Regulations of Microcredit & Financial Institutions in Bangladesh

Tahmidur Rahman, Senior Associate

5 Aug 2019

What are the rules and Regulations of Microcredit & Financial Institutions in Bangladesh regarding incorporating and then managing a microcredit and microfinance institutions in Bangladesh? What are the regulatory compliances to maintain for an already established one? We explain everything in details in this post.

The concept of Microcredit and Microfinance

Before diving on to the rules and Regulations of Microcredit & Financial Institutions in Bangladesh, let’s recap the concept of microcredit and microfinance. Although the practice of lending small amounts of money for investment and consumption purposes has been popular in Bangladesh, modern structured, systemic, group-based and institutionalized micro-credit operations are Bangladeshi developments, pioneered by the Grameen Bank and replicated around the world with local modifications and adaptations. The system has experienced explosive growth here and elsewhere, and has given hope to millions of poor and lower middle class men & women and to generate income to get out of poverty. The Microfinance Management System has overcome the structural problems of targeting and providing financial services to millions of poor people.

The Societies Registration Act 1860, Companies Act 1994, Cooperative Societies Act 1984, Charitable and Religious Trust Act 1920 and Trust Act 1882 are the acts under which NGOs operating under microcredit programs may be registered. NGOs eligible to receive donations from different foreign sources must be registered with the NGO Office of International Contributions (Voluntary Activities) Regulation Ordinance 1978.

The MFIs was found to have transaction costs. Identifying and choosing target lenders and maintaining a high level of loan recovery are also expensive.

Before we deep dive into the details of Microcredit institutions in Bangladesh, if would like to know the rules for registration of a company in Bangladesh, visit the blog post below.

If you want to know how to open a company in Bangladesh or about company formation click here!

Microcredit in Bangladesh

The continued “double-dip” slowdown in the investment markets is impacting Bangladesh’s economies. In addition, recent over-indebtedness problems in several countries have shown that there is over-supply of micro-credit. In this context, Bangladesh’s microfinance sector has shown great resilience and continues to contribute to the improvement of macroeconomic development. Bangladesh has achieved a remarkable achievement in financial inclusion in Asia. Approximately 81% of its adult population, including both the formal and microfinance markets, has been put under financial inclusion under the guidance of Micro regulation authorities, i.e MRA and Bangladesh Bank.

According to a recent World Bank survey, Bangladesh is second amongst the Asian countries to Sri Lanka in terms of financial inclusion indicators. The report shows that 40% of Bangladesh adult’s accounts are in formal financial institutions, which is 35% in India and 10% in Pakistan. MFIs in Bangladesh are already working with remittance channeling banks and mobile money transfer software. Bangladesh has also made good progress in terms of consumer rights and empowerment. The total savings has also increased by 23.25 percent to BDT 63.3 billion in June 2011 compared to previous year from 26.1 million clients, over 93 percent of them are women.

Regulations of Microcredit & Financial Institutions in Bangladesh

The Microcredit Regulatory Authority (MRA) was founded by the Government of the People’s Republic of Bangladesh under the Microcredit Regulatory Authority Act 2006 to promote and promote sustainable development of the microfinance sector by establishing an enabling environment for NGO-MFIs in Bangladesh. As the regulatory organ, MRA determines the rules and regulations of Microcredit & Financial Institutions in Bangladesh, i.e the NGO-MFIs. The Authority’s license is required to carry out microfinance operations in Bangladesh. MRA provides statistical information on the microfinance market on a regular basis. The NGO-MFIs provide operating data on the specified format twice a year and financial information on a yearly basis. The Government passed the Microcredit Regulatory Authority Act 2006 in July 2006 on the basis of suggestions made by the Committee. Under this Act, the Government established a separate Microcredit Regulatory Authority (MRA) and appointed its Board of Directors, chaired by the Governor of the Bank of Bangladesh. Under this new law, all operating MFIs will have to apply for a license from the Authority. No MFIs will be allowed to operate within the country without a license from the Authority. According to the legislation, all organizations that have a microcredit operation must separate their financial operations from other development works and keep their accounts separate.

The top three MFIs contribute 54% of the total outstanding loans as well as deposits of the microfinance sector in Bangladesh. Two of the largest MFIs, BRAC & ASA, each represent more than five million lenders. There are a few more of them evolving quickly. On the other hand, the smallest 428 NGO-MFIs contributed just 4 per cent of the total outstanding loan and 5 per cent of the total savings. The corporate dominance ratio is highly skewed in favor of large MFIs: only 22 companies hold 76% of the market share, while the three largest entities manage more than 50% of both the clients and the total financial portfolios.

On the other hand, Grameen Bank offers credit without collateral for a wide range of revenue generation and asset building activities. It also provides its members with housing loans. During the 2009-10 fiscal year, its cumulative microcredit disbursement amounted to Tk 91.9 billion, which was more than 28 per cent of the previous year. The number of its borrower members rose to 90,000, and 95% of them were women. It operates in over 45.000 villages. Several major micro-credit initiatives in Bangladesh that implement Grameen’s group-based approach include Brac, an NGO with more than 1 million members, and the Bangladesh Rural Development Board (BRDB), a government agency offering micro-credit to some 500,000 members.

Legal Requirements to be an NGO-MFI in Dhaka, Bangladesh

|

License Issuing Procedure of MFI-NGO’s in Bangladesh

(1) In order to obtain a license, a person shall apply to the Authority in the prescribed form set out in the given form by MRA.

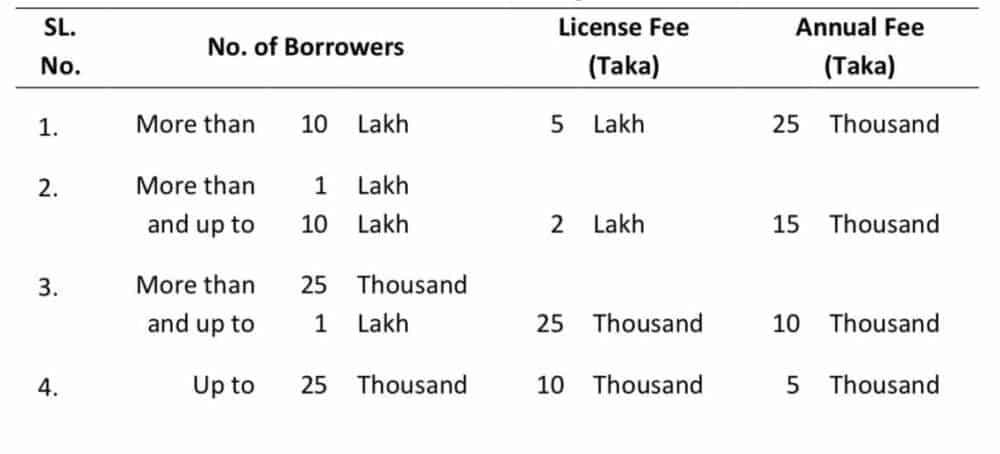

(2) Upon receipt of the request in the following form, the Authority shall evaluate the information provided with the request and, upon satisfaction, request the payment of the required license fee. (Follow the figure below).

(3) The Authority shall issue the license in the form set out in Annex B within 10 (ten) days of receipt by the applicant of the license fee referred to in sub-clause (2).

(4) If the application is denied, the Authority shall inform the applicant in writing within 30 (thirty) days of the rejection.

License Issuing Procedure of MFI-NGO’s in Bangladesh

(a) The licensed entity shall abide by the law and all provisions of this Microcredit Authority Provisions 2010;

(b) the licensed organization shall not be able to operate its Microcredit Activities outside the area of operation approved by the Registration Authority;

(c) the full address of the Head Office and the Branch Offices of the company shall be notified to the Authority;

(d) any alteration in the area of operation permitted by the Registration Authority;

(e) any change of address of the Head Office shall be notified to the Authority in advance;

(f) changes to the address of the Head Office or Branch Office shall be notified to the Customers and to all other relevant parties;

(g) the licensed organization shall pay the annual fees mentioned in the table beforehand;

(h)The licensed organization must provide all information as required by the Authority and extend all co-operation in carrying out any inspection and investigation by the Authority.

“TRW is Considered as one of the leading firms in Investment Law in Dhaka, Bangladesh”

Models of Lending in Bangladesh

1. Grameen Bank Style Microfinance

For all practical purposes, existing regulations of Microcredit & Financial Institutions in Bangladeshis is regulated by working out the presented by the Grameen Bank’s simple group-based approach. The basic structure is as follows: poor women and men are grouped into classes or groups that meet once a week to deposit a small amount of savings to build up their own resources. The Bank or MFIs lends a one-year loan (some MFIs repay loans within 43-46 weeks) which the lender repays in equal weekly instalments along with interest. Once the lender repays one loan, it is entitled to obtain another loan normally of a higher amount within the total loan limit, which, of course, is adjusted upwards over time.

The methodology was found to be so reliable and efficient that almost the entire industry adopted this method with minor adjustments to savings / credit policies such as savings and loan interest, savings withdrawal rules, etc. Today, almost 33 million women and men are working on this basic system every week. With time, however, both the Bank and other MFIs have modified their processes to deliver more than one form of savings and credit products, as the complexity of demand has changed and MFIs have also learned to deal with more complex situations.

2: Self Help group system

A handful of non-governmental organizations have attempted and are still pursuing the so-called self-help group approach to creating a financial service delivery system. In this case, the organizer or NGO organizes self-help groups with the goal of promoting the mobilization of savings among disadvantaged women and men. If the participating members need a loan, they can borrow from their samity, i.e. their own savings funds. If the funds are not sufficient, the self-help Samities may seek to borrow additional capital from banks or the NGO. The second option was tried in Bangladesh, but the first alternative was not possible.

3: Individual Lending System

As the Regulations of Microcredit & Financial Institutions in Bangladesh are maintained by both the MRA and the Bangladsh Bank, the central issue in designing an individual system as opposed to a group-based system is to deliver flexible and demand-driven services to each client / borrower. The group-based system is seen as a’ one-size fits all’ system. The individual loan strategy, i.e. providing savings and credit services to each customer on the basis of the particular client’s request. Flexibility may occur in the form of the amount and frequency of the deposit of savings, the amount of the loan and the length of the loan, the repayment of the amount of the loan and the frequency of installments (no fixed schedule is considered flexible) etc.

Nevertheless, lending to individuals does not necessarily make it entirely’ flexible.’ For example, ASA and BRAC disburse loans to individual clients under their respective microenterprise loan programs but offer a fixed one-year loan and a fixed monthly repayment plan.

4.Fin-tech money lenders

Although currently there’s no money lending MFI which is solely operating on FinTech-enabled payment processing and modelled their micro finance institutions according to that modern app based payment skeleton structure presented in other countries all around Asia, like Moneytap or koinworks. Implementing a credit based money lending through apps in bangladesh will play a huge role in modern era of lending credits. This will also reduce the amount of cash needed for printing and distributing currency notes. In addition, it will help mitigate the risks of counterfeit currencies circulating in the country. Reduced cash requirements would help the central bank reduce costs and manage risks.

Currently in Bangladesh, specialized financial institutions for processing transactions are generally referred to as payment banks. Payments banks are especially useful for people who do not have a bank account but engage in payment activities. FinTech allows these banks to keep their operating costs to a minimum. Payments banks are exploiting mobile telecommunications infrastructure and their large subscriber base to remove the barriers to entry. They compete with cash transactions to provide their customers with a simpler, faster and cheaper alternative. FinTech will help to achieve all of this for payment banks. With the right kind of guidance from regulators, the payment sector in Bangladesh could grow rapidly.

5.Informal money lenders

Informal money lenders are another typical source of micro-loans that follows’ individual loans.’ No up-to-date information and research on their activities is available. Nevertheless, it is assumed, on the basis of anecdotal evidence and small studies, that rural poor are no longer dependent on money lenders for small loans due to the proliferation of MFIs. We have the potential to borrow from one or more MFIs for investment or, in some cases, for consumption purposes. Nevertheless, due to the lack of a large-scale agricultural loan from MFIs, money lenders can still be found borrowing for emergency loans to the poor and also for agricultural loans.

“Implementing a credit based money lending through apps in bangladesh will play a huge role in modern era of lending credits.”

Can fintech loan apps can mushroom in bd

The four key elements of the Digital Bangladesh Vision Government are the creation of human resources, the participation of women, civil services and, finally, the use of technology in businesses. Since the use of technology in industry is one of the key elements of “Virtual Bangladesh Vision,” MFS has made the most significant improvement over the years. However, only 47% of the population is still financed. Meaning that only 47% of the population has access to useful and affordable financial products and services that meet their needs–transactions, payments, savings, credit and insurance–delivered in a responsible and sustainable manner.

Fintech & Microcredit in Bangladesh

MFS still in its infancy has many downsides, for example: interoperability, limited service and withdrawal restriction among others. On the other hand, MFIs are currently facing competition from the finance and agent banking sectors. MFIs lack a comprehensive IT infrastructure that limits their ability to provide a variety of products and services to the financially excluded remote parts market. On the other hand, if we take a look at agent banking, we’ll see how both the collection of deposits and the disbursement of loans have grown. As of September 2018, the loan disbursement through the agent banking network amounted to BDT 150 crore, up 9.8% from a quarter earlier that year.

At the same time, the collection of deposits increased 28 per cent to BDT 2,577 crore, according to data from the central bank. As MFS and agent banking are more like an extension of traditional banks or in association with banks and mobile phone operators, they can easily remove customers from MFIs.

In fact, despite infancy in some cases, these MFS now even deliver savings to consumers, and they also have technical support. Nevertheless, social inclusion is not their main objective.

MFIs can use FinTech’s ability to address poverty in a pro-poor way by actively leveraging their large customer database.

Given all the benefits, the complete digitization of the microfinance sector will be strenuous as a number of challenges emerge.

First of all, the costs of developing virtual field applications are very high for MFIs. In a report published by UNCDF, one of the senior managers of a large MFI developed in Bangladesh suggested that hardware costs, for example: smartphone, tablets, would be too high for them.

One of the most difficult challenges for MFIs is to win customer trust. As most MFI clients are peasants, they lack financial and technical literacy. In fact, the TMSS Senior Manager stated that, if they ask their customers to apply for a loan.

Subscribe to our Awesome Newsletter.

Can I Expedite My Marriage Green Card?

Can I Expedite My Marriage Green Card? TRW Law Firm | U.S. Immigration Advisory Understanding How to Expedite a Marriage-Based Green Card Application in 2025 Waiting for your marriage-based green card can be one of the most stressful stages of the U.S. immigration...

Adjustment of Status vs. Consular Processing: Which Path Is Right for Your Green Card?

Adjustment of Status vs. Consular Processing: Which Path Is Right for Your Green Card? By TRW Law Firm | U.S. Immigration Practice | Updated March 2025 When applying for a U.S. marriage-based green card, your choice between Adjustment of Status...

AB 540 Affidavit Guide 2025 – TRW Law Firm

AB 540 Affidavit Guide 2025 – TRW Law Firm Expert Legal Assistance for Tuition Relief and Residency Documentation in California 🔍 What is the AB 540 Affidavit? AB 540 Affidavit Guide 2025 – TRW Law Firm The AB 540 Affidavit is a California state declaration...

B-1/B-2 Visitor Visa Guide 2025 – TRW Law Firm

B-1/B-2 Visitor Visa Guide 2025 – TRW Law Firm Expert Guidance for U.S. Travel, Business, and Tourism Visas from Bangladesh and Beyond 🌎 What is a B-1 / B-2 Visa? The B-1/B-2 visa is a non-immigrant visa that allows foreign nationals, including Bangladeshi...

CR1 and IR1 Spouse Visas, Explained — A TRW Law Firm Guide to U.S. Spousal Immigration (2025 Edition)

CR1 and IR1 Spouse Visas, Explained — A TRW Law Firm Guide to U.S. Spousal Immigration (2025 Edition) What Are CR1 and IR1 Spousal Visas? A CR1 or IR1 spouse visa is a type of U.S. immigrant visa that allows a foreign spouse of a U.S. citizen (or, in some...

K-1 Fiancé Visa Guide 2025 – By TRW Law Firm

K-1 Fiancé Visa Guide 2025 – By TRW Law Firm Expert Legal Guidance for Marriage-Based U.S. Immigration from Bangladesh and Beyond 🔍 What is a K-1 Visa? The K-1 visa, also known as the fiancé(e) visa, allows the foreign fiancé of a U.S. citizen to travel to...