Charitable Trust in Bangladesh | Laws, Formation, Regulation of Charitable Trust| Everything you need to know about Charitable Trust in Bangladesh

Tahmidur Rahman, Senior Associate, TR Barristers in Bangladesh

2 Oct 2019

Table of Contents

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

This post in will explain in details about Charitable Trust in Bangladesh| Formation Process of a charity, Regulation of the Trust etc. | Everything about Charitable trust that you need to know and be aware of.

What is a Charitable Trust?

A charitable trust is a group of properties or assests that a beneficiary signed over or uses to create a charitable fund, typically with liquid investment. The assets are owned and handled for a fixed period of time by the charity, with some or all of the value that the assets produce going to charity. This may take the form of a permanently fixed sum per year, called an annuity or uni-trust, which measures annual payments based on a percentage of the value of the trust in a given year and is therefore subject to adjustment. Conventionally there are no set beneficiaries of a charitable trust. That is true even where the people who directly benefit from the trust are easily ascertainable, say for the elderly or the disabled in the case of a residential home. In the case of a charitable trust, the obligation of assurance is relaxed in the following sense: as long as it is evident that the settlor wished to commit funds to charity, it will not matter if the precise charitable aims desired by the settlor are well defined; the court must formulate a charitable use scheme for the funds. Charitable trust might also last indefinitely depending on the conditions or the investment.

The requirement for being identified as a ‘Charity’ in Bangladesh

Whether a certain purpose is charitable can be determined by treating the issue in two factors:

a) Is the purpose or the intention of the trust is prima facie charitable?

b) If so, is it in the public interest?

Advantages of Setting up Charitable and Religious Trusts in Bangladesh

- In the case of a charitable trust, the presumption of assurance is relaxed in the following sense: as long as it is clear that the settlor intended to commit funds to charity, it does not matter if the specific charitable purposes intended by the settlor are specifically specified, Thus, for example, a trust will be perfectly legitimate simply for charitable purposes.

- A Trust in Charity can last forever. Where charitable trust funds remain but the original charitable intent is basically no longer achievable, the cy-près doctrine will be applied to establish a new, workable, charitable purpose trust for the funds.

- There are significant fiscal advantages in the form of a reduction or exemption from different taxes and charges. Without going into the specifics of these tax benefits, one should consider their practical significance to individual charities and the wider concerns posed by this type of tax relief for any reason that falls under the legal definition of charity.

Charitable and Religious Trusts Law in Bangladesh

ii) Voluntary Social Welfare Agencies (Registration and Control) Ordinance 1961 (iii) Compliance Rules on Foreign Donations (Voluntary Activities), 1978 (iv) Microfinance Regulatory Policy, 2006 (v) Foreign Contributions (Compliance) Ordinance 1982 (vi) Society Registration Act, 1860 (vii) Trust Act 1882 (viii) Company Act 1994

The concept of Trust in Bangladesh

In Bangladesh both private and public trusts are in operation. A private trust is one where certain chosen persons are given profit, i.e the beneficiaries are listed. For instance, in trust for C, A conveys its land to B, where B will work as the trustee for C. In order to establish the trust, one must designate the trust property as the holder, and must also appoint an individual or group of individuals to serve as trustees with respect to the trust. When choosing the trustees, it should be borne in mind that only those who are capable of legitimately owning property and are capable of implementing contracts should be trustees. A minor or an insane person, for example, can’t serve as a trustee. Trustees have strong, if not onerous, legal duties which they have to adhere strictly to. Therefore the chosen settlor trustees are always to be told of their legal responsibilities. These trustees have the right to obtain any fees / remuneration for their work.

In addition, there must be a simple and definite ‘intention’ or ‘intent’ of creating the trust. Can not be made for reasons unknown or undefined. It goes without saying that the trust ‘s intent has to be a lawful one, above and above. As for example, a trust may be established for the education of poor children in an area; for certain medical purposes; for charitable purposes; for the protection of someone; for the creation of a scholarship or school, or even for the benefit of a single individual or a particular group of people. The individual or group of people profiting from the trust would be legally recognized as the trust’s ‘beneficiaries.’

In regards to charitable trust in Bangladesh, the trust is extended on the public at large in a mutual confidence gain. Recipients are not visible here. Trusts to support activities relating to general health or education are charitable trusts. This could be a faith in charity or in religion. For examples, A transfers its property to B for the construction of a hospital for the general population.

Permission and Registration in regards to creation of waqf

Under the terms of the Registration Act, if the trust property is an immovable property (e.g. land) the trust deed has to be registered. Unless, on the other hand, the property in question is not fixed but mobile, like, money or otherwise, then there is no legal requirement to register the instrument of trust. Regardless of the disposition of the fiduciary interest, your father will transfer the interest to the trustees following the required legal formalities annexed to the transfer of that type of property.

However it’s important to remember that there is no obligation for any authority to take any permission to establish a trust. Nevertheless, permission / registration is required to establish a Waqf. Waqf means the permanent dedication of any movable or immovable property by a person professing Islam, for any reason recognised by Muslim law as holy, religious or charitable. Trust and Waqf are terms which are essentially related. However, there are variations in the intent, administration, and regulating legislation.

The WAQF Ordinance 1962 and Charitable Trust in Bangladesh

Like the English definition of trust, the Muslim Law which is implemented in Bangladesh recognizes a waqf institution. A property owner, both movable and immovable, may settle his property in perpetuity for the use of beneficiaries. The owner can create a waqf by making a declaration in an instrument. The so settled property is known as the waqf property and the person who creates the waqf is known as a waqif. The waqf is governed by a trustee who according to the waqf instrument requirements is known as a mutawalli.

The Waqfs Ordinance 1962 mandates all waqfs to be registered at the Waqf Administrator ‘s office via a request made by the waqf property’s Mutawallis. Upon receipt of the letter, the Administrator shall continue with the registration of the waqf property after which the Administrator shall hold its detailed details in his record, including the deeds, the name of the mutawalli and the rules of succession to the mutawalli office. The 1962 Ordinance has no provision to terminate the waqf, as it requires a permanent dedication of a house. But the Ordinance empowers the Waqf Administrator to take over and assume the administration, control and management of any waqf property when it is found that the waqf ‘s objectives are not being properly accomplished in the context of its intended purposes and when this event occurs, the Administrator or the waqif may contact the court and seek its guidance in this regard.

Classification of Waqf – Trust in Bangladesh

A wakf produced during death is known as a testamentary wakf-23-as in the case of a gift

Wakf is commonly divisible into two

(i) Wakf helping the general public;

(ii) Wakf supporting their relatives, children or offspring.

(A) wakf helping the general public: wakf (Masliah -al aama) e. g. Mosques, cemeteries, dargae, takias etc.

The key legislation on this public wakf in Bangladesh is the 1962 Wakf Ordinance (Ord No. 1 of 1962), which was enacted to update and amend the law on the administration and management of wakf property in Bangladesh.

(B) relatives, children or descendants benefiting from wakf: these may be of three types.

Exclusively for the family: The Muslim Law accepts wakfs for the family. The view is expressed by Ameer All relying on a number of Prophet (sm) traditions that a Wakf is a legitimate one only for the benefit of the family of the Wakif (without any provision for charity). Bikani-Bikan Mia vs. Shuk Lai . But this view of Ameer Ali was disapproved by the Privy Council and it was held that wakf,exclusively for one’s family was not a wakf for charitable purposes and was therefore invalid.

- Wakfs substantially for the familly ,with some provisions for charity : Before the enactment of the 1913 Act, the private council held that if the primary purpose of the wakf was the aggrandizement of the estate, the wakf would be null even if there were any illusory gift for charity.

Abdul Fata Mohammad vs. Rasamaya (I. L. R 22 Cal. 619 (PC) It was held that a wakf for both the chanty and the family was valid only if the property had been significantly committed to charitable purposes but not otherwise. According to the Act, 1913 wakf is accepted significantly for relatives, the only prerequisite being absolute commitment to charity. The Act is intended to extend and not limit the law relating to wakfs.

(iii) Wakfs substantially for charity with some provision for the family :

Also before the 1913 Act; wakf, whose primary aim was a permanent commitment of the property to charity held to be legitimate even though private settlement was in favor of the wakif itself or his relatives. (Mohammad v. Amarchand Ahsnullah)

Thus these wakfs have always been valid and are valid even now without invoking the provisions of the 1913 Wakf Act.

So we see that law relating to wakfs in Bangladesh is partially regulated and controlled by the statutes, judicial decisions and partly by Muslims’ personal rules.

Religious and Charitable Endowments under Hindu Law in Bangladesh

Religious endowments such as Debottar (the property dedicated to Deity ‘s ownership) and Mutts (the religious educational institution) can be created orally and in writing. And may take the form of both gift and will (will apply if the case is regulated by theAct in the event of a will section 57 of the Succession Act). Endowments may be created for charitable purposes to feed the needy or the Brahmans etc. Formal Endowments Acts for religious or charitable purposes must comply with T.P ‘s requirements. Play, dated 1882. And the Enrolment Act, 1908. (Charitable Trust in Bangladesh)

Dedication to faith can be of two forms i. e. Complete or partial. In the event of a full dedication the owner absolutely loses his tille and diely becomes the absolute owner and in the case of a partial dedication the owner retains the property and only a fee is created in favor of the item where the dedication is of total nature any surplus money may be used by applying the cypress doctrine. Debottar can follow two types i. e. Both private and public. In public debottar, the right to worship is open to the general public, In private debottar the privilege is limited to members of a specific family or members of a certain group of persons and the public are not entitled.

Required Formalities in creation of a Hindu Charitable Trust in Bangladesh

For the creation of a Hindu religious or charitable endownent, no formalities are usually required. Yet according to some administrations.

- (A) The object or intent of the trust shall be a true religious or charitable intent, in accordance with Hindu law laws.

- (B) Under Hindu law the creator should be able to establish a trust in respect of the specific property;

- (C) The creator should state the object of the trust and the property in question with adequate precision;

- (D) The trust shall not, for the time being, object to the provisions of the statute.

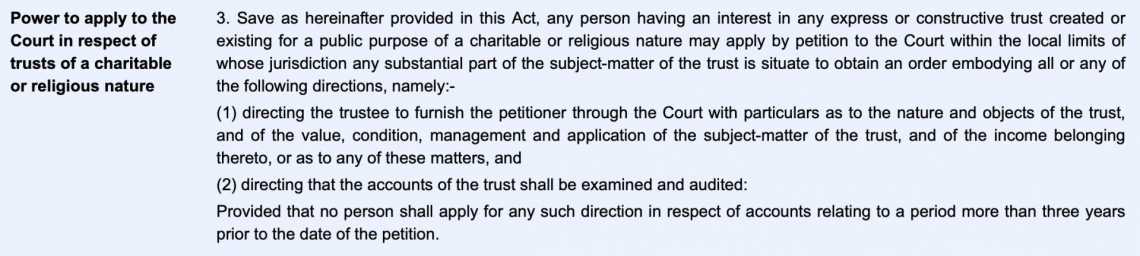

Regulation in regards to Hindu Charitable Trust in Bangladesh:

(a) Religious endowments Act, 1863,

(b) Charitable and Religious Trusts Act, 1920,

(c) Sec. 92 of Civil Procedure Code, 1908,

(d) Transfer of property Act, 1882,

(e) Registration Act, 1908

(f) Succession Act, 1925

TR Barristers in Bangladesh ranked as the best law firm in ‘BD Law Firms ranking 2020’ Bangladesh in non-profit and charity formation- Charitable Trust in Bangladesh

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165