SPA agreement in Bangladesh

What is the meaning of a Sales and Purchase Agreement (SPA)?

A Sales and Purchase Agreement (SPA agreement in Bangladesh) is a legal contract between a property buyer and seller. This agreement is legally binding and clearly explains the terms and conditions of the transaction. A SPA’s purpose is to define the legal obligations and protect the rights of the transaction’s parties. Common SPA transactions include the sale of real estate, goods, stock, or other assets. SPAs are not used to sell services.

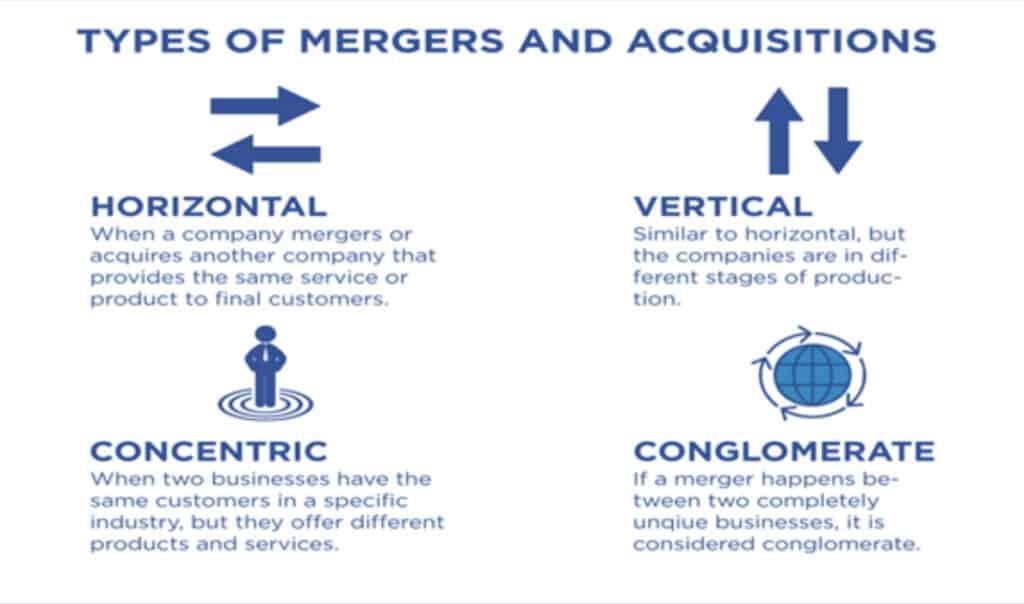

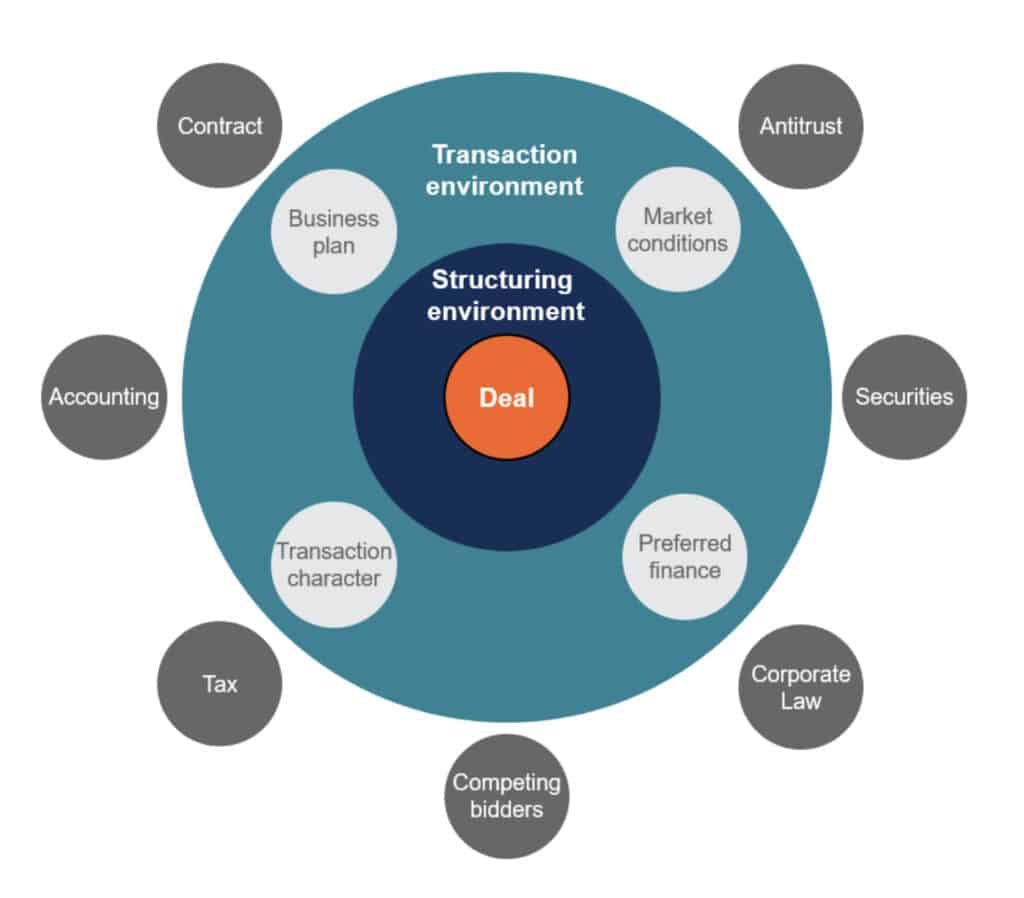

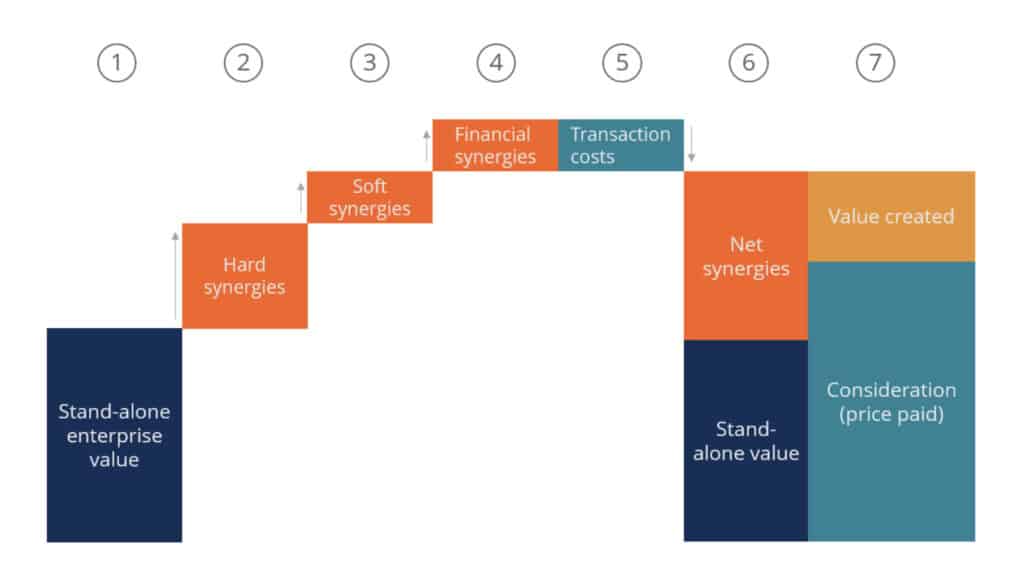

An SPA is typically entered into in mergers and acquisitions by the buyer and seller(s) of a target company’s stock, with the seller(s) agreeing to sell a specific number of shares to the buyer for a specified price. The provisions and mechanics of an SPA can be worth more than the headline price. A SPA with clear financial terms is critical in achieving these goals, whether selling a business to achieve a clean exit at a predictable price or acquiring a business with appropriate remedies in place should the target company’s financial position not be as represented.

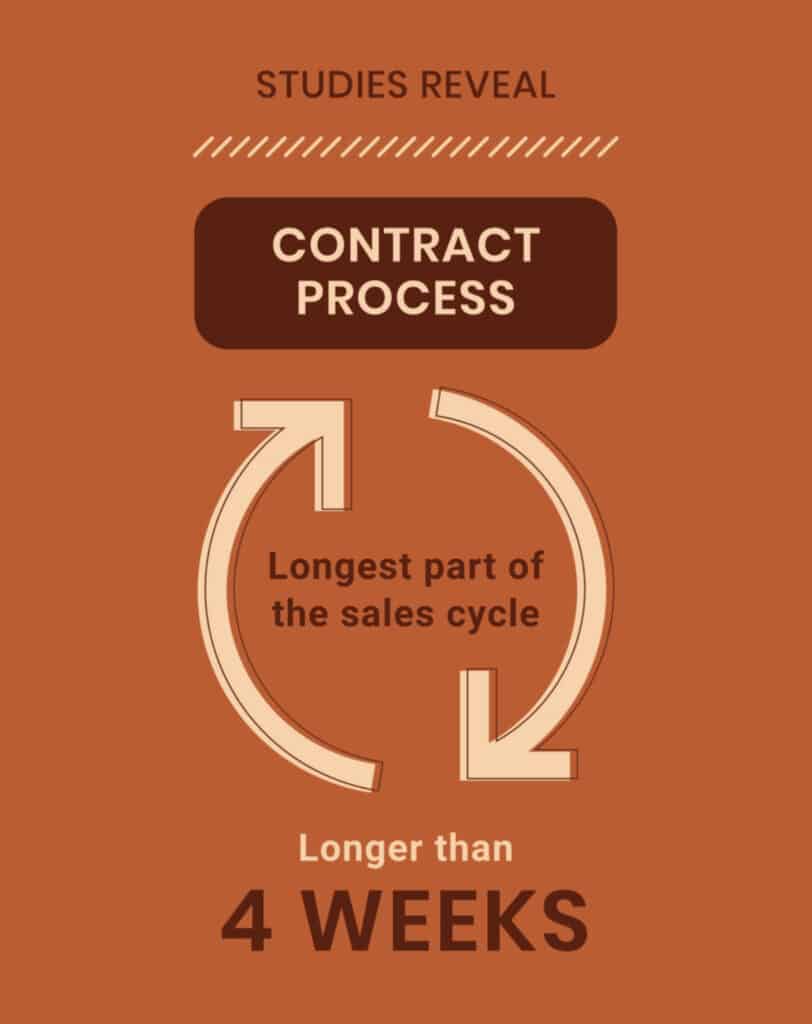

The SPA is negotiated throughout the transaction during the M&A process. After the buyer has completed due diligence to determine the true state of the company for sale, the final phase of the transaction is to draft the SPA and determine the company’s sale price.

Key Learning Points

- The SPA is the principal document that lays out the terms of a transaction and is negotiated by the buyer and seller.

- Clear and solid financial terms in the SPA are essential to closing a successful transaction.

- Prior to drafting the SPA, the parties usually negotiate and execute a term sheet, which addresses all the principal terms of the transaction, which can then be incorporated into the SPA.

- An M&A transaction is typically accompanied by extensive due diligence before the SPA is finalized.

- SPAs may also be affected by existing shareholders’ agreements between the shareholders of a target company

Key components of a SPA

In essence, the sale and purchase agreement clarifies the terms of the transaction so that both parties are on the same page. Typical contract terms include the purchase price, the closing date, the amount of earnest money the buyer must submit as a deposit, and a list of included and excluded items.

The purchase and sale agreement is one of the most significant documents in a business owner’s life. Due to this, it should be approached with caution and rigor, with legal professionals guiding both the seller and the buyer.

For example:

What should a purchase agreement include?

Common characteristics and terms of a Sale and Purchase Agreement (SPA).

1 The parties to the contract

In the simplest form of a sale, there are only two parties to the agreement: the seller and the buyer. However, additional parties may be involved if, for instance, the company being sold has multiple shareholders. To sell their shares, each of these shareholders will be required to sign the sale and purchase agreement.

2 Contract for sale and purchase

This provision is typically the shortest and simplest in the SPA. However, it is one of the most important, as it ensures that full legal ownership of the shares (also known as “title”) and all rights that attach to the shares are properly transferred (e.g., rights to dividends). Typically, this provision also states that the shares are unencumbered, reassuring the buyer that the seller has not pledged any of the shares to a bank or other lender.

Consideration No. 3

Buyers pay a seller for an acquired company in the form of cash, debt (such as a promissory note issued by the buyer), shares of the buyer, or a combination of these.

4 Restriction clauses

The purchaser will want to prevent the seller from launching a new, competitive business that will detract from the value of the company being sold. Therefore, the sale and purchase agreement will include restrictive covenants prohibiting the seller (for a specified time period and within specified geographic regions) from soliciting existing customers, suppliers, or employees, and from competing with the company being sold in general. These covenants must be reasonable in terms of geography, scope, and duration. Otherwise, they could be in violation of competition law.

5 Warranty and indemnity provisions

Warranties are factual assertions made by a seller in the SPA regarding the condition of the sold company. If a warranty later proves to be false and the company’s value decreases, the buyer may have a claim for breach of warranty. All aspects of the company, including its assets, accounts, material contracts, litigation, employees, property, insolvency, intellectual property, and debt, are covered by the warranties.

If more specific risks are identified during due diligence, they are likely to be covered by an appropriate indemnity in the sale and purchase agreement, in which the seller agrees to reimburse the buyer pound for pound for the indemnified liability.

(6) Precedent conditions

Simultaneous signing and closing (where the parties sign the SPA and close the sale on the same day) is the preferred and simplest method for concluding a transaction. Occasionally, however, there is a need for a delay between the signing and completion of a contract in order to satisfy certain final conditions. These are commonly known as “conditions precedent” and include tax authority clearances, merger approval by authorities, and third-party consent (for example, where a change of control provision exists in a material contract of the company being sold).

Unless the parties agree otherwise, the sale and purchase agreement terminates if all specified conditions are not met by a certain date (the “longstop date”), unless the parties agree otherwise. Therefore, it is crucial that the SPA specifies how to determine when the conditions precedent have been met and when they can no longer be met. Additionally, it should specify which party is responsible for fulfilling each condition precedent. The obligated party must use reasonable efforts to satisfy the relevant conditions precedent by the longstop date.

7) Finalization

Legal ownership of the shares is transferred to the buyer, resulting in the buyer’s ownership of the target company. Typically, a completion schedule in the SPA will include a list of all documents to be signed and other actions required to close the deal.

8) Post Completion

The sale and purchase agreement continues to be an important reference document following the closing, as it outlines the terms of any earn-out and includes restrictive covenants, confidentiality obligations, warranties, and indemnities, all of which may remain highly relevant.

Depending on the size of the transaction, a single SPA may contain a substantial amount of content. Here are a few instances of what you may encounter in an SPA.

What information does SPA agreement generally include:

The information outlined in a purchase contract can vary by state but it usually includes:

| Buyer and seller names | The names of all parties who have held or will hold title to the property. |

| Property information | The property address, square foots, and land plot information. |

| Price and financing information | The home’s final purchase price and the amount of the mortgage, if any, the buyer has taken out for the purchase. |

| Possession date | The possession date: when the buyer can take control of the property. |

| Closing date | The date the transaction is finalized, and the home officially changes hands. |

| Addition or Exclusion | Any fixtures that the seller intends to leave behind, such as a washer/dryer or range, as well as any large items/furniture that they are bringing with them. |

| Earnest money deposits | Sums indicating good faith the buyer has made, typically put into an escrow account. |

| Closing costs | Any closing costs required, as well as who pays them. |

| Contingencies | The conditions that must be satisfied before a transaction can be consummated. Home sale, home inspection, appraisal, and financing are examples of common contingencies. Often, contingencies include a specified time frame. For example, a customer may be required to obtain financing by a certain date. |

Asset Identification

A SPA describes the particular asset being sold. In the case of real property, the physical location is identified (i.e., by address and parcel number). This section is less robust for the sale of easily interchangeable duplicate goods.

Cost and Terms of Purchase

A SPA defined the transaction’s exchange rate. In addition, the agreement specifies what portion of the purchase price is due as a down payment and how that deposit will be made. This section of the contract specifies how the remaining balance (total purchase price minus deposit) will be paid.

Due Dilligence

For the sale of larger assets, the SPA typically contains a section requiring the purchaser to acknowledge their due diligence. Additional due diligence periods that correspond to additional deposits or upfront payments may be outlined in the PSA.

In addition to indemnification statements and the purchaser’s acknowledgment of the condition of the assets, this section likely contains both. In addition, the buyer typically affirms their right to terminate the contract under certain conditions. This section may also include clarification regarding which members of the purchaser’s team are authorized to speak on behalf of the company.

Covenants/Conditions Prior to Close

Generally, an SPA describes the next steps in a transaction. In order for the sale to be legally binding, these conditions must be met; failure to comply with these conditions constitutes a breach of contract. Under these conditions, the buyer may have the right to cancel the sale (if such rights are identified in the section prior).

Many of these covenants concern risk mitigation and asset protection. This section typically describes what a seller must do if unforeseen litigation threatens the transaction. In addition, it specifies what insurance requirements should cover the asset through the sale, what warranties will continue to exist, and confirms the asset’s exclusivity.

Damages/Remedies

In certain instances, it may be necessary to communicate what each party will do if the asset being sold is damaged prior to sale or during transit. This section frequently defines various degrees of damage, such as minor and major. The contract then specifies several remedies for each level of damage.

Other Chapters

If applicable, an SPA may contain additional sections. Title and survey information regarding a property is commonly included in real estate transactions. Existing tenants or the current state of the space may be referenced in particular restrictions and conditions.

A SPA typically specifies the applicable broker commissions. In addition to the dollar amount to be paid, an SPA specifies who is responsible for paying commissions and the process and timeline for issuing those payments.

For transactions requiring confidentiality, an SPA outlines the terms of the transaction. This includes the stipulations regarding public or press releases, the use of promotional materials referencing the sale, and the remedies in the event that one party breaches this provision of the contract.

If the sale is contingent on the completion of other transactions, the SPA will outline the consequences of a sale’s termination if the other deal falls through. Imagine a real estate developer attempting to purchase two adjacent properties with the intent of demolishing both to construct a single building. The developer may include language in one SPA that makes the transaction contingent on the execution of the second SPA.

Examples of Spas Available on the Market:

Real estate transactions are one of the most common occurrences of SPAs. As part of the negotiation process, both parties reach an agreement on the final sales price. In addition, other transaction-related details, such as a closing date or contingencies, are included.

Large, publicly traded companies use SPAs in their supply chains. A SPA may be utilized when acquiring a large quantity of materials from a supplier or when making a single large-scale purchase. A company may, for instance, enter into an SPA with a supplier to purchase a specified quantity of goods at a fixed price.

A SPA may also function as a contract for revolving purchases such as a monthly delivery of raw materials, inventory, or other tangible goods. Even if delivery is delayed or spread out over time, the purchase/selling price can be established in advance. SPAs are established to assist suppliers and buyers in forecasting demand and costs, and their importance increases as the size of the transaction grows.

In another instance, an SPA is frequently required during the acquisition of one business by another. Because the SPA specifies the exact nature of what is being bought and sold, the agreement may allow a business to sell its tangible assets to a buyer without selling the naming rights associated with the business.

Example of SPA:

Tahrem Investment Holding Limited (the purchaser) and 3DOM Inc (the seller) entered into an SPA for the purchase of the entire issued and paid-up share capital of 3DOM (Singapore) Spc. Ltd. (the target). Under the terms of the SPA, the buyer must acquire from the seller the entire issued and paid-up capital of the target.

Key Sales and Purchase Agreement (SPA) Terms:

The purchaser hired an independent, qualified appraiser to complete a report on the target’s value. The independent expert in valuation, the buyer, and the seller all agreed that the value of the target should be S$1,700,000,000.

Consideration:

The consideration was agreed upon on a willing-buyer and willing-seller basis, following substantive negotiations with the seller, and is based on a 20% discount to the actual valuation of the target as determined by an independent, qualified valuation expert.

The parties have agreed that the consideration will be paid in shares. The buyer shall issue and allot to the seller 1,813,333,333 new fully paid common shares (the shares) in its capital (the consideration shares) at a pre-consolidation issue price of S$0.75 per share.

Following the acquisition, the target organization will become a subsidiary of the acquirer.

The parties agreed that the buyer will be responsible for paying the transaction fees.

Conditions:

The proposed acquisition is contingent upon the satisfaction or waiver of customary conditions precedent for a transaction of this nature, including but not limited to:

- the consideration derived from the actual valuation being at least S$1.36 billion;

- the completion of financial, legal, operational, and any other due diligence on the target by the buyer, and the results of such due diligence being reasonably satisfactory to the buyer;

- the findings and methodology presented in the valuation report to be issued by the independent qualified valuer being satisfactory to the buyer;

- the entry into service agreements by the key management of the target, on mutually agreeable terms;

- the seller procuring the target shall obtain such approval(s) as may be required from the respective target’s board of directors and its shareholder(s) in connection with the SPA;

- the buyer obtaining such approval(s) as may be required from its directors and shareholders the proposed share issuance;

- the allotment and issuance of consideration shares at completion;

In Bangladesh, the merger and acquisition of companies is regulated by the Bangladesh Securities and Exchange Commission (BSEC) under the Securities and Exchange Ordinance, 1969 and the Securities and Exchange Commission Act, 1993. Additionally, the Bangladesh Competition Act, 2012 regulates the merger and acquisition activity to prevent the creation of monopolies or anti-competitive practices.

In accordance with these laws, any merger or acquisition of a public limited company in Bangladesh must be approved by the BSEC and the shareholders of the companies involved. The BSEC will review the proposed merger or acquisition to ensure that it is fair and in the best interests of the shareholders. Any proposed merger or acquisition that may result in a substantial lessening of competition must be notified to the Bangladesh Competition Commission for review.

Given this context, the following changes will be made to the SPA:

- The parties involved in the merger or acquisition agree to comply with all relevant laws and regulations in Bangladesh, including but not limited to the Securities and Exchange Ordinance, 1969, the Securities and Exchange Commission Act, 1993 and the Bangladesh Competition Act, 2012.

- The parties also agree to obtain all necessary approvals and clearance from the BSEC and the Bangladesh Competition Commission before closing the transaction.

- The proposed acquisition is conditional upon the fulfillment or waiver of customary conditions precedent for a transaction of this nature, including but not limited to the following:

- Obtaining the approval(s) required from the BSEC and the Bangladesh Competition Commission

- The seller procuring the target shall obtain such approval(s) required from the respective target‘s board of directors and its shareholder(s) in connection with the SPA;

- The buyer obtaining such approval(s) as may be required from its directors and shareholders and the proposed share issuance;

- The parties agree to include any additional terms or conditions as may be required by the laws and regulations of Bangladesh

It is important to note that the above is not a comprehensive list and that it’s highly recommended to seek legal and financial advice before finalizing any SPA, as laws and regulations are subject to change.

Here are the steps involved in a merger or acquisition (M&A) of a company in Bangladesh:

| Column 1 | Column 2 | Column 3 |

|---|---|---|

| Compliance with laws and regulations | The parties agree to comply with all relevant laws and regulations in Bangladesh, including but not limited to the Securities and Exchange Ordinance, 1969, the Securities and Exchange Commission Act, 1993 and the Bangladesh Competition Act, 2012. | Obtain legal advice to ensure compliance with all relevant laws and regulations. |

| Approvals and clearance | The parties agree to obtain all necessary approvals and clearance from the BSEC and the Bangladesh Competition Commission before closing the transaction. | Submit the necessary documents and applications to the BSEC and the Bangladesh Competition Commission for review and approval. |

| Due Diligence | The parties conduct a thorough due diligence exercise on the target company, including financial, legal, operational, and any other relevant aspects. | Hire a due diligence expert to assist with the process and review the results of the due diligence exercise. |

| Valuation | The parties appoint an independent qualified appraiser to complete a valuation report on the target company. | Review and negotiate the valuation report with the seller to arrive at a mutually agreed upon price. |

| Consideration and Payment | The parties agree on the terms of the consideration and payment, such as the price, payment method, and any contingencies. | Review and negotiate the terms of the consideration and payment with the seller. |

| Structure | The parties agree on the post-acquisition structure of the target company and any related companies. | Review and negotiate the post-acquisition structure with the seller. |

| Closing and Completion | The parties finalize all necessary documents, approvals, and conditions for the closing and completion of the transaction. | Ensure that all closing and completion requirements are met before finalizing the transaction. |

Are you planning to register a private limited company in Bangladesh?

Company formation and registration at Tahmidur Rahman Remura: The Law Firm in Bangladesh:

The legal team of Tahmidur Rahman, The Law Firm in BangladeshRemura: The Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering a Private Limited Company in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS