Nonbank Financial institutions in Bangladesh, MicroFinance and NBFI formation in Bangladesh:

Nonbank Financial Institutions (NBFIs) in Bangladesh have played an important part in the country’s financial system (NBFI formation in Bangladesh). Due to the rapidly growing

need for long-term finance and equity-type services, this sector has evolved as an increasingly vital component of the financial system. NBFIs offered differentiation to Bangladesh’s bank-based financial market.

Parallel to the saturation of the banking industry, the emergence of NBFIs has ushered in a new chapter of strengthening the country’s financial system. Consequently, this sector has emerged as a key participant in preserving the health of our financial and economic sectors.

By providing diverse investment instruments and risk pooling services, NBFIs in Bangladesh play a crucial role in bridging gaps in financial intermediation.

In recent years, NBFIs have experienced rapid growth, which reflects the significance of financial innovation and holds the prospect of enhancing financial intermediation through meeting long-term financing demands.

A nonbank financial institution (NBFI) is a financial institution that lacks a full banking license and is therefore unable to take public deposits. NBFIs facilitate alternative financial services, including collective and individual investments, risk sharing, financial advice, brokerage, money transmission, and check cashing.

NBFIs serve as a conduit for consumer credit (along with licensed banks). Insurance companies, venture capitalists, currency exchanges, certain microlending groups, and pawnshops are examples of nonbank financial institutions. These non-bank financial firms offer services that are not necessarily fit for banks, compete with banks, and specialize in particular industries or groups. (NBFI formation in Bangladesh)

Risk pooling institutions and Insurance Firms

Insurance firms underwrite economic risks related to mortality, disease, property damage or loss, and other types of loss. They offer a contingent guarantee of financial protection in the event of a loss. Life insurance and general insurance firms are the two most common categories of insurers. General insurance contracts are often short-term, but life insurance contracts are lengthier and terminate upon the insured’s death.

Life and property insurance are accessible to all segments of the population. Due to the nature of the insurance sector (companies must access a vast amount of information to assess the risk in each instance), insurance companies enjoy a high level of information efficiency.

Life insurance firms insure against financial loss resulting from the insured’s untimely death. Each term, the insured will pay a specified amount as an insurance premium. Because the likelihood of mortality grows with age but premiums remain constant, the insured overpays in the beginning and underpays in the end.

The overpayment made during the first few years of the contract represents the monetary worth of the insurance policy. (NBFI formation in Bangladesh)

Two subcategories comprise general insurance: market and social insurance. Social insurance protects against the risk of income loss resulting from unemployment, disability, disease, or natural calamities.

Due to the unpredictability of these risks, the ease with which the insured can conceal relevant information from the insurer, and the presence of moral hazard, private insurance companies frequently do not offer social insurance, leaving a void in the insurance industry that is typically filled by the government.

In industrialized Western societies, social insurance is more prevalent than family networks and other organic social support organizations.

Market insurance is a form of property insurance that has been privatized. Insurance providers accept a single premium payment. In exchange, the insurance companies will make a defined amount contingent on the insured event. Examples include burglary, fire, property destruction, and natural disasters.

Contractual institutions for savings

Contractual savings institutions (also known as institutional investors) enable individuals to invest in collective investment vehicles in a fiduciary capacity as opposed to a principal capacity. Collective investment vehicles invest the pooled funds of individuals and businesses in a variety of equities, debt, and derivatives securities. However, the individual has equity in the CIV itself as opposed to the specific investments made by the CIV. Mutual funds and private pension plans are the two most prevalent instances of contractual savings institutions.

Open-end and closed-end mutual funds are the two most common varieties. Open-ended mutual funds generate fresh investments by permitting the public to purchase more shares at any time. Shareholders may liquidate their holdings by selling their shares back to the open-ended fund at the net asset value.

In an IPO, closed-end funds issue a specified number of shares. By selling their shares on a stock exchange, the shareholders capitalize on the value of their holdings.

One can categorize mutual funds according on the nature of their investments. Some funds, for instance, invest in high-risk, high-return assets, while others concentrate on tax-exempt securities. Others focus on speculative trading (hedge funds), a particular industry, or cross-border investments.

Pension funds are mutual funds that restrict the investor’s access to their investment until a specified date in the future. In exchange, pension funds receive substantial tax incentives to encourage the working population to set aside a portion of their present income for a time when they are no longer employed (retirement income).

Other nonbank financial institutions

Market makers are broker-dealer institutions that quote purchase and sell prices for an inventory-held item. Among these assets are stocks, government and corporate debt, derivatives, and foreign currencies (NBFI formation in Bangladesh). The market maker instantly sells from its inventory or makes a buy to offset the inventory loss upon receiving an order.

The bid-offer spread, or the gap between the purchasing and selling bids, is how the market maker generates a profit. Market makers enhance the liquidity of any asset in their stock.

Specialized sectoral financiers offer a limited array of financial services to a certain industry. For instance, leasing businesses provide funding for equipment, whereas real estate financiers give prospective homeowners with access to funds. Leasing businesses have two distinct benefits over other sector-specific specialized financiers. Because they possess the leased equipment as part of their collateral agreement, they are partly shielded against the danger of default.

In addition, leasing companies enjoy favorable tax treatment on their equipment investments.

Other providers of financial services include mortgage and securities brokers, management consultants, and financial advisors. They charge a fee for their services. The majority of financial service providers enhance the investor’s informational efficiency. In the case of brokers, however, they do provide a service that enables investors to liquidate existing assets.

NBFI’s role in the economic system

NBFIs augment banks in providing individuals and businesses with financial services. They can present banks with competition in the supply of these services. While banks may offer a collection of financial services as a bundle, NBFIs unbundle these services and customise their offerings to specific populations.

Individual NBFIs may also specialize in a particular industry, so acquiring an informational advantage. By unbundling, targeting, and specializing, NBFIs increase competition in the financial services sector.

A financial system that incorporates non-bank financial institutions can insulate economies against financial shocks and allow them to recover from them. NBFIs offer several options for converting an economy’s savings into capital investments, which serve as backup facilities in the event that the primary form of intermediation fails.

However, in countries where adequate regulations are lacking, non-bank financial institutions (NBFI formation in Bangladesh) can increase the financial system’s fragility. Even though not all NBFIs are weakly regulated, those that make up the shadow banking system are. In the run-up to the recent global financial crisis, regulators mainly ignored entities such as hedge funds and structured investment vehicles, focusing instead on pension funds and insurance firms.

If a significant portion of the financial system consists of NBFIs that operate largely unchecked by government regulators and anybody else, the entire system’s stability may be at stake. Weaknesses in NBFI regulation can feed a credit bubble and asset overpricing, followed by a collapse in asset prices and loan defaults.

Integration of banks and non-banks and supervisory integration

The banking, securities, and insurance markets have grown increasingly interconnected, and inter-market connections are expanding rapidly. In response, one of the most significant changes in financial sector regulation over the past two decades has been a shift from the traditional sector-by-sector approach to supervision (with separate supervisors for banks, securities markets, and insurance companies) to a greater cross-sector integration of financial supervision (ihák and Podpiera, 2008). This has a significant impact on monitoring and regulation practices worldwide.

A three-pillar or “sectoral” model (banking, insurance, and securities), a two-pillar or “dual peak” model (prudential and business behavior), and an integrated model are utilized globally (all types of supervision under one roof).

According to the World Bank’s Bank Regulation and Supervision Survey, one of the most noteworthy trends of the previous decade has been a shift from the three-pillar model to either the two-pillar model or the integrated model (with the twin peak model gaining traction in the early 2000s). In a recent study, Melecky and Podpiera (2012) examined the drivers of supervisory structures for prudential and business conduct supervision over the past decade in 98 countries.

They discovered, among other things, that countries progressing to a higher stage of economic development tend to integrate their supervisory structures, small open economies tend to opt for more integrated supervisory structures, and financial deepening causes countries to integrate supervision progressively more. (The relevant information on the framework of supervision is accessible at https://www.worldbank.org/en/publication/gfdr.)

How do these diverse institutional systems compare with regard to the occurrence of crises and the mitigation of their effects? Cross-country regressions utilizing data from a large number of emerging and established economies provide some evidence in support of the twin peak model and against the sectoral model (Cihák and Podpierer, 2008).

During the global financial crisis, several twin peak jurisdictions (especially Australia and Canada) have been comparatively untouched, but the United States, a jurisdiction with a fractionalized sectoral approach to supervision, has been at the center of the crisis.

However, the crisis experience is anything but black and white, since the Netherlands, one of the twin peaks model’s instances, was involved in the bankruptcy of Fortis, one of the largest European bank failures. It is too early to draw a definitive conclusion, and it is notoriously difficult to separate the effects of supervisory architecture from other consequences.

The major difference between banks and NBFIs are as follows (NBFI formation in Bangladesh):

| Basis for Comparison | NBFI | Bank |

| Incorporated under | Financial Institution Act, 1993 | Bangladesh Bank Order, 1972. |

| Demand Deposit | Not Accepted | Accepted |

| Foreign Investment | Allowed up to 100% | Allowed up to 74% for private sector banks |

| Payment and Settlement system | Not a part of system. | Integral part of the system. |

| Maintenance of Reserve ratios | Not required | Compulsory |

| Deposit insurance facility | Not available | Available |

| Credit creation | Not a part of system. | Integral part of the system. |

| Transaction services | Not required | Compulsory |

Exiting NBFI’s in Bangladesh:

- Agrani SME Financing Company Limited

- Bangladesh Finance & Investment Company Limited

- Bangladesh Industrial Finance Company Limited

- Bangladesh Infrastructure Finance Fund Limited

- Bay Leasing & Investment Limited

- CAPM Venture Capital and Finance Limited

- Delta Brac Housing Finance Corporation Limited

- Fareast Finance & Investment Limited

- FAS Finance & Investment Limited

- First Finance Limited

- GSP Finance Company (Bangladesh) Limited

- Hajj Finance Company Limited

- IDLC Finance Limited

- Industrial and Infrastructure Development Finance Company Limited

- Industrial Promotion and Development Company of Bangladesh Limited

- Infrastructure Development Company Limited

- International Leasing and Financial Services Limited

- Islamic Finance and Investment Limited

- Lanka Bangla Finance Limited

- Meridian Finance and Investment Limited

- MIDAS Financing Limited

- National Finance Limited

- National Housing Finance and Investments Limited

- People’s Leasing and Financial Services Limited

- Phoenix Finance and Investments Limited

- Premier Leasing & Finance Limited

- Prime Finance & Investment Limited

- Reliance Finance Limited

Regulatory Authority of NBFI in Bangladesh:

The Bangladesh Bank is the regulatory body for both banking and non-banking financial institutions including for NBFI formation in Bangladesh. Bangladesh Bank is the Central Bank of Bangladesh, which was formed on December 16, 1971 by Bangladesh Bank Order 1972-President’s Order No. 127 of 1972. (Amended in 2003, NBFI formation in Bangladesh).

The general supervision and control of Bangladesh Bank’s affairs and business have been assigned to a nine-member Board of Directors led by the Governor, who is also the institution’s chief executive officer. There are 45 departments and 10 branch offices at Bangladesh Bank.

Bangladesh Bank’s vision is stated in its Strategic Plan (2010-2014):

“To develop continuously as a forward-looking central bank with competent and committed professionals of high ethical standards, conducting monetary management and financial sector supervision to maintain price stability and financial system robustness, supporting rapid broad-based inclusive economic growth, employment generation, and the eradication of poverty in Bangladesh.”

1. to formulate and implement monetary policy;

2. to formulate and implement intervention policies in the foreign exchange market;

3. to advise the Government on the interaction of monetary policy with fiscal and exchange rate policy, on the impact of various policy measures on the economy, and to propose legislative measures it deems necessary or appropriate to attain its objectives.

4. to keep and administer Bangladesh’s official foreign reserves; 5. to promote, regulate, and guarantee a secure and effective payment system, including the issuance of bank notes.

5. to monitor and oversee financial institutions and banking institutions.

The Key functions of Bangladesh Bank on NBFI in Bangladesh:

- The primary responsibilities of this department are outlined below:

- The Financial Institutions Act of 1993 authorizes the issuance of licenses for the establishment of new nonbank financial institutions and branches of existing nonbank financial institutions.

- Formulation of prudential regulations to ensure the soundness of nonbank financial institutions.

- Corporate governance is ensured through the monitoring of NBFI activities.

- Conducting off-site supervision of NBFIs by routinely collecting, evaluating, and monitoring a variety of data/information to ensure compliance with policies, regulations, and practices.

- Evaluation of the financial and management health of NBFIs using the CAMEL rating and assessment of their potential to absorb shocks using stress testing.

- Evaluation and oversight of the financial instruments issued by NBFIs, including Zero Coupon Bonds, Asset-backed Securitization Bonds, etc.

- BASEL Accord implementation in NBFIs to achieve risk-based capital adequacy.

In Bangladesh, NBFIs were established under the Companies Act of 1913 and were governed by the rules of Chapter V of the Bangladesh Bank Order of 1972. The ‘Financial Institution Act, 1993’ and the ‘Financial Institution Regulation, 1994’ were enacted in 1993 and 1994, respectively, to address the regulatory void and broad scope of operations to be covered by NBFIs (NBFI formation in Bangladesh), respectively. The Financial Institutions Act of 1993 licenses and regulates nonbank financial institutions.

There are 34 NBFIs authorized under this act. According to the Financial Institution Regulation, 1994, the minimum paid-up capital for NBFIs is now one billion Taka.

Twenty-one NBFIs have raised money by issuing IPOs, whereas three are exempt from launching IPOs. Other significant sources of funding for NBFIs include term deposits, credit facilities from banks and other NBFIs, call money, bonds, and securitization. Compared to banks in Bangladesh, the business focus of NBFIs is limited. Currently, NBFIs operate as multi-product financial institutions.

Sector Performance of NBFIs and Business Expansion

Outreach: Currently, three of the thirty-one NBFIs are government-owned, ten are joint ventures, and the remainder are privately owned. As of 30 June 2012, the branch network expanded to 164 locations. There are no NBFIs established outside of Bangladesh.

In 2011 and 2012, the asset base of NBFIs rose significantly. 2011 saw a gain of 14.7% in aggregate industrial assets, from Taka 251.5 billion in 2010 to Taka 288.4 billion in 2011. The growth rate for 2012 is likely to exceed that of 2011. By the end of June 2012, total assets had grown to 309 billion Taka (NBFI formation in Bangladesh).

NBFIs invest in several economic sectors, however their investments are primarily concentrated in the industrial sector. In June 2012, the various industries in which NBFIs invested were industry (42.6%), real estate (18.5%), margin loans (8.0%), trade and commerce (10.4%), merchant banking (1.4%), farm sector (1.3%), and others (others) (17.8 percent)

Liabilities and Equity:

The industry’s aggregate liability climbed to Taka 235.7 billion in 2011 from Taka 206.8 billion in 2010, while equity increased to Taka 52.7 billion in 2011 from Taka 44.7 billion in 2010, representing increases of 14.0 and 17.9 percent, respectively. At the end of June 2012, total liabilities and equity amounted to 252,2 billion Taka and 56,8 billion Taka, respectively.

The total deposits of NBFIs increased by 19.3 percent, from Taka 94.4 billion (45.7 percent of total liabilities) in 2010 to Taka 112.6 billion (47.8 percent of total liabilities) in 2011. On 30 June 2012, total deposits reached 124,2 billion taka (49.2 percent of total liabilities).

INSTRUCTIONS FOR ESTABLISHING A NONBANK FINANCIAL INSTITUTION:

The Financial Institution Act of 1993 and the Financial Institution Regulations of 1994 govern the prerequisites and process for establishing a financial institution (NBFI formation in Bangladesh).

Before creating a financial institution in Bangladesh, the following actions must be taken:

i) Obtain name clearance from Bangladesh Bank

ii) Shareholder or Director Personal Information

iii) Form a Memorandum and obtain Bangladesh Bank’s permission.

iv). Apply for Registration of the proposed firm at the Registrar of Joint Stock Companies (RJSC) under the Companies Act, 1994, as a Public Limited Company by providing all the pertinent documents and government fees, and acquire a Certificate of Incorporation from RJSC.

v) License from Bangladesh Bank

vi) Acquire a VAT, TIN certificate from the National Board of Revenue and a business license from the city government.

Bangladesh Bank has complete authority over whether or not to give any license. Prior to issuing a license, Bangladesh Bank may consider the financial condition of the applicant, management qualities, capital and future earnings prospects, objectives outlined in the memorandum of association, and whether the establishment of the financial institution is in the public’s best interest.

In addition, Bangladesh Bank would establish a minimum paid-up capital requirement for domestically formed financial institutions based on a number of parameters. 1 billion BDT in paid-up capital would be required for the formation of an NBFI.

In addition, specific legislative requirements must be met in order to form a non-governmental organization/NGO. Micro Finance Institution NGSOs (MFI-NGO) are NGOs that engage in microcredit operations; a license is required from the Micro Credit Regulatory Authority (MRA) under the MRA Act 2006 to operate such a program.

This organization’s mission is to reduce poverty, create employment opportunities, and aid aspiring small business owners.

Legal issues related to NBFI and NBFI formation in Bangladesh:

As stated previously, the difficulties of the banking business are not limited to the incorporation procedure. The difficulties also extend to the operational role. To successfully operate in this field without experiencing any legal repercussions, one must be knowledgeable of its legal issues.

The proprietors of a financial institution must comply with the banking regulations and the legislation applicable to their institution in order to avoid penalties.

Despite the fact that both banks and non-banking financial institutions are considered financial institutions, their incorporation, operation, regulation, and methodology are separate.

This implies that all financial institutions are banks, but not all banks are financial institutions. Therefore, when a person decides to form his institution, he must comply with the Bank Companies Act 1991 and the Guidelines to establish a banking company in Bangladesh in the case of a bank, or the Financial Institution Act 1993 and the Financial Institution Regulation 1994 in the case of a non-banking financial institution.

In the Bangladeshi banking industry, dishonor of checks is a fairly regular issue. As per the Negotiable Instruments Act, a person or business must never pay another person with a bank cheque for an amount that exceeds the balance remaining in his bank account or there were insufficient funds in his bank account to cover the cheque. Otherwise, he would be subject to imprisonment or a fine of up to three times the amount of the cheque, or both.

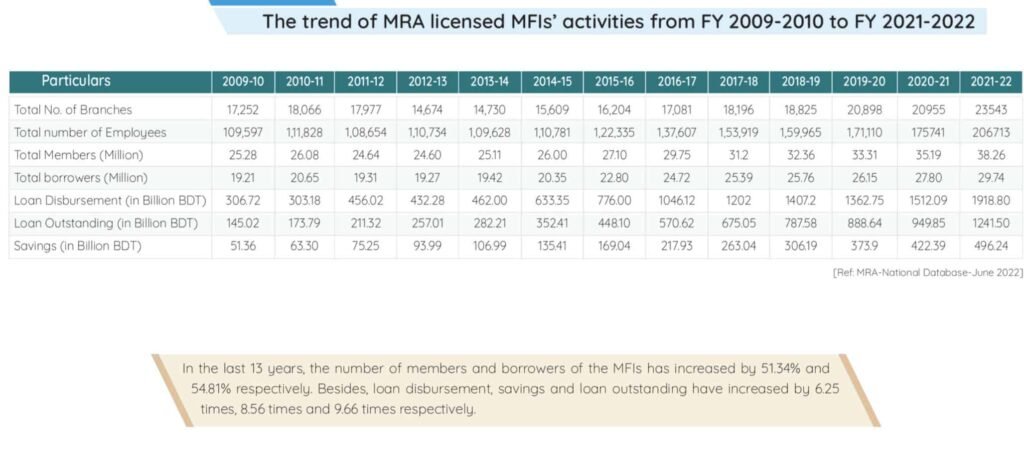

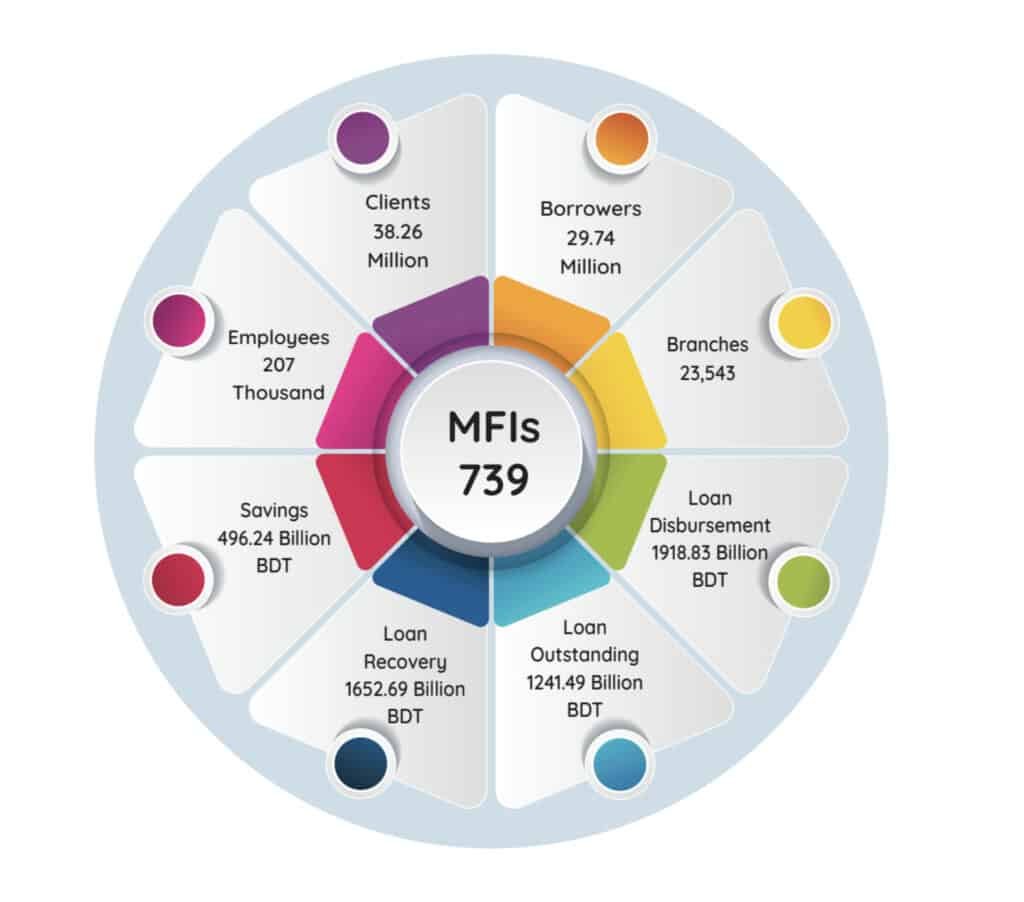

It is possible to gain insight into microcredit performance by tracing the link between branch staf and the savings, loan disbursement, and loan outstanding cycle observed at the branch level.

From 2015 to 2023 , productivity as measured by the savings-to-loan ratio increased, while

client-to-staf and borrower-to-staf ratios showed small changes.

In June 2023 , the client-to-employee ratio was 183, while the borrower-to-employee ratio was 141. In addition, it was noticed that a disproportionate amount of MFI employees were stationed in the headquarters.

Because of their larger size, larger MFIs place a heavier strain on their headquarters, which is responsible for things like system administration and lending management.

A signiûcant chunk of each branch’s workforce is dedicated to accounting and other operationalactivities, and all employees work relentlessly to increase their branch’s recovery rate.

Increasing the number of field employees per branch can help MFIs increase their loan disbursement rate, which in

turn reduces the amount of resources spent on collection and debt recovery.

In accordance with the Money Laundering Prevention Act of 2012, the Bangladesh bank plays a crucial role in eradicating and preventing money laundering offenses by taking action against all illegal and suspicious unauthorised money transactions.

Bangladesh bank has the authority to suspend or freeze transactions of any account, to issue necessary directions from time to time to the reporting organizations for the prevention of money laundering, to monitor whether directions imposed on the reporting organizations have been complied with and, if necessary, to conduct on-site inspections to determine the same, to impose fines/suspend license of the reporting agency for failing to provide information in a timely fashion, etc.

Under the Money Laundering Prevention Act of 2012, the Bangladesh Financial Intelligence Unit is responsible for eradicating and curbing money laundering and terrorist financing activities in Bangladesh by assisting other law enforcement agencies and financial intelligence units of other countries with the exchange of information related to such activities.

Whenever there is a foreign transaction between parties, banking laws must be observed. According to the Foreign Exchange Regulation Act of 1947, it is illegal for anyone other than an authorized dealer, a bank authorized by the Bangladesh Bank to deal in foreign exchange, to buy or borrow from, sell or lend to, or exchange foreign exchange with a person who is not an authorized dealer.

Therefore, it is imperative that the entities with foreign investors ensure that the initial investments are made through proper banking channels, i.e. at the time of company incorporation or purchasing shares of an existing company, the foreign investors should be remitting the share capital amount from their foreign bank account to the Company’s bank account in Bangladesh, along with a note stating “investment in the share capital of (Name of the Company)”.

This will demonstrate that the investment was made through the proper channels, and when remitting the profit, these initial investment paperwork and information will facilitate a smooth transfer in accordance with Bangladesh Bank regulations.

Legal process of establishing a Non-bank Financial institution in Bangladesh:

The Financial Institution Act of 1993 and the Financial Institution Regulations of 1994 govern the prerequisites and process for establishing a financial institution.

Before creating a financial institution in Bangladesh, the following actions must be taken:

i) Obtain name clearance from Bangladesh Bank

ii) Shareholder or Director Personal Information

iii) Form a Memorandum and obtain Bangladesh Bank’s permission.

iv. Apply for Registration of the proposed firm at the Registrar of Joint Stock Companies (RJSC) under the Companies Act, 1994, as a Public Limited Company by providing all the pertinent documents and government fees, and acquire a Certificate of Incorporation from RJSC.

v) License from Bangladesh Bank

vi) Acquire a VAT, TIN certificate from the National Board of Revenue and a business license from the city government.

Bangladesh Bank has complete authority over whether or not to give any license. Prior to issuing a license, Bangladesh Bank may consider the financial condition of the applicant, management qualities, capital and future earnings prospects, objectives outlined in the memorandum of association, and whether the establishment of the financial institution is in the public’s best interest.

In addition, Bangladesh Bank would establish a minimum paid-up capital requirement for domestically formed financial institutions based on a number of parameters. 1 billion BDT in paid-up capital would be required for the formation of an NBFI.

In addition, specific legislative requirements must be met in order to form a non-governmental organization/NGO. In regards to NBFI formation in Bangladesh, Micro Finance Institution NGSOs (MFI-NGO) are NGOs that engage in microcredit operations; a license is required from the Micro Credit Regulatory Authority (MRA) under the MRA Act 2006 to operate such a program. This organization’s mission is to reduce poverty, create employment opportunities, and aid aspiring small business owners.

Legal issues in regards to NBFI formation in Bangladesh:

As stated previously, the difficulties of the banking business are not limited to the incorporation procedure. The difficulties also extend to the operational role. To successfully operate in this field without experiencing any legal repercussions, one must be knowledgeable of its legal issues. The proprietors of a financial institution must comply with the banking regulations and the legislation applicable to their institution in order to avoid penalties.

Despite the fact that both banks and non-banking financial institutions are considered financial institutions, their incorporation, operation, regulation, and methodology are separate.

This implies that all financial institutions are banks, but not all banks are financial institutions. Therefore, when a person decides to form his Institution, he must comply with the Bank Companies Act 1991 and the Guidelines to establish a banking company in Bangladesh in the case of a bank, or the Financial Institution Act 1993 and the Financial Institution Regulation 1994 in the case of a non-banking financial institution.

In the Bangladeshi banking industry, dishonor of checks is a fairly regular issue. As per the Negotiable Instruments Act, a person or business must never pay another person with a bank cheque for an amount that exceeds the balance remaining in his bank account or there were insufficient funds in his bank account to cover the cheque.

Otherwise, he would be subject to imprisonment or a fine of up to three times the amount of the cheque, or both.

In accordance with the Money Laundering Prevention Act of 2012, the Bangladesh bank plays a crucial role in eradicating and preventing money laundering offenses by taking action against all illegal and suspicious unauthorised money transactions.

Bangladesh bank has the authority to suspend or freeze transactions of any account, to issue necessary directions from time to time to the reporting organizations for the prevention of money laundering, to monitor whether directions imposed on the reporting organizations have been complied with and, if necessary, to conduct on-site inspections to determine the same, to impose fines/suspend license of the reporting agency for failing to provide information in a timely fashion, etc.

Under the Money Laundering Prevention Act of 2012, the Bangladesh Financial Intelligence Unit is responsible for eradicating and curbing money laundering and terrorist financing activities in Bangladesh by assisting other law enforcement agencies and financial intelligence units of other countries with the exchange of information related to such activities.

Whenever there is a foreign transaction between parties, banking laws must be observed. According to the Foreign Exchange Regulation Act of 1947 (NBFI formation in Bangladesh), it is illegal for anyone other than an authorized dealer, a bank authorized by the Bangladesh Bank to deal in foreign exchange, to buy or borrow from, sell or lend to, or exchange foreign exchange with a person who is not an authorized dealer. (NBFI formation in Bangladesh)

Therefore, for NBFI formation in Bangladesh, it is imperative that the entities with foreign investors ensure that the initial investments are made through proper banking channels, i.e. at the time of company incorporation or purchasing shares of an existing company, the foreign investors should be remitting the share capital amount from their foreign bank account to the Company’s bank account in Bangladesh, along with a note stating “investment in the share capital of (Name of the Company)”.

This will demonstrate that the investment was made through the proper channels, and when remitting the profit, these initial investment paperwork and information will facilitate a smooth transfer in accordance with Bangladesh Bank regulations for NBFI formation in Bangladesh.

FAQ about MRA in Bangladesh:

Here’s a table of 10 frequently asked questions about the Micro-credit Regulatory Authority (MRA) and the requirements for establishing a Non-Banking Financial Institution (NBFI) in Bangladesh:

| Question | Answer |

|---|---|

| What is the Micro-credit Regulatory Authority (MRA)? | The MRA is the regulatory body responsible for overseeing the micro-credit and micro-finance sector in Bangladesh. The MRA was established under the Micro-credit Regulatory Authority Act, 2006 and is responsible for ensuring that the micro-credit and micro-finance institutions in Bangladesh operate in a fair, transparent and sustainable manner. |

| What are the requirements for establishing an NBFI in Bangladesh? | According to the Financial Institution Act 1993 and the Financial Institution Regulation 1994, entities interested in establishing an NBFI in Bangladesh must comply with the following requirements: 1. The minimum paid-up capital must be BDT 1 Billion. 2. The company must have a minimum of five directors. 3. The company must have a registered office in Bangladesh. 4. The company must appoint a CEO, who is a Bangladeshi citizen. 5. The company must submit an application to the MRA for approval. 6. The company must comply with the Bangladesh Bank regulations for NBFI formation in Bangladesh. |

| What is a Micro-credit organisation in Bangladesh under MRA act 2006? | Micro Credit Organisation means any micro credit organization, in whatever name it is called, certified to operate run micro credit program under this Act, (and) registered under — (a) The Societies Registration Act, 1860 (Act XXI of 1860); (b) The Trust Act, 1882 (Act II of 1882); (c) The Voluntary Social Welfare Agencies (Registration and Control) Ordinance, 1961 (Ord. No XL VI of 1961); (d) Samabaya Samity Ain (cooperative societies act) (Act no 47 of 2001); or (e) Company Ain (company act) (act 18 of 1994). “Micro Credit” means loan facilities offered by micro credit organization certified under this Act for poverty alleviation, employment generation and facilitate a small entrepreneur. Domination of the Act — Whatever is laid down in other laws valid for the present, the regulations of this Act shall be enforced. |

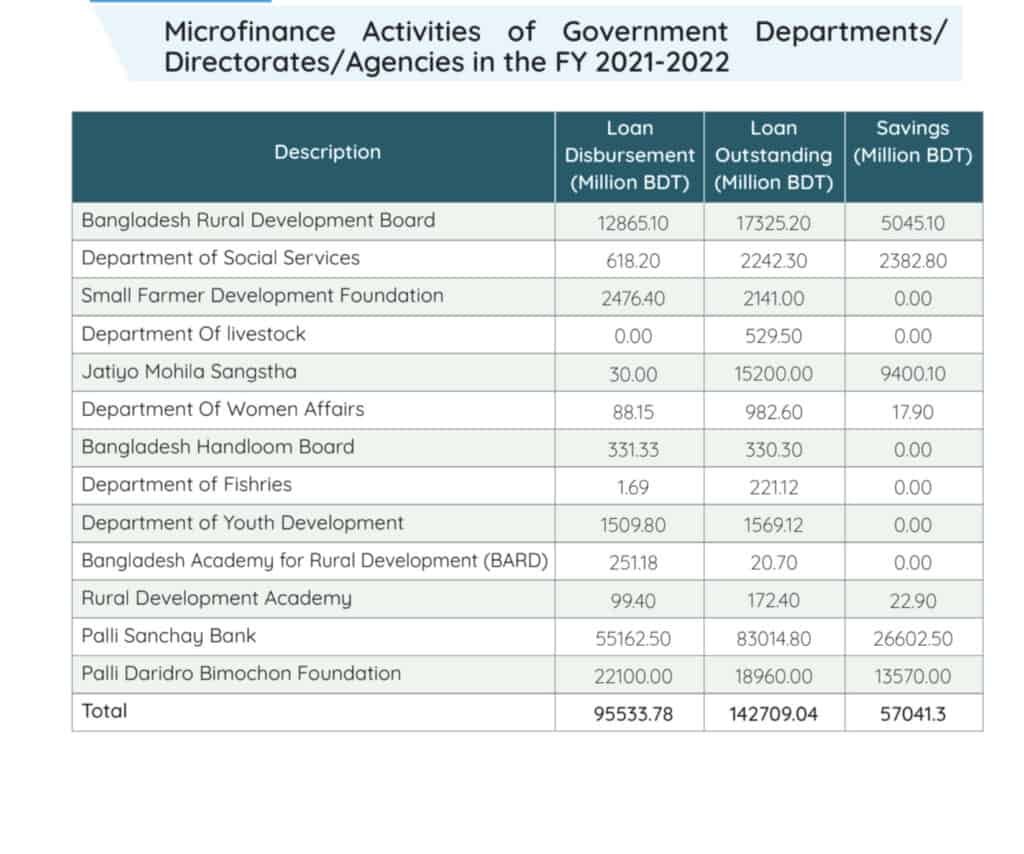

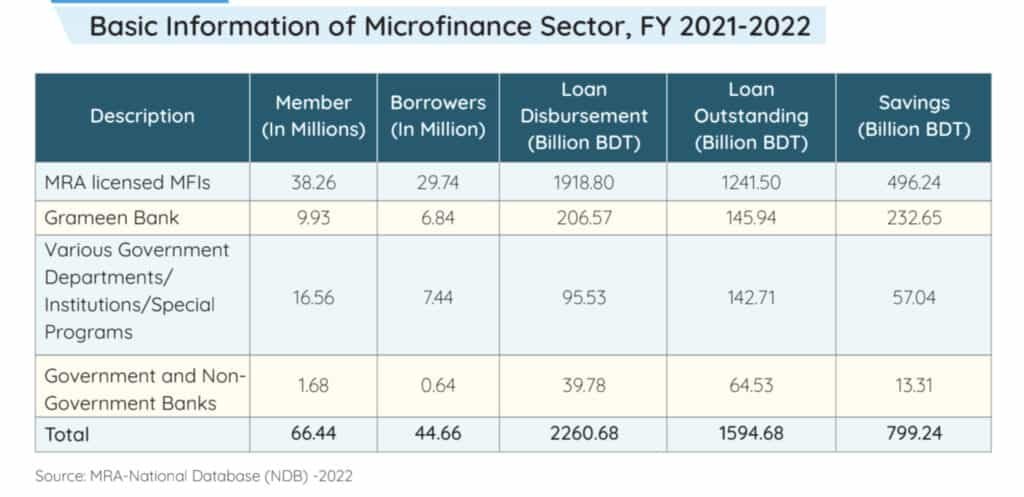

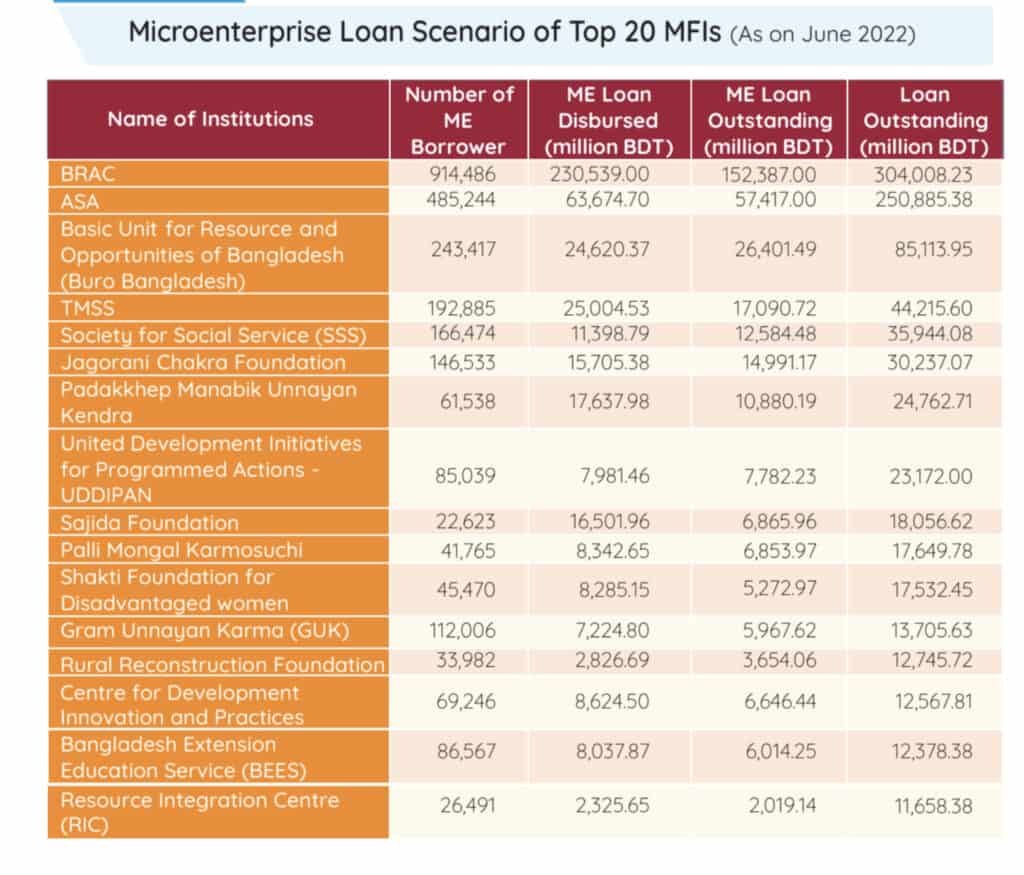

| How much MFI’s can can disburse micro-enterprise loans and what is the the mandatory liquidity reserve ? | In accordance with this, the Microcredit Regulatory Authority, Bangladesh’s regulatory body for the microfinance sector, recently rolled out its policy incentives for the microfinance sector by amending several rules of the existing Microcredit Regulatory Authority Rules, 2010. According to the amendments, the mandatory liquidity reserve of MRA-licensed MFIs has been reduced from 15% to 10%. MFIs can now disburse microenterprise loans up to 60% of their total business portfolio, up from 50% previously, and can draw 50% of their capital from term deposits and 40% from voluntary deposits. This policy change is expected to inject additional funds into the microfinance sector, thereby stimulating rural economic growth. In Bangladesh, the microfinance sector is comprised of MRA-licensed MFIs, various banks and non-bank financial institutions, Grameen Bank, and various government agencies under various ministries. Along with MRA-licensed MFIs, these organizations provide microcredit to help people get out of poverty. This microfinance sector has become a model of financial inclusion, with 66.447 million members and 44.66 million borrowers. The loan outstanding and loan disbursement of the microfinance sector in FY 2021-22 were BDT 1594.68 billion and BDT 2260.68 billion, respectively, with MRA licensed MFIs contributing 77.90% and 84.90%. |

| What is the role of Bangladesh Bank in NBFI formation? | Bangladesh Bank is the central bank of Bangladesh and plays a crucial role in the formation of NBFIs. Bangladesh Bank is responsible for ensuring that all NBFIs comply with the Bangladesh Bank regulations for NBFI formation and operate within the guidelines set out by the Financial Institution Act 1993 and the Financial Institution Regulation 1994. |

| What is the Negotiable Instruments Act in Bangladesh? | The Negotiable Instruments Act is a legislation in Bangladesh that governs the issuance and payment of negotiable instruments, such as cheques. According to this act, a person or business must never pay another person with a bank cheque for an amount that exceeds the balance remaining in his bank account or there were insufficient funds in his bank account to cover the cheque. |

| What is the Money Laundering Prevention Act of 2012? | The Money Laundering Prevention Act of 2012 is a legislation in Bangladesh aimed at preventing and combating money laundering and terrorist financing activities in Bangladesh. The Bangladesh Financial Intelligence Unit is responsible for implementing this act and ensuring that all financial institutions comply with its provisions. |

| What is the Foreign Exchange Regulation Act of 1947? | The Foreign Exchange Regulation Act of 1947 is a legislation in Bangladesh that regulates the foreign exchange transactions in Bangladesh. According to this act, it is illegal for anyone other than an authorized dealer, a bank authorized by the Bangladesh Bank to deal in foreign exchange, to buy or borrow from, sell or lend to, or exchange foreign exchange with a person who is not an authorized dealer. |

| What are the requirements for foreign investors to invest in NBFIs in Bangladesh? | Foreign investors interested in investing in NBFIs in Bangladesh must comply with the following requirements: 1. The initial investments must be made through proper banking channels. 2. The foreign investors must remit the share capital amount from their foreign bank account to the Company’s bank account in Bangladesh, along with a note stating “investment in the share capital of (Name of the Company)”. 3. The investment paperwork and information must demonstrate that the investment was made through proper channels. |

| How does the MRA regulate the micro-credit and micro-finance sector in Bangladesh? | The penalties for non-compliance with regulatory requirements by NBFIs in Bangladesh may include fines, suspension or revocation of license, and legal action. |

| Can NBFIs offer loans to microfinance or SME clients in Bangladesh? | Yes, NBFIs can offer loans to microfinance or SME clients in Bangladesh as long as they comply with the relevant laws and regulations. |

| How does the MRA ensure the sustainability of NBFIs in Bangladesh? | The MRA ensures the sustainability of NBFIs in Bangladesh by implementing measures to promote financial stability, encourage responsible lending practices, and ensure the soundness of the institutions. |

Are you planning to do NBFI formation in Bangladesh?

NBFI formation in Bangladesh with Tahmidur Rahman Remura: TRW: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman, The Law Firm in Bangladesh: TRW, The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and incorporating a NBFI formation in Bangladesh. For queries or legal assistance, please reach us at: