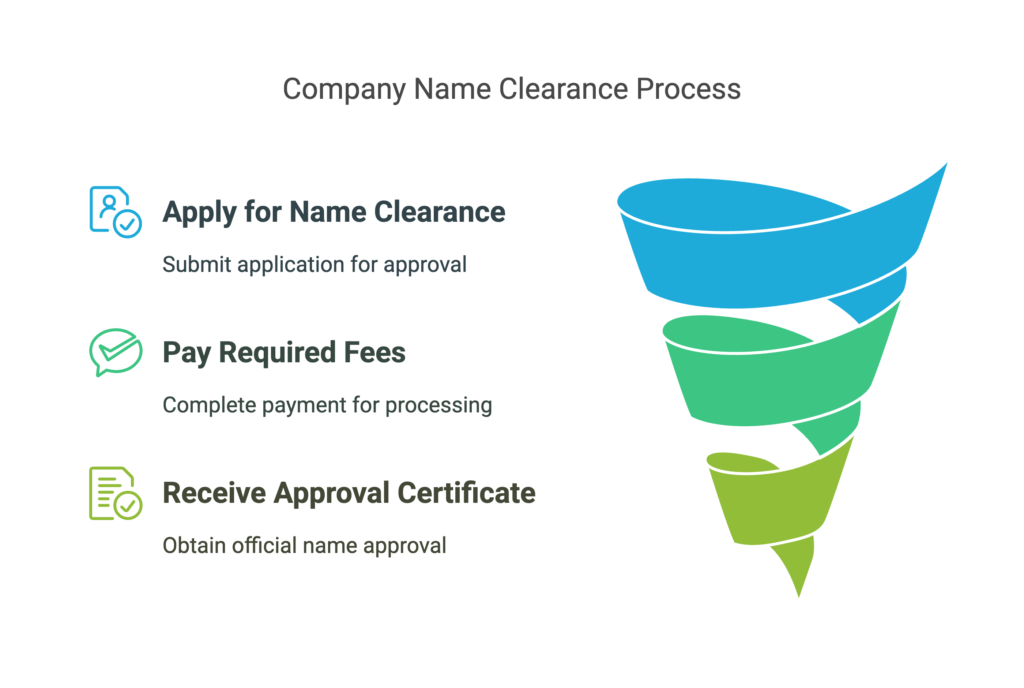

Step 1: Business Name Clearance

The first step in forming a private LIMITED COMPANY IN BANGLADESH is to fix a desired name for the company. Following the selection of a name, the applicant must apply FOR NAME CLEARANCE IN ORDER to obtain the name approval certificate RJSC.

The certificate is usually delivered within 1 to 2 days. Investors are required to PAY RJSC THE NECESSARY FEES for name clearance and verification.The government fee for name clearance is currently 230 BDT or around 3 USD.

Step 2: Drafting Required Documents

In order to form a Private Limited company in Bangladesh, a MEMORANDUM OF ASSOCIATION (MOA) and ARTICLES OF ASSOCIATION (AOA) must be prepared by the company.

Drafting Memorandum of Association (MoA):

A limited company’s Memorandum of Association (MOA) states the company’s objectives, company’s authorized capital, and list of the shareholders along with their respective shareholdings.

However, it should be noted that in order to begin A BANKING, fINANCE, SCHOOL, OR HOSPITAL BUSINESS, prior approval from the relevant authority is required.

Drafting Articles of Association (AoA):

The AoA outlines all of the regulations that govern how a limited company operates. The AoA should include the number and list of directors, the board’s power, the Managing Director’s power, the meeting process, quorum, notice procedure, and the appointment of auditors.

It also specifies how the company’s bank account will be managed.

Step 3: Opening a Bank Account

To start a private limited company in Bangladesh, you will need to open a temporary BANK ACCOUNT IN THE PROPOSED COMPANY NAME WITH ANY SCHEDULED BANK IN BANGLADESH.

This stage is solely applicable if the proposed company has FOREIGN SHAREHOLDING. The following documents need to be filed to the respective banks in order to open the bank account:

- Name Clearance

- Draft copy of your MoA and AoA

- Board Resolutions of the foreign company

- Passports copies of the representative shareholders

- BANK ACCOUNT opening forms.

Foreign investors wanting to form a private limited company in BANGLADESH MUST DEPOSIT THE REQUISITE PAID-UP CAPITAL INTO THE COMPANY’S BANK account.

The remitted funds will be held by the bank. The bank will produce an ENCASHMENT CERTIFICATE, which will be required by RJSC in order for the company to be incorporated.

This certificate states that the appropriate capital contribution has been duly deposited in the proposed company’s temporary bank account.

CLICK HERE TO MAIL US IF YOU HAVE ANY LEGAL QUERIES REGARDING THIS

OR CALL US ON +8801847220062 OR +8801779127165

Step 4: Company Registration with the RJSC

In order to REGISTER THE PRIVATE LIMITED COMPANY IN BANGLADESH, all the required information and documents must be submitted to the RJSC. They are as follows:

- Details of Directors (name, parents name, passport number, email ID, mobile number)

- National Identification Number (if Bangladeshi national)

- Tax Identification Number (if Bangladeshi national)

- Limit of paid up capital and authorized capital

- Photo of all shareholders (1 copy)

- Address of the company

- Signatories of the bank account

The registration fee and stamp duty must be paid in the RJSC’s designated bank.

The GOVERNMENT fee will be calculated depending on the proposed company’s approved share capital.

A certificate of INCORPORATION MUST BE OBTAINED FROM THE RJSC AFTER ALL PROCESSES HAVE BEEN COMPLETED SUCCESSFULLY IN ORDER TO REGISTER A PRIVATE LIMITED COMPANY IN BANGLADESH.

Step 5: Post-registration Formalities

After SUCCESSFUL company formation, the last step in order to form a private limited company in Bangladesh is to acquire the following certificates/licenses:

(a) Trade License

The companies must obtain a trade license from the local authorities. The proposed Company must submit an application to the local City Corporation, together with all essential paperwork and payments.

The COST OF GETTING A TRADE LICENSE is around USD 200, and it can be renewed annually. Three to four working days are typically required to receive it.

b) TIN (Tax Identification Number)

A private limited company in Bangladesh must obtain an E-TIN from the NATIONAL BOARD OF REVENUE‘s (NBR) website, which can be done free of cost.

c) VAT Registration Certificate

The newly formed company must also obtain a VAT REGISTRATION Certificate from the National Board of Revenue. This should take about 5-7 working days.

d) Fire Certificate

BANGLADESH FIRE SERVICE AND CIVIL DEFENSE Authority will need to issue a fire certificate to the private limited company.

e) Environmental Clearance Certificate

Furthermore, each year, the company must submit to the RJSC the following documents:

- Schedule X which is a list of shareholders and an annual summary of share capital.

- Balance Sheet within 30 days of ANNUAL GENERAL MEETING (AGM).

- Profit and Loss Account within 30 days of AGM.

Form 23B which is a letter of approval from the auditor that must be provided within 30 days of the appointment date.

Essential Information for Foreign Investors

Foreign investors need to keep the following things in mind when they plan to form a private limited company in Bangladesh:

- The costs of registering a company are primarily determined by the company’s authorized capital. The average cost is between USD 1800.

- SHELF COMPANIES ARE NOT PERMITTED and must have a physical place of business in Bangladesh.

- BANGLADESH FOREX REGULATIONS ALLOW FOR THE FULL REPATRIATION OF PROFITS AND INVESTMENTS.

- Foreign nationals may be employed at a 20:1 (local: expat) ratio, subject to obtaining the necessary work permit.

- Except in a few restricted areas, 100 percent FDI investment is permitted.

- Directors can be either foreign or domestic nationals.

- The typical CORPORATE INCOME TAX RATE ranges from 25% to 45 percent, depending on the sector and nature of the company.However, tax exemptions are available for selected sectors and areas for 5-7 years.

- There are also additional tax exemptions for investing in Special Economic Zones.

What are some alternative ways to set up a company in Bangladesh?

BRANCH OFFICE:

A branch is not a separate incorporated entity, but rather an extension of its parent company. In other words, the parent company is liable for the liabilities of its branches.

With BANGLADESH INVESTMENT DEVELOPMENT AUTHORITY’S (BIDA) approval, a branch can engage in commercial activities. The Exchange Control Guidelines, on the other hand, strictly monitor its operation.

In Bangladesh, the average time to open a branch officis 45- 60 days.

LIASON OFFICE:

A liaison, also known as a representative office, is subject to BIDA approval similarly as a branch.

It must have an overseas parent company, and its activities are limited because it only serves as a communication or coordination instrument for Bangladesh’s business resources.

Also, keep in mind that a liaison office in Bangladesh cannot earn any local income. Through remittance, the parent company bears all of its expenses and operational cost. It also adheres to the general BUSINESS REGISTRATION PROCEDURE IN BANGLADESH.

Are you planning to register a private limited company in Bangladesh?

Company formation and registration at Tahmidur Rahman Remura: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman, THE LAW FIRM IN BANGLADESH Remura: The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering a Private Limited Company in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: INFO@TRFIRM.COM

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS