Trade License in Bangladesh | Fees, Processing and Renewal

Tahmidur Rahman, Senior Assoicate

31 October 2019

Table of Contents

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

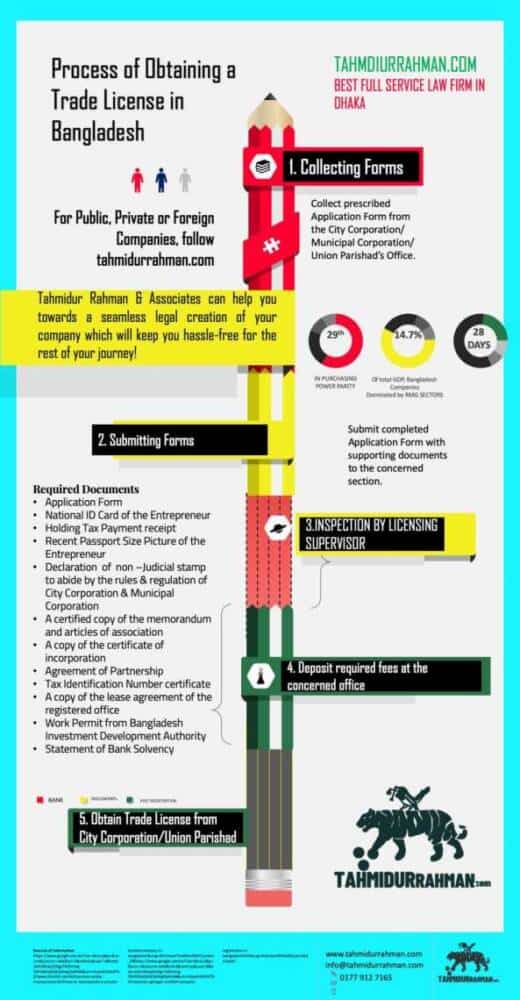

One of the important steps of starting business in Bangladesh is acquiring a trade license. A businessman must obtain a business license from the respective business area’s City Corporation or City Council. Here, in this post in details we will explain the procedure of obtaining a trade license in Bangladesh, the fees and finally the renewal process of trade license in Bangladesh.

Step by Step Process of acquiring Trade License for any Business Entity

Step by Step Process:

Below is an overview of the process of obtaining a trade license for companies operating within the zone of Dhaka City Corporation. Many local authorities have similar rules.

Step 1:

Collect prescribed Application Form from the City Corporation/ Municipal Corporation/ Union Parishad’s Office.

Step 2:

Submit completed Application Form with supporting documents to the concerned section.

Step 3:

Inspection by the Licensing Supervisor.

Step 4:

Required fees to deposit at the concerned office.

Step 5:

Obtain Trade License form the City Corporation/ Municipal Corporation/ Union Parishad office.

The trade license filled-in application form must be accompanied by the required documents.

Required Documents:

- Application Form

- National ID Card of the Entrepreneur

- Holding Tax Payment receipt

- Recent Passport Size Picture of the Entrepreneur

- Declaration of non –Judicial stamp to abide by the rules & regulation of City Corporation & Municipal Corporation

- A certified copy of the memorandum and articles of association

- A copy of the certificate of incorporation

- Agreement of Partnership

- Tax Identification Number certificate

- A copy of the lease agreement of the registered office

- Work Permit from Bangladesh Investment Development Authority

- Statement of Bank Solvency.

If you want to know how to open a company in Bangladesh or about company formation click here!

Trade Licesne For Commercial/ Corporate Entities.

STEP 1: OBTAIN THE PROPER FORM OF THE PROPER OFFICE.

Depending on the type of business, Dhaka City Corporation (DCC) has two forms for a trade license. The “K” form must be used by a commercial firm. Although the ten zonal offices use the same K form, the form must be obtained by a client from their respective zonal office. What distinguishes it from that of other zones is a seal and the officer’s initials selling the form. The form will cost Tk. 10 (Yes, it’s that low to encourage potential business ventures).

STEP 2: GET CERTIFICATION OF THE LOCAL WARD COMMISSIONER.

On completion of the application, it must be sent for approval to the local ward commissioner.

STEP 3: BOOK BY TK 50, COLLECT LICENSE, AND SUBMIT APPLICATION WITH SUPPORTING DOCUMENTATION TO DCCS ZONAL OFFICE.

For the K Form, the receipt of the lease for the premises from which the company operates or, if purchased, the receipt of the municipal tax payment shall be made. Supporting documents include: 3 copies of owner’s PP size photo Rent receipt or proof of ownership of premises

Step 4: Await Licensing Supervisor (LS) inquiry.

The LS usually goes to the business entity for a visit when submitting the form to verify the information provided.

STEP 5: PAY FEE AND COLLECT TRADE LICENSE PREDETERMINED.

The business is asked to go to the DCC office to pay the predetermined fee and collect their trade license after the LS inspection is completed. The fee schedule depends on the class under which the application was made.

STEP 6: SIGNBOARD FEE.

Another choice for commercial licensing is the signboard charge. The company’s charge is compulsory for all types of business. A trader has 30% of his license fee to pay.

TRADE LICENSE FOR A MANUFACTURING COMPANY

STEP 1:PROCURE THE PROPER FORM FROM THE OFFICE OF THE PROPER OFFICE.

From the zonal office of the DCC where the manufacturing company must submit its request.

STEP 2:GET CERTIFICATION OF THE LOCAL WARD COMMISSIONER.

Local ward commissioner must validate the completed form.

STEP 3:SUBMIT APPLICATION WITH SUPPORTING DOCUMENTATION.

Supporting documents include:

1. 3 copies of the owner’s PP size photo

2.Rent or premises ownership proof

3. No neighbourhood objection certificate

4. Written undertaking on a Tk 150 non-judicial stamped paper

5. Fire license from the local fire department.

STEP 4: Sign OF THE SUPERVISOR LICENSING (LS).

The LS usually goes to the business entity for a visit when submitting the form to verify the information provided.

STEP 5: PAY PREDETERMINED FEE AND COLLECT TRADE LICENSE.

Once the LS has completed its inspection, the company is asked to go to the DCC office to pay the predetermined fee and collect its trade license. The fee schedule depends on the class under which the application was made.

STEP 6: SIGNBOARD FEE

A signboard fee must also be paid when collecting the trade license. The signboard fees must charge 30 per cent of the license fee for all types of business.

” TRW is Considered as one of the leading firms in Investment Law in Dhaka, Bangladesh” (Tahmidur Rahman)

Trade License Renewal Process in Bangladesh

The renewal process for your business licenses You must collect a form. There will be options in the form from 1 to 18. From 1 to 6, you must write the name of the institution, the name of the applicant, the name of the applicant’s parents.

If there are two people to start trading, the name of two people should be included. In addition, the two applicants ‘ pictures should be included. But you have to pick one from the business while dealing with different people. Accessing this person can accomplish the application.

The address of the company should be noted in the 7 number blank box. You must write the number of national identity cards in the 8 number blank boxes. You need to write down seriously in the 10 number empty boxes. You’ve got to write your mobile number there. You have to fill in the entire form in this way until the end. You must submit this to the authority by completing the form. You will then have the approval for renewal to continue your business legally. It’s not difficult to renew trading licenses. Only, according to the procedure, you have to go. You can do all the work perfectly within one day.

You may contact us to know how to renew your business license in detail.

Hence to summarise the renewal steps:

STEP 1: PICK-UP DEMAND BILL FROM THE LICENSE BOOK (THIS BOOK IS VALID FOR FIVE YEARS)

When the expiring trade license is checked, the LS fills the details in the demand bill and gives the business booklet. The demand bill is like a bank deposit slip, a four-page booklet. All the pages contain the same information: one page is for the bank and one page is for the business.

STEP 2: PAY RELEVANT FEE AT DESIGNATED BANK

Deposit by application bill designated bank and automatically renew the license.

“Depending on the type of business, Dhaka City Corporation (DCC) has two forms for a trade license. The “K” form must be used by a commercial firm.”

All Business Licenses in Bangladesh

Once a company is registered or is about to register, it is absolutely essential that the person in charge should know the business niche and comply in a much-needed legal manner in order to avoid challenges. For example, if a business that may have an impact on the environment has to procure a company’s relevant licenses, permits and certificates in Bangladesh. We at TR Barristers in Bangladesh Associates provides Company and Corporate Legal services to help acquire such Licenses.

FAQ that our clients generally ask about trade license in Bangladesh

How to obtain a business license in Bangladesh?

For any kind of business enterprise in Bangladesh, a trade license is compulsory. It is issued by the respective areas of the local government. Each business enterprise must acquire a Trade License from each local authority under which it operates. If a business enterprise has more than one business site, each local authority must acquire a trading license. It is released for a period of one year and has to be periodically renewed. Some government fees are attracted by the Trade License, which typically depends on the business forms.

The process of obtaining trade licenses for companies operating within the area of Dhaka City Corporation is listed below. Some municipal councils have laws that are identical. For more details, you are advised to contact the appropriate local government.

How to get a trade license as a commercial firm in Bangladesh?

STEP 1: Obtain the Correct form.

Depending on the type of company, Dhaka City Corporation (DCC) has two types of commercial license. The “K” type needs to be used by a commercial company. Although the ten zonal offices use the same K form, the form must be obtained by a company from its respective zonal office. What sets it apart from that of other zones is a seal and the initials of the officer selling the type. The form will cost Tk. 10.

STEP 2: GET THE LOCAL WARD COMMISSIONER’S CREDENTIALS.

It has to be sent for validation to the local ward commissioner after the form is completed.

STEP 3: Obtain a license book from TK. 50 and Send APPLICATION TO DCCS ZONAL OFFICE WITH SUPPORTING Documents.

For the K Form, it is appropriate to include a rent receipt for the premises on which the company is operating or if owned, a municipal tax payment receipt. Documents to support this include:

3 copies of the owner’s picture in PP format

Leasing receipt or proof of possession of premises

Stage 4: Wait for the enquiry of the Licensing Supervisor (LS) .

The LS usually goes to the business organization for a visit upon submission of the form to check the details given.

Stage 5: PAY PREDETERMINED FEE AND CLOSE TRADE LICENSE.

The company is requested to go to the DCC office to pay the predetermined fee and receive their trade license after inspection by the LS is concluded. The schedule of payments depends on the business category in which the request was filed.

Phase 6: FEE OF SIGNBOARDS

A signboard fee often has to be charged when collecting the trade license. For all forms of companies, 30 percent of the license fee would be paid for signboard fees.

How to get a trade license for a manufacturing firm in Bangladesh?

STEPS PROCESS:

Step 1:PROCURE THE PROPER FORM

For Tk, the “I” shape will have to be purchased. 10 from the DCC zone office where the manufacturing business has to send its order.

STEP 2:GET CERTIFICATION OF THE LOCAL WARD COMMISSIONER.

The completed form must be checked and certified by the local ward commissioner.

STEP 3:SUBMIT APPLICATION WITH DOCUMENTATION SUPPORTING.

Supporting documents shall include:

3 copies of the owner’s picture of PP scale

Leasing receipt or proof of possession of premises

No neighborhood certificate of objection

A written undertaking for a Tk 150 non-judicial stamped paper

Fire License of the local fire department Environmental Certificate of the DOE

Stage 4: AWAIT ENQUIRY ON THE LICENSING SUPERVISOR (LS).

Upon submission of the form, the LS typically goes to the business entity for a visit to check the details given.

STEP 5: PAY PREDETERMINED FEE AND COLLECT TRADE LICENSE.

After inspection by the LS is concluded, the business is asked to go to the DCC office to pay the predetermined fee and collect their trade license. The fee schedule depends on the business category under which the application was filed.

STEP 6: SIGNBOARD FEE

When collecting the trade license, a signboard fee has to be paid as well. For all types of business the signboard fees will payable 30% of the License fee.

What is drug license in Bangladesh?

You need to get a drug license if you want to deal with medicine. This drug license is issued by the Department of Medicine Administration under the Ministry of Health and Family Planning. License fee is 3000 BDT inside the municipal area and outside the municipal area is BDT 1500.

How to apply for drug licence in bangladesh?

You need the following documetns for getting a drug license in Bangladesh:

- Bank statement.

- Treasury Chalan of the License fee submission.

- The receipt of the rent of the shop or photocopy of the rental agreement. …

- An Angikarpotro by another licensed pharmacist.

How to get GMP certificate License for drug?

Good manufacturing Practice (GMP) Certificate:

- An Application in Company Letter Head

- Manufacturing license of medicine

- Your company profile

What are the documents required for a trade license in Bangladesh?

An applicant needs the following documents:

- Copy of National ID card (NID) of the entrepreneur

- Three (3) Passport size Photograph

- Copy of Passport (in case of Foreigner)

- Necessary Information to fill up the Form

- Holding Tax payment receipt

- Recent receipt (papers) or ownership proof

- 3 copies Passport size photos of the business holder (attested)

- A non-judicial stamp of Tk. 150/- for abiding rules of city Corporation

- Memorandum & Articles of Association (for Limited Company)

- Agreement of partnership (If he / she has a partner)

- TIN Certificate of Individual and entity

- Certificate of Incorporation (For Limited Company)

- Statement of Bank Solvency (Full Clearance)

- Work Permit from Bangladesh Investment Development Authority (BIDA)

- License from Fire service & Civil Defence (Applicable for Industry)

[Note: Each and every copy should be attested by first class gazette officer/ Word Councilor]

How to renew a trade license in Bangladesh?

The renewal process is comparatively routine and no inspection is required. When the trade license comes up for renewal the business has to go the LS.

PROCESS STEPS:

STEP 1: PICK-UP DEMAND BILL FROM THE LICENSE BOOK (THIS BOOK IS VALID FOR FIVE YEARS)

The LS fills in the details in a demand bill upon reviewing the expiring trade license and gives the company the booklet. A four page booklet similar to a bank deposit slip is the demand bill. All the pages are filled with the same information: one page is for the bank and one is for the company.

STEP 2: PAY RELEVANT FEE AT DESIGNATED BANK

Deposit designated bank through demand bill and it will automatically renew the license.

What is the 2023 trade license fee list in bangladesh?

| Business Type | Sub Type | Trade License Fees in Taka | City Corporation |

| Bank, Insurance & Fincial Insttution | Scheduled Bank | 10000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Scheduled Bank | 10000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Insurance(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Insurance(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Lending Institution(Branch Office) | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Lending Institution(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Currency Excenge | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Currency Excenge | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Stock Buy-Sale Organization(Branch Office) | 3000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Stock Buy-Sale Organization(Branch Office) | 3000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | N.G.O(Branch Office) | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | N.G.O(Branch Office) | 5000 | Dhaka South City Corporation |

| Business Nature | Capital From Taka | Capital To Taka | trade License Fees | Sub-Category |

| Limited Company | 0 | 100000 | 1500 | Dhaka South City Corporation |

| Limited Company | 0 | 100000 | 1500 | Comilla City Corporation |

| Limited Company | 100001 | 500000 | 2000 | Comilla City Corporation |

| Limited Company | 100001 | 500000 | 2000 | Dhaka South City Corporation |

| Limited Company | 500001 | 1000000 | 3500 | Comilla City Corporation |

| Limited Company | 500001 | 1000000 | 3500 | Dhaka South City Corporation |

| Limited Company | 1000001 | 2500000 | 4500 | Comilla City Corporation |

| Limited Company | 1000001 | 2500000 | 4500 | Dhaka South City Corporation |

| Limited Company | 2500001 | 5000000 | 5500 | Dhaka South City Corporation |

| Limited Company | 2500001 | 5000000 | 5500 | Comilla City Corporation |

| Limited Company | 5000001 | 10000000 | 7500 | Dhaka South City Corporation |

| Limited Company | 5000001 | 10000000 | 7500 | Comilla City Corporation |

| Limited Company | 10000001 | 50000000 | 10000 | Comilla City Corporation |

| Limited Company | 10000001 | 50000000 | 10000 | Dhaka South City Corporation |

| Limited Company | 50000001 | 999999999999 | 12000 | Dhaka South City Corporation |

| Limited Company | 50000001 | 999999999999 | 12000 | Comilla City Corporation |

How to register a partnership business in Bangladesh?

PARTNERSHIP -PROCEDURE OF REGISTRATION

A collaboration with the Registrar of Joint Stock Companies and Company of Bangladesh (‘RJSC’) may be registered.

The registration process for the partnership consists of two steps: a) reservation of the name; and b) entity registration. A partnership registration may be done within one or two days under normal circumstances.

Step 1- Selecting the name of the Relationship

The partners are free to choose any term, subject to the following rules, as they want for their partnership firm:

To contribute to misunderstanding, the names must not be too identical or close to the name of another existing company doing similar business. The explanation for this rule is that a company’s image or goodwill can be injured if an allied brand can be adopted by a new company.

The name does not include any terms expressing or suggesting the government’s sanction, approval or sponsorship.

You can apply for name clearance using the RJSC website once you have selected a name.

How to get a factory registration certificate in Bangladesh?

Documents Required

- Orginial copy of license fee or renewal fee or Treasury Challan

- Reciept of Licence and Renewal Fee payment according to the number of workers.

- Construction design of the factory

- Photocopy of the trade licence

- Duly filled in Form 1 and Form 2

- Memorandum of Association (Limited Company only)

| Category | Number of Workers | License Fee (BDT) | Renewal Fee |

| A | 5-30 | 500 | 250 |

| B | 31-50 | 1000 | 500 |

| C | 51-100 | 1500 | 800 |

| D | 101-200 | 2500 | 1200 |

| E | 201-300 | 3000 | 1500 |

| F | 301-500 | 5000 | 2500 |

| G | 501-750 | 6000 | 3000 |

| H | 751-1000 | 8000 | 4000 |

| I | 1001-2000 | 10000 | 5000 |

| J | 2001-3000 | 1200 | 6000 |

| K | 3001-5000 | 15000 | 7000 |

| L | 5001 & Above | 18000 | 8000 |

Total Income in Corporate Tax: Scope, Accrual and Source in Corporate Tax

Total Income in Corporate Tax: Scope, Accrual and Source in Corporate Tax The expressions "scope of total income" and "accrual" (or "accrued") have special significance within the structure of the Ordinance. Income tax is a geography-based legislation. The taxation...

General Overview of Corporate Tax in Bangladesh

Corporate Tax in Bangladesh in 2024 Under $2(20) of the Ordinance, a "company" means a company as defined in the Companies Act 1913 or the Companies Act 1994 and includes (1) a body corporate established or constituted by or under any law for the time being in force;...

Anti Corruption Commission in Bangladesh and its powers 2024

Anti Corruption Commission in Bangladesh and its powers in 2024 Are you looking for information on Anti Corruption Commission in Bangladesh and its powers in Bangladesh and anti bribery laws in Bangladesh ? This TRW Expert Guide (part 1) from the best lawyers in...

How to Enforce Foreign Law in Bangladesh in 2024

How to Enforce Foreign Law in Bangladesh In an increasingly globalized world, cross-border transactions have become routine, bringing with them a rise in disputes that often culminate in foreign court judgments or decrees. For a country like Bangladesh, which is...

Minors as per the Law of Bangladesh

Who are Minors as per the Law of Bangladesh Minors as per the Law of Bangladesh: Understanding who qualifies as a minor under the law is crucial for legal practitioners, policymakers, and citizens alike. In Bangladesh, the legal definition of a minor is shaped by...

Admission in Evidence Act of Bangladesh

What is the Admission in Evidence Act? Admissions are defined in Sections 17 to 31 of the Bangladeshi Evidence Act, 1872. General admittance is the subject of Sections 17 to 23, while confession is the subject of Sections 24 to 31. A confession is a valid and...