No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Tahmidur Rahman, Senior Associate

28 Oct 2019

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

Women Rights against Sexual Violence in Bangladesh:

Are you being sexually abused and would like to know about your rights in Bangladesh and take legal actions against the perprator? Or are you wrongfully accused of an offence of sexual violence? This post in details will deal with the legal provisions and remedies of women’s rights against sexual violence and the process of taking legal action based on those discrete situations.

In our country (i.e in Bangladesh), there are different laws to deal with women’s oppression, most of which are described in Nari-O-Shishu Nirjaton Daman Ain 2000. This “Act” comprises 34 parts of a strict nature and is considered one of the most important laws dealing with violence against women and children despite having “Penal Code” and “CRPC” in our judiciary. It deals with crimes related to the trafficking and abduction of children and women on women and children, rape, rape and dowry-related death, sexual harassment, etc.

Domestic abuse as an incident or pattern of controlling, coercive, threatening, degrading and violent behaviour, including sexual violence, by a partner or ex-partner in the majority of cases, but also by a family member or career. It is faced by women in the vast majority of cases and committed by men. A non-partner (not including sexual harassment) is estimated to have experienced either physical or sexual intimate partner violence or sexual violence at some point in their lives by 35 percent of women worldwide.

Before we dive into the punishment regarding the crimes and how you can avail the necessary support lets see the Flowcharts which will help to classify the crime and its degree henceforth.

Here in the first part (Section 01-08) of the infographics of the act, which prominently deals with abduction, kidnap predominantly.

This part of the flowchart specifically deals with the Rape in Bangladesh by a sexual offender hence all subsections of the section are included below.

In regards to Women Rights against Sexual Violence in Bangladesh, Nari O Shishu Nirjaton Daman Ain is quite stern and includes extreme punishments of land. Section 19(1), as its counterpart section 4(f) of the CRPC, clearly makes all crimes under this act “cognizable.” A “Cognizable Offence” may be charged without a warrant by the police. Nevertheless, the most striking part of this Act is Section 19(2), which made all crimes pursuant to this Act non-bailable. This definitely limits other insincere attorneys who want to keep an offender out of court instead of keeping him behind the bar. Another landmark when it comes to research.

Domestic abuse as an incident or pattern of controlling, coercive, threatening, degrading and violent behaviour, including sexual violence, by a partner or ex-partner in the majority of cases, but also by a family member or career. It is faced by women in the vast majority of cases and committed by men. A non-partner (not including sexual harassment) is estimated to have experienced either physical or sexual intimate partner violence or sexual violence at some point in their lives by 35 percent of women worldwide.

The investigation is to be completed within fifteen working days from the date of the arrest pursuant to Section 18(1)(a). Additionally, Section 18(1)(b) provides for the completion of the inquiry within sixty working days where the perpetrator is not found but the time limit may be extended subject to the fulfilment of the conditions contained in the following sections. This requires an appointed body (Police) to pass the order of the investigation within a specified period of time for the end of justice.

For throwing or attempting to throw any substance burner, caustic or poisonous over a child or a woman, the offender shall be punished, with rigorous imprisonment of either description which may extend to seven years but not less than three years and also with fine not exceeding fifty thousand bdt.

“TR Barristers in Bangladesh is Considered as one of the leading firms in Family and Child Law in Dhaka, Bangladesh”

Carpe Noctem Bangladesh

OFFENCE COMMITTED BY CORROSIVE OR ANY OTHER SUBSTANCES (Punishment):

The offender shall be punished with life imprisonment and fine for rape with a woman or child. If the woman or child so raped died later as a result of rape or any act by him, the rapist shall be punished with death or lifelong transportation and also with a fine not exceeding one lakh bdt.

According to a criminal defense attorney, if more than one man rape a woman or a child and that woman or child dies or is injured in consequences of that rape, each of the gang shall be punished with death or rigorous imprisonment for life and also with fine not exceeding one lac taka.

A woman or child being assaulted must be subjected to medical tests as soon as the crime is committed. If the medical examination is not carried out immediately, the Court may order the doctor’s appointing authority to take action against him for neglect of duty.

If the Tribunal finds that there is a need for any woman or child to be held in safe custody at any point of an offence trial, the Tribunal may order that the woman or child be kept out of prison and under a Govt’s custody. Govt-determined authority. To that end, or under the custody of a person or organization that the tribunal considers appropriate.

The aggrieved party by the order, judgment or punishment imposed by the Tribunal, can appeal to the High Court Division within the period of sixty days against such order, judgment or punishment.

Serious crimes, including Nari-O-Shishu Nirjaton Daman Ain offenses, in practice. But in such situations, without unnecessary delay, the arrested person must be handed over to the police.

The inquiry guidelines are included in the S. 18 Of the law. Based on S. 18(1)(a) The investigation into the offenses must be completed within fifteen working days of the date on which the accused was arrested or handed over to the police while the accused was caught in red handed over at the time the crime was commissioned.

Otherwise, S. 18(1)(b) calls for the investigation to be concluded within sixty working days where the accused is not caught in red handed over but as a result of the request by the approved officer or the Tribunal of the First Information Report (FIR) or as a result of the investigation. The time limit may be extended if the conditions specified in the following sections are fulfilled. Therefore, it appears from the aforementioned provisions that investigating any allegation regarding Nari Nirjaton does not depend on the accused person being arrested. Law requires that each case be investigated and submitted to the Court followed by the Police Report.

Legal Support regarding Nari o shishu nirjatan daman ain by TR Barristers in Bangladesh

If the other party participates in unfair practices, this could be reversed by an appeal to a negative judgment. TR Barristers in Bangladesh provides the client with the most promising advice to try the best result in that situation. Whether you need assistance in deciding your dispute is a suitable applicant for Nari o shishu nirjatan daman ain or you need counsel to ensure that your legal rights are protected while you are engaged in cases involving Nari o shishu nirjatan daman ain, The Barristers, Advocates, and lawyers at TR Barristers in Bangladesh, Dhaka, Bangladesh law firm, are highly experienced in dealing with them.

For Legal Support regarding Nari o shishu nirjatan daman ain by TR Barristers in Bangladesh:

Want new articles before they get published?

Subscribe to our Awesome Newsletter.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

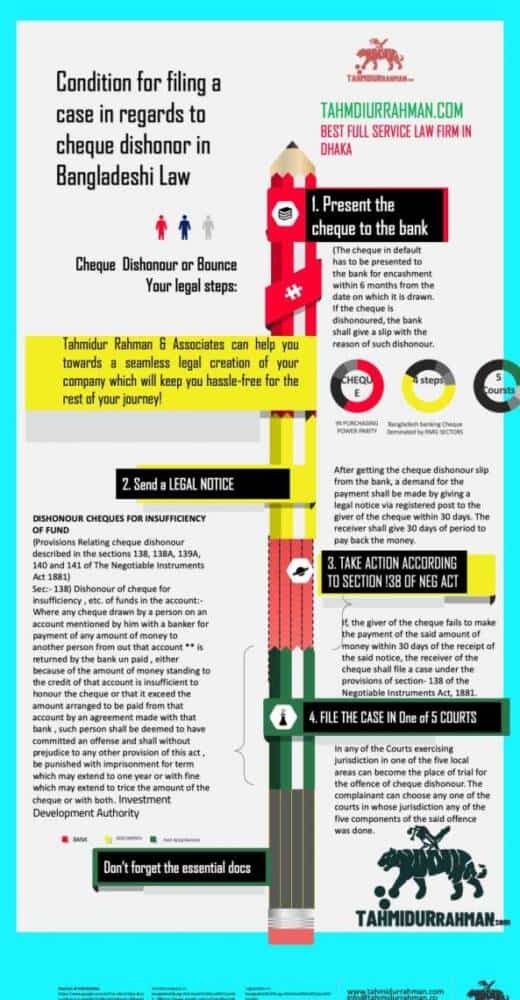

What to do When Cheque Dishonour or Bounce in Bangladesh? How can you take legal actions to retrieve your money? This post provides COMPLETE OVERVIEW OF HOW TO DEAL WITH CHEQUE DISHONOURING IN BANGLADESH.

Currently, even a business organisation in Bangladesh like MANY OTHER COUNTRIES, without maintaining a bank account, can not operate its daily activities. Despite the massive development in the recent past in BANGLADESH OF ALTERNATIVE delivery channels such as Internet Banking, BEFTN (Bangladesh Electronic Funds Transfer Network), RTGS (Real Time Gross Settlement) and many other aspects of digital banking, people are still comfortable enough to use checks for personal and business transactions. In the case of large-scale TRANSACTIONS, the use of checks is obviously the best way in our country because of security issues.

The possibility of a check being dishonoured is significantly high due to the high number of transactions through this mode. The receiver of checks must therefore have sufficient and effective legal redress, which they can consider when faced with this situation. Recently, in a case of dishonouring the test, a well-known film actor has been accused and filing these cases is almost regular occurrences with different courts across our country. People deliberately issue checks without making funds available in their bank accounts due to a lack of integrity and ethical practice. It may only seem to be a misdemeanour, it is, in fact, a serious crime.

1. The most vital LAW ENACTED TO PROVIDE LEGAL REMEDY TO SUCH A SITUATION IS THE NEGOTIABLE INSTRUMENTS ACT, 1881 (Act No. XXVI of 1881). Section 6 of this Act established what constitutes a cheque, stating that’ a bill of exchange drawn on a stated banker and not presented as payable other than on order.’ In addition, in the case of laws, a check was also known as an order on a borrower by a lender to pay the whole or part of a debt to another person.

2. If a check is not cleared because of insufficient funds or if the debtor who issued the check to the lender ordered his bank to dishonor the check or for any other reason, then the remedy will be under Section 138 of the above Act.

3. Section 138 of the Negotiable Instrument Act, 1881 makes it clear that, whenever a check is bounced, it is then accepted as correct until it is otherwise proved that an unscriptural guilt is created which involves punishment of a criminal nature which may include 01 (one) year of captivity or fine, which may extend to three times the value of the dishonoured check or both. In addition, the person who is regrettable also has a civil remedy under the same section, and in order to obtain the civil remedy, the person has to take some steps.

4. The first issue to be assessed by the court is whether the check has been presented to the bank for withdrawal within six months of the person being dismissed. If the check has been presented to the bank for withdrawal any time after it has been given to the regrettable person for six months, then the court will not allow the claim. Considering that the check has been submitted within a valid period of time and if it is dishonored, then pursuant to Section 138 of the Negotiable Instrument Act, 1881, the unfortunate person must send a written notice by registered post with acknowledgement due to the person who gave the check claiming the money back.

6. It should be remembered that the crime of dishonor of the search referred to in section 138 of the Act is considered a criminal offence. The legislation was aimed at punishing and not obtaining a due sum. Nevertheless, the section retains the possibility of restitution as the owner of the check can be paid by the court an amount of any fine recovered up to the check value. If someone wants to recover cash that has not been discovered then he or she will file a civil SUIT FOR MONEY recovery. In reality, however, it was found that filing a criminal proceeding under s.138 was the most effective way to recover money.

The recipient of the check may file a case against the applicant under the following conditions:

The default check must be submitted to the bank for encashment within 6 months from the date it is drawn. If the check is dishonored, due to such dishonour, the bank shall give a slip.

Upon obtaining a check dishonor slip from the bank, the payment application shall be made by notifying the giver of the check within 30 days by registered post. The recipient will give the money back for 30 days.

Unless, within 30 days of receiving the notice, the giver of the check fails to make the payment of the said amount of money, the receiver of the check shall file a case under section 138 of the Negotiable Instruments Act, 1881.

The recipient of the check may file a case against the applicant under the following conditions:

When the owner presents the check for encashment to a bank, he will bring in court the claim for check dishonor that has local jurisdiction over that bank.

The offense of check dishonor can be completed with the emphasis on certain specifics:

i) drawing of the check,

ii) presenting the check,

ii) returning the check unpaid by the drawee bank,

iv) giving written notice to the drawer of the check demanding payment of the check sum,

v) failure of the drawer to make payment within 30 days of receipt of the notice.s of receiving the notice, the giver of the check fails to make the payment of the said amount of money, the receiver of the check shall file a case under section 138 of the Negotiable Instruments Act, 1881.

Now, if the above five different acts were carried out in five different locations, one of the courts exercising jurisdiction in one of the five local areas could become the place of trial for the offense of cheque dishonour. The plaintiff may select any of the courts in whose jurisdiction any of the five components of the said offense have been made.

CLICK HERE TO MAIL US IF YOU HAVE ANY LEGAL QUERIES REGARDING THIS

OR CALL US ON : +8801847220062 OR +8801779127165

“Tahmidur Rahman|The Legal Source is Considered as one of the leading firms in Banking Law in Bangladesh”

Telegraph Bangladesh

The offender who commits the dishonor of the cheque shall be punished with imprisonment for a term of up to one year or with a fine of up to three times the value of the cheque or both.

Skyscrapers in Bangladesh

FAQ

Dishonoured checks are ones that the bank on which they are drawn declines to honor (pay). Non-sufficient funds (NSF), which denotes that there are not enough cleared funds in the account on which the check was drawn, is the most frequent cause for a bank to refuse to honor a check. [1] A bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check are all terms that might be used to describe an NSF check. Such checks are often returned with the endorsement “Refer to drawer,” instructing the recipient to get in touch with the check’s issuer for a justification of why it wasn’t cashed.

The sole difference between a cheque bounce and a cheque dishonour is that a cheque dishonour happened because of a distinguishing signature, an incorrect date, etc. However, the reason the check bounced was because there weren’t enough funds in the drawer’s account.

Yes, even if the check was previously dishonored, you may still bring it to the bank for payment. It should go without saying that the check can only be presented in the bank once while it is still valid. The typical check’s validity term is three months.

Any major bank may refuse to honor a check if there aren’t enough cleared funds in the account to cover it. Additional justifications for not honoring a check include:

A violation of Section 138 constitutes a non-cognizable offense. Additionally, it is an offense that is subject to bail. Section 138 violation will consist of the following elements: Drawing a check by the drawer to pay off a debt or other obligation

A violation of Section 138 constitutes a non-cognizable criminal offense. Additionally, it is an offense that is subject to bail. Section 138 violation will consist of the following elements: Drawing a check by the drawer to pay off a debt or other obligations.

A complainant and/or the person holding the check in good faith are obligated under Section 138(b) of the Act to notify the accused within 30 days of receiving notification from the bank that the check or other instrument has been dishonored.

Tahmidur Rahman, Senior Associate

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

What are the process of Tax Submission in Bangladesh ( Personal Income Tax, Corporate Income Tax, Custom Duties etc.) and what are the rules and regulations that relate to specific custom duties, supplementary duties, regulatory duties and their relationships with HS code and brand valuation and how to deal effectively with the issue? This post in details will provide a complete overview of Tax Submission in Bangladesh and will hopefully answer to your quries in regards to Tax Law in Bangladesh.

In Bangladesh, the history of income tax submission dates back to 1860 when British rulers introduced it in this country under the title of the Income Tax Act, 1860. Many changes have occurred since then. Recently, taxation facilities have become one of the Bangladeshi business organization’s important and complex compliance issues. Tax levy and taxes were updated by the promulgation of the Finance Act almost every year. Tax facilities in Bangladesh are usually regulated by the 1984 Income Tax Ordinance.In Bangladesh, legal aid related to VAT, tax and customs is high in demand. Because of its complexity, particularly for businesses, new investors and entrepreneurs understanding the various formalities involving taxation is a big challenge.

With income tax in particular, different statutory requirements for e.g. income advance tax, source tax deduction, tax exemptions, tax rebate, procedures for filing annual tax returns along with their assessments, etc., and their correlation, which can be found difficult without proper knowledge. Here one by one, we will explain the procedures and regulations in regards to Tax Submission in regards to Bangladeshi Law.

One has to pay his or her income tax at the end of each fiscal year, and a number of Bangladesh taxpayers are doing the job quite successfully.But there are also many clashes with filing their tax returns because they have little or no idea of the process.Things seem to be rather difficult, particularly for the first time people who pay taxes.

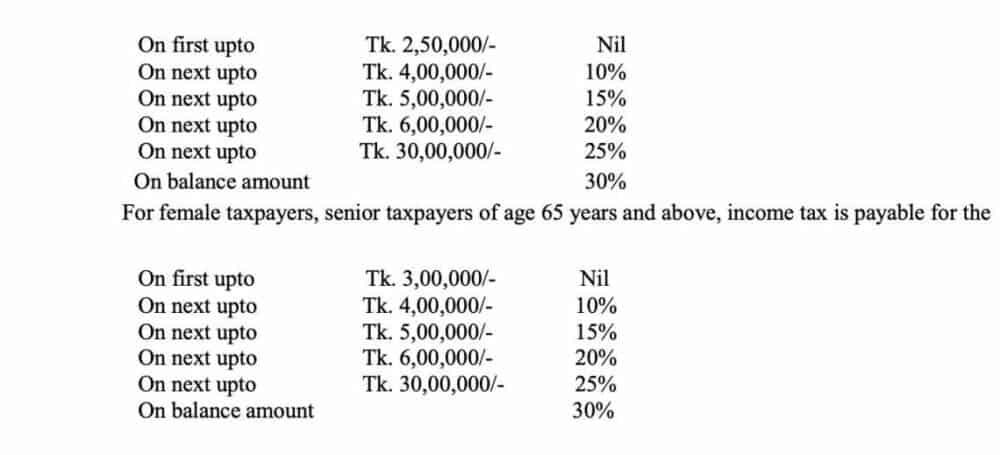

In accordance with the stipulation set out in the Finance Act, if any person earned more than Tk 220,000 during the 2013-14 income year, he / she must send his / her income return along with the source(s) of income. Nonetheless, the total non-taxable income limit will be Tk 275,000 for women and senior taxpayers aged 65 and above, Tk 350,000 for physically challenged mentally handicapped workers, and Tk 400,000 for war injured freedom fighters serving in the gazette.

The following person must also submit his / her income tax return, however, if he / she did not earn much more than the maximum limit, if he / she:

(i) resides in a municipal corporation or paurashava or divisional headquarters (HQ) or district headquarters and owns a motor vehicle including a jeep / microbus or is a member of a VAT registered club;

(ii) runs a business or profession licensed and operates a bank account;

(iii) has registered as a doctor, dentist, lawyer, income tax practitioner with a recognized professional body;

(v) is a candidate for an office of any paurashava, city corporation, or a Member of Parliament;

(vi) assessed to tax for any of the three years immediately preceding the income year;

(vii) participates in a tender floated by the Government, semi- Government, autonomous body or a local authority. In addition, any registered company/Non-Government Organisation (NGO) shall file a return of its income or the income of any other person for whom the company/NGO is assessable to the authority.

The tax rates during the assessment year 2014-15 for individual taxpayer other than female, taxpayers of 65 years and above, differently able person, retarded employee and gazetted war-wounded freedom fighter are as follows:

Income Tax Submission in Bangladesh

The income tax return is something that people are required to submit each year by November 30. And by that time, you will have to update your employment, property, and income tax data through a form. The main reason is that the data submitted for a fiscal year may vary from the information submitted a year earlier.

A taxpayer has to notify the state on its current status after using a TIN. Punitive measures are also in place to avoid taxes.

Every income tax payer is entitled to receive income tax return form free of charge from tax offices or NBR i.e. National Board of Revenue website. In addition, NBR has launched online tax calculator on www.nbrtaxcalculatorbd.org to promote the assessment of their taxes by assessees. Additionally, for small businessmen, doctors and lawyers, NBR offers spot assessment. Anyone who invests Tk 1000,000 as initial capital shall pay Tk 4000 and pay Tk 2000-4000 as income tax to those doctors and lawyers who have practiced their profession for 5-10 years.

For Tax Submission in Bangladesh, each assessee shall deposit the amount to the govt after assessing the amount of income tax. Exchequer by pay order, challan treasury or online via www.nbrepayment.gov.bd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned.

For details of filing system, click here or in the image below-

Many individual classes enjoy tax holidays. For example, if you own savings certificates, invest in the stock market and have life insurance, a certain amount of your income tax will be waived.

For this purpose, income tax lawyers suggest savings tools as they are most risk-free and can be found at the National Savings Bureau, post offices, and banks.

In addition, an assessee shall be guilty of an offense punishable by imprisonment for a term that may extend to one year or a fine or both if he / she refuses to provide the return of income in due time without reasonable cause. In addition, the DC of Taxes will impose fine Tk 10 percent of the last estimated amount, but not less than Tk 1000, and will also impose fine Tk 50 late on each day.

Therefore, a person will be guilty of an offense punishable by imprisonment that may stretch to five years but may not be less than three months or fine or both if he disguises the information or intentionally gives false details of his earnings in regards to tax submission in Bangladesh .

The established income tax collection schemes are soft, complicated, time-consuming and are not yet taxpayers ‘ trouble-free. In this regard, the entire system of tax management should be effectively structured to prevent tax evasion.

If you have a service allegation or other tax-related issues, you can file a written appeal to the tax commissioner detailing the problems.

The prosecutor must hold a hearing on it after receiving the petition, leading to its settlement.

If not, with his or her issues, the taxpayer should petition a jury. The person still has the option to move to the High Court as a last resort remedy in the event of a further failure to substantiate the complaint.

And last but not least, a taxpayer will know that whatever service they get is not safe. In fact, a taxpayer gets the services by paying money.

All goods except those listed in the VAT Act’s First Schedule and all services except those specified in the Second Schedule are taxable goods and services. Originally, a comprehensive list comprising the list of services subject to VAT was the Second Schedule of the VAT Act. The First and Second Schedules now list respectively statutory exemptions to goods and services. The third schedule lists the goods and services subject to additional duties (SD) and their relevant statutory rates.

Most of the countries that implement VAT worldwide operate a single standard VAT rate. Appendix 1 indicates certain countries ‘ VAT rates with the year in which they launched VAT. In regards to Tax Submission in Bangladesh, country’s VAT legislation provides a standard rate of 15 percent for home consumption goods and services in line with best international practice and a zero rate for exports. Under the rule, all taxable goods and services manufactured and sold for sale in the country are subject to VAT at 15%. For all goods and services to be exported and deemed to be exported from the country, a rate of 0 percent applies. In practice, however, there are some other rates that emerged from different methods

All importers, zero-threshold exporters and suppliers (manufacturers, dealers, wholesalers, retailers) of all taxable goods and services with an annual turnover limit of BDT 60 millions (BDT 6 million, equivalent to US$ 80,400) and above are required to be registered under VAT. The VAT law requires a divisional VAT office to issue a certificate of registration within 2 (two) working days of receiving a request.

Businesses below the threshold can opt for voluntary registration of VAT in Bangladesh, in line with international practice. The amount of VAT collected shows that the majority of VAT registered persons are optionally or voluntarily registered.

One of the reasons is that while the threshold has undergone upward revision quite a few times over the past 20 years, those with their existing threshold within voluntary VAT registration could not escape the net once the threshold was increased due to administrative convenience as well as external pressure.

The study of different VAT regimes, particularly those of developing countries, suggests that in a simpler procedure, despite the distortionary effects of the different treatment between undertakings above and below the threshold, many countries tax undertakings differently and at a much lower rate.

This is done primarily because of the administrative and compliance costs, equity and competitive advantages and disadvantages of the economically involved parties. In Bangladesh, this is no exception. Section 8 of the Act provides that undertakings whose annual turnover is below the VAT threshold and for which VAT registration has not been made compulsory are entitled to pay turnover tax @ 3% of declared and approved annual turnover without the possibility of claiming input tax credit. Nevertheless, most of the taxable products listed and a number of items are not eligible for turnover tax as they are required to register VAT.

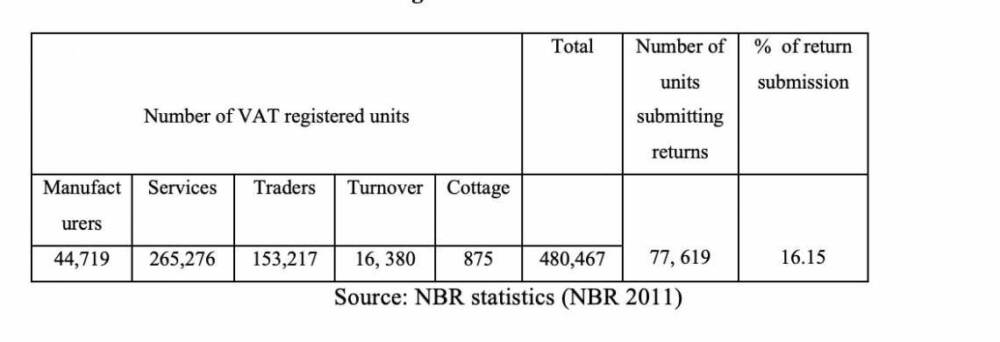

The number of businesses registered under VAT system is 480,467, which is glaringly poor as compared to the number of total businesses in the country. According to the economic census of 2001 and 2003 the total number of businesses in different sectors was 3,674, 971 of which 1,127, 613 were registered with the trade licensing authorities

Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. The Bangladesh VAT filing scenario shows a huge difference between what’s being taught in the book and what’s being done.

Although Return should be the core of all VAT activities in an ideal VAT system, namely tax liability, input tax credit, drawback, and revenue statistics, VAT returns were not given the importance they deserve in Bangladesh. Return filing rate is very low. According to the latest statistics, out of 480,467 registered VAT-payers, the number of returning units in 2009-2010 was only 77,619, i.e. 16.15% (NBR, 2011).

One of the reasons for weak return filing is that VAT is obtained at sources in the case of firms with more than 70% (estimated) registered individuals, such as construction firm, procurement provider. The lack of a culture of voluntary tax compliance is another reason for the unsatisfactory rate of return submission. Due to the lack of successful compliance, the situation is further compounded.

Until now, there has been no significant VAT system automation in Bangladesh. Although most VAT commissioners have data processing units with the VAT Information Management System (VIMS) computer program in place, returns are not processed systematically.

“TR Barristers in Bangladesh is Considered as one of the leading firms in Tax Law in Dhaka, Bangladesh”

Bangladesh is implementing the Harmonized Commodity Coding System. Import ProceduresDocuments required for importation include a letter of credit authorization form, a lading or airway bill, commercial invoice or packing list, and origin certificate. For certain imported items or services, the relevant government agencies require additional certifications or import permits related to health, safety or other matters. For the public sector, reduced documentation requirements are applicable.

Foreign companies must obtain permission from the Chief Import and Export Controller and submit the following documents: photocopies of an import registration certificate; photocopies of invoices, lading bills and import permits duly certified by the bank; a copy of the General Index Register (GIR) certificate; a certified copy of the last tax order; name and description of each impairment.

The following documents must be submitted by private sector importers: certificate of affiliation to a registered chamber of commerce and local industry or professional association established in Bangladesh; proof of payment of renewal fees for import registration certificates (IRC) for the tax year; copy of tax identification number (TIN) certificate; three copies of previou proof of payment.

A new customs law is likely to soon be put in parliament under which the government will have to digitalize the associated environment, said National Revenue Board (NBR) officials.

The new draft law also implements various measures in line with global trends to promote the clearance of goods planned for export and import from ports to encourage international trade, they said.

“In view of international best practices, we have drafted the new law. The latest one is more up-to-date and more pragmatic, “a senior official of the NBR said, trying to remain unnamed as he was not allowed to speak to the media.

The new law includes various measures to promote faster trade, followed by advanced economies.

One of the clauses is the Advance Cargo Declaration, which provides companies with the ability to request customs-related import documentation prior to the arrival of goods in ports.

Under a mechanism called Post Clearance Audit, the new law will also open up the scope for compliant businesses to quickly clear goods.

According to the draft, compliant and honest traders will receive a green channel for importing and exporting goods as authorized economic operators.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Tahmidur Rahman, Senior Assoicate

31 October 2019

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

One of the important steps of starting business in Bangladesh is acquiring a trade license. A businessman must obtain a business license from the respective business area’s City Corporation or City Council. Here, in this post in details we will explain the procedure of obtaining a trade license in Bangladesh, the fees and finally the renewal process of trade license in Bangladesh.

Below is an overview of the process of obtaining a trade license for companies operating within the zone of Dhaka City Corporation. Many local authorities have similar rules.

Step 1:

Collect prescribed Application Form from the City Corporation/ Municipal Corporation/ Union Parishad’s Office.

Step 2:

Submit completed Application Form with supporting documents to the concerned section.

Step 3:

Inspection by the Licensing Supervisor.

Step 4:

Required fees to deposit at the concerned office.

Step 5:

Obtain Trade License form the City Corporation/ Municipal Corporation/ Union Parishad office.

The trade license filled-in application form must be accompanied by the required documents.

Depending on the type of business, Dhaka City Corporation (DCC) has two forms for a trade license. The “K” form must be used by a commercial firm. Although the ten zonal offices use the same K form, the form must be obtained by a client from their respective zonal office. What distinguishes it from that of other zones is a seal and the officer’s initials selling the form. The form will cost Tk. 10 (Yes, it’s that low to encourage potential business ventures).

On completion of the application, it must be sent for approval to the local ward commissioner.

For the K Form, the receipt of the lease for the premises from which the company operates or, if purchased, the receipt of the municipal tax payment shall be made. Supporting documents include: 3 copies of owner’s PP size photo Rent receipt or proof of ownership of premises

The LS usually goes to the business entity for a visit when submitting the form to verify the information provided.

The business is asked to go to the DCC office to pay the predetermined fee and collect their trade license after the LS inspection is completed. The fee schedule depends on the class under which the application was made.

Another choice for commercial licensing is the signboard charge. The company’s charge is compulsory for all types of business. A trader has 30% of his license fee to pay.

From the zonal office of the DCC where the manufacturing company must submit its request.

Local ward commissioner must validate the completed form.

Supporting documents include:

1. 3 copies of the owner’s PP size photo

2.Rent or premises ownership proof

3. No neighbourhood objection certificate

4. Written undertaking on a Tk 150 non-judicial stamped paper

5. Fire license from the local fire department.

The LS usually goes to the business entity for a visit when submitting the form to verify the information provided.

Once the LS has completed its inspection, the company is asked to go to the DCC office to pay the predetermined fee and collect its trade license. The fee schedule depends on the class under which the application was made.

A signboard fee must also be paid when collecting the trade license. The signboard fees must charge 30 per cent of the license fee for all types of business.

” TRW is Considered as one of the leading firms in Investment Law in Dhaka, Bangladesh” (Tahmidur Rahman)

Trade License Renewal Process in Bangladesh

The renewal process for your business licenses You must collect a form. There will be options in the form from 1 to 18. From 1 to 6, you must write the name of the institution, the name of the applicant, the name of the applicant’s parents.

If there are two people to start trading, the name of two people should be included. In addition, the two applicants ‘ pictures should be included. But you have to pick one from the business while dealing with different people. Accessing this person can accomplish the application.

The address of the company should be noted in the 7 number blank box. You must write the number of national identity cards in the 8 number blank boxes. You need to write down seriously in the 10 number empty boxes. You’ve got to write your mobile number there. You have to fill in the entire form in this way until the end. You must submit this to the authority by completing the form. You will then have the approval for renewal to continue your business legally. It’s not difficult to renew trading licenses. Only, according to the procedure, you have to go. You can do all the work perfectly within one day.

You may contact us to know how to renew your business license in detail.

When the expiring trade license is checked, the LS fills the details in the demand bill and gives the business booklet. The demand bill is like a bank deposit slip, a four-page booklet. All the pages contain the same information: one page is for the bank and one page is for the business.

Deposit by application bill designated bank and automatically renew the license.

“Depending on the type of business, Dhaka City Corporation (DCC) has two forms for a trade license. The “K” form must be used by a commercial firm.”

Once a company is registered or is about to register, it is absolutely essential that the person in charge should know the business niche and comply in a much-needed legal manner in order to avoid challenges. For example, if a business that may have an impact on the environment has to procure a company’s relevant licenses, permits and certificates in Bangladesh. We at TR Barristers in Bangladesh Associates provides Company and Corporate Legal services to help acquire such Licenses.

FAQ that our clients generally ask about trade license in Bangladesh

For any kind of business enterprise in Bangladesh, a trade license is compulsory. It is issued by the respective areas of the local government. Each business enterprise must acquire a Trade License from each local authority under which it operates. If a business enterprise has more than one business site, each local authority must acquire a trading license. It is released for a period of one year and has to be periodically renewed. Some government fees are attracted by the Trade License, which typically depends on the business forms.

The process of obtaining trade licenses for companies operating within the area of Dhaka City Corporation is listed below. Some municipal councils have laws that are identical. For more details, you are advised to contact the appropriate local government.

STEP 1: Obtain the Correct form.

Depending on the type of company, Dhaka City Corporation (DCC) has two types of commercial license. The “K” type needs to be used by a commercial company. Although the ten zonal offices use the same K form, the form must be obtained by a company from its respective zonal office. What sets it apart from that of other zones is a seal and the initials of the officer selling the type. The form will cost Tk. 10.

STEP 2: GET THE LOCAL WARD COMMISSIONER’S CREDENTIALS.

It has to be sent for validation to the local ward commissioner after the form is completed.

STEP 3: Obtain a license book from TK. 50 and Send APPLICATION TO DCCS ZONAL OFFICE WITH SUPPORTING Documents.

For the K Form, it is appropriate to include a rent receipt for the premises on which the company is operating or if owned, a municipal tax payment receipt. Documents to support this include:

3 copies of the owner’s picture in PP format

Leasing receipt or proof of possession of premises

Stage 4: Wait for the enquiry of the Licensing Supervisor (LS) .

The LS usually goes to the business organization for a visit upon submission of the form to check the details given.

Stage 5: PAY PREDETERMINED FEE AND CLOSE TRADE LICENSE.

The company is requested to go to the DCC office to pay the predetermined fee and receive their trade license after inspection by the LS is concluded. The schedule of payments depends on the business category in which the request was filed.

Phase 6: FEE OF SIGNBOARDS

A signboard fee often has to be charged when collecting the trade license. For all forms of companies, 30 percent of the license fee would be paid for signboard fees.

STEPS PROCESS:

Step 1:PROCURE THE PROPER FORM

For Tk, the “I” shape will have to be purchased. 10 from the DCC zone office where the manufacturing business has to send its order.

STEP 2:GET CERTIFICATION OF THE LOCAL WARD COMMISSIONER.

The completed form must be checked and certified by the local ward commissioner.

STEP 3:SUBMIT APPLICATION WITH DOCUMENTATION SUPPORTING.

Supporting documents shall include:

3 copies of the owner’s picture of PP scale

Leasing receipt or proof of possession of premises

No neighborhood certificate of objection

A written undertaking for a Tk 150 non-judicial stamped paper

Fire License of the local fire department Environmental Certificate of the DOE

Stage 4: AWAIT ENQUIRY ON THE LICENSING SUPERVISOR (LS).

Upon submission of the form, the LS typically goes to the business entity for a visit to check the details given.

STEP 5: PAY PREDETERMINED FEE AND COLLECT TRADE LICENSE.

After inspection by the LS is concluded, the business is asked to go to the DCC office to pay the predetermined fee and collect their trade license. The fee schedule depends on the business category under which the application was filed.

STEP 6: SIGNBOARD FEE

When collecting the trade license, a signboard fee has to be paid as well. For all types of business the signboard fees will payable 30% of the License fee.

You need to get a drug license if you want to deal with medicine. This drug license is issued by the Department of Medicine Administration under the Ministry of Health and Family Planning. License fee is 3000 BDT inside the municipal area and outside the municipal area is BDT 1500.

You need the following documetns for getting a drug license in Bangladesh:

Good manufacturing Practice (GMP) Certificate:

An applicant needs the following documents:

[Note: Each and every copy should be attested by first class gazette officer/ Word Councilor]

The renewal process is comparatively routine and no inspection is required. When the trade license comes up for renewal the business has to go the LS.

The LS fills in the details in a demand bill upon reviewing the expiring trade license and gives the company the booklet. A four page booklet similar to a bank deposit slip is the demand bill. All the pages are filled with the same information: one page is for the bank and one is for the company.

Deposit designated bank through demand bill and it will automatically renew the license.

| Business Type | Sub Type | Trade License Fees in Taka | City Corporation |

| Bank, Insurance & Fincial Insttution | Scheduled Bank | 10000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Scheduled Bank | 10000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Insurance(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Insurance(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Lending Institution(Branch Office) | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Lending Institution(Branch Office) | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Currency Excenge | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Currency Excenge | 5000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | Stock Buy-Sale Organization(Branch Office) | 3000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | Stock Buy-Sale Organization(Branch Office) | 3000 | Comilla City Corporation |

| Bank, Insurance & Fincial Insttution | N.G.O(Branch Office) | 5000 | Dhaka South City Corporation |

| Bank, Insurance & Fincial Insttution | N.G.O(Branch Office) | 5000 | Dhaka South City Corporation |

| Business Nature | Capital From Taka | Capital To Taka | trade License Fees | Sub-Category |

| Limited Company | 0 | 100000 | 1500 | Dhaka South City Corporation |

| Limited Company | 0 | 100000 | 1500 | Comilla City Corporation |

| Limited Company | 100001 | 500000 | 2000 | Comilla City Corporation |

| Limited Company | 100001 | 500000 | 2000 | Dhaka South City Corporation |

| Limited Company | 500001 | 1000000 | 3500 | Comilla City Corporation |

| Limited Company | 500001 | 1000000 | 3500 | Dhaka South City Corporation |

| Limited Company | 1000001 | 2500000 | 4500 | Comilla City Corporation |

| Limited Company | 1000001 | 2500000 | 4500 | Dhaka South City Corporation |

| Limited Company | 2500001 | 5000000 | 5500 | Dhaka South City Corporation |

| Limited Company | 2500001 | 5000000 | 5500 | Comilla City Corporation |

| Limited Company | 5000001 | 10000000 | 7500 | Dhaka South City Corporation |

| Limited Company | 5000001 | 10000000 | 7500 | Comilla City Corporation |

| Limited Company | 10000001 | 50000000 | 10000 | Comilla City Corporation |

| Limited Company | 10000001 | 50000000 | 10000 | Dhaka South City Corporation |

| Limited Company | 50000001 | 999999999999 | 12000 | Dhaka South City Corporation |

| Limited Company | 50000001 | 999999999999 | 12000 | Comilla City Corporation |

PARTNERSHIP -PROCEDURE OF REGISTRATION

A collaboration with the Registrar of Joint Stock Companies and Company of Bangladesh (‘RJSC’) may be registered.

The registration process for the partnership consists of two steps: a) reservation of the name; and b) entity registration. A partnership registration may be done within one or two days under normal circumstances.

Step 1- Selecting the name of the Relationship

The partners are free to choose any term, subject to the following rules, as they want for their partnership firm:

To contribute to misunderstanding, the names must not be too identical or close to the name of another existing company doing similar business. The explanation for this rule is that a company’s image or goodwill can be injured if an allied brand can be adopted by a new company.

The name does not include any terms expressing or suggesting the government’s sanction, approval or sponsorship.

You can apply for name clearance using the RJSC website once you have selected a name.

| Category | Number of Workers | License Fee (BDT) | Renewal Fee |

| A | 5-30 | 500 | 250 |

| B | 31-50 | 1000 | 500 |

| C | 51-100 | 1500 | 800 |

| D | 101-200 | 2500 | 1200 |

| E | 201-300 | 3000 | 1500 |

| F | 301-500 | 5000 | 2500 |

| G | 501-750 | 6000 | 3000 |

| H | 751-1000 | 8000 | 4000 |

| I | 1001-2000 | 10000 | 5000 |

| J | 2001-3000 | 1200 | 6000 |

| K | 3001-5000 | 15000 | 7000 |

| L | 5001 & Above | 18000 | 8000 |

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

This post in will explain in details the Land LAW IN BANGLADESH – Rules & Regulations, Everything about property law that you need to know and be aware of.

At first let’s summarise the main forms of land properties or title to lands in Bangladesh. It is important to understand that the types of land classified below may co-exist so that there are several layers of tenure in relation to one parcel of land. For example, a person who has common law freehold may enter into a 3-year lease with a tenant, who may in turn lease a room to a sub- tenant.

Exclusive land ownership for an indefinite period of time. No PRIVATE INDIVIDUAL HAS THE RIGHT TO OWN MORE THAN 20 ACRES OF AGRICULTURAL LAND UNDER BANGLADESHI LAW. It is estimated that 69% of farm land ownership in BANGLADESH IS CURRENTLY COMMON LAW Freehold (as surveyed in 2005).

The right to use a government land plot for a term of 99-years at no expense varying from one to three acres. The Ministry of Lands grants landless persons (i.e. persons without freehold of common law) rights to use khas. Often this type of tenure is called a’ permanent lease.’

The right to use land or housing owned by another, also referred to as a money lease, for a fixed period in exchange for payment of rent. It is important to sign leases of more than one year. There is no need to provide one year or fewer leases in writing.

Each shareholder and landowner receives one-third of the crop, and the remaining third is allocated on the basis of their contribution to crop costs. Sharecropper contracts must be legacy for at least five years.

Official government bodies and normal institutions share jurisdiction over property law in the Chittagong Hill Tracts. Nevertheless, customary law is applied in practice and institutions of government seldom interfere.

Cooperative ownership is a condominium-like ownership of an apartment. The purchaser holds stock shares in the building company and a rent or transfer of the apartment being sold by the seller’s contract in a collective ownership.

Where a person occupies residential accommodation as an employee of a government agency or private organization, or as an agricultural land labourer.

There are many forms of unofficial tenure, which means tenure that does not meet the requirements for registration. It includes the following details.

• Leasing without a registered lease— a person who has a verbal AGREEMENT to occupy land or housing for a rent payment of more than one year or from year to year.

• Unregistered land ownership— a person owns land under circumstances but the land is not properly registered. For example, the land transfer was not registered to the current owner, or the current owner owns part of a subdivided block and the subdivision was not registered.

The Lands Ministry, which has the following divisions, is the largest government agency responsible for land management, which governs the Land LAW IN BANGLADESH – Rules & Regulations, and Everything regarding property law.

• The Land Record & Survey Directorate is responsible for conducting land surveys and creating individual land registration certificates (khatian) and maps (mouza) for each parcel of land.

• The Land Reform Board is responsible for administering government land (i.e. khas), establishing and collecting land development tax, ENFORCING LAND REFORM LAWS and preparing modified property registration certificates.

• The Land Appeal Board is responsible for the determination of appeals against decisions of government officials on land issues, namely land taxes and land ownership and boundaries as reported in land registration certificates (khatians) and maps (mouza).10 In addition to the above, the Land Registration Department is responsible for the registration of land ownership changes arising from land recording. The LAND REGISTRATION OFFICE IS HOUSED WITHIN THE LAW, Justice and Parliamentary Affairs Ministry. This operates at district level by District Registrars and by Sub Registrars at Upazilla, i.e in Sub-District Level.

“TR Barristers in Bangladesh is Considered as one of the leading firms in Property Law in Dhaka, Bangladesh”

Carpe Noctem Bangladesh

According to Bangladeshi law, the following forms of TRANSACTIONS are required to be registered: leases for more than one year or from year to year; freehold transactions relating to common law, such as transfers or subdivisions; and the granting of 99-year government land leases (khas).

In fact, informal conveyancing is extremely common as there are major issues with the system of land REGISTRATION IN BANGLADESH.We use the word ‘ informal conveyancing’ to refer to transactions that do not comply with the criteria for registration. The World Bank ranks Bangladesh 186th out of 190 countries for the speed, reliability and performance of its land registration processes.17 The shortcomings in the land registration PROCESS IN BANGLADESH are as follows:

For example, registering a transfer of freehold land in Dhaka will take about 245 days, require a payment of 10 percent of the purchase price and involve eight different procedures.These procedures are generally too difficult for lay people to follow without legal assistance, and too expensive for urban poor people. The cost of land registration is exacerbated by required speed moneys in government offices.

The reliability of land registration certificates (khatian) and maps (mouza) is undermined by the fact that there are several government agencies involved in the process of land registration and poor coordination between them. At three different offices, ownership rights are registered:

o The Directorate of Land Record & Survey (DLRS) is responsible for conducting surveys of land, including preparing individual land record certificates (khatian) and maps (mouza);

o The Department of Land Registration (DLR) is responsible for registering land transfers and reporting these to the Land Reform Board; and

o The Land Reform Board (LRB) is responsible for manually preparing updated land record certificates.

The purchaser often requires a comprehensive due diligence report on several complex issues involving authenticity, title, possession and land transfer history prior to acquisition, purchase of land or long-term lease for commercial purposes. ONLY A PHYSICAL SEARCH OF BOOKS AND RECORDS IN A NUMBER OF OFFICES CAN PROVIDE THE SAME, IN ADDITION TO PHYSICAL SURVEY IS OFTEN REQUIRED TO LOCATE AND MEASURE THE LAND. ONCE DUE DILIGENCE IS DONE, WHEN LAND / BUILDING / APARTMENT IS FOUND TO BE SATISFACTORY, THE PURCHASER ALSO NEEDS ASSISTANCE IN PREPARING THE DOCUMENTATION OF THE DEED OF AGREEMENT for Purchase (Baina); Sale Deed; Lease Agreement, etc. It’s a very complex matter to deal with land.

CLICK HERE TO MAIL US IF YOU HAVE ANY LEGAL QUERIES REGARDING THIS

OR CALL US ON : +8801847220062 OR +8801779127165

In Bangladesh, the transfer of property is GOVERNED by the Transfer of Property Act 1882, which essentially shapes the Land Law in Bangladesh & Rules and regulatations. In this act, “transfer of property” means an act by which a living person transmits property to one or more other living persons, or to himself, or to himself, or to one or more other living persons, in the present or future; and “transfer of property” means such an act. “Living PERSON” INCLUDES AN INDIVIDUAL CORPORATION or association or body.

There are four modes of property transfer given below: sale; lease; exchange; and inheritance and mortgage transfer of gift property.

Sale is an ownership transfer in exchange for a price paid or promised or part paid or promised. Unless the price is determined, a sale is not complete.

Contract for Sale: If the seller and buyer agree to sell or buy the property at a later stage, the seller and buyer must enter into a contract for sale. A agreement establishes a contractual responsibility between the buyer and the seller, and a contract for sale does not change ownership of the property. A sales contract in the sub-registry should be registered.

The lease of immovable property is a transfer of the right to enjoy such property, made expressly or implied or in perpetuity for a certain period of time, in consideration of a price paid or promised, or in consideration of money, a share of crops, services or any other value.

The trade is called an exchange if two people swap each other’s ownership of one item for the possession of another, one thing or both things being cash only.

Gift is the transfer of certain existing mobile property made voluntarily and without consideration by a person called the donor, to another PERSON CALLED THE DONOR AND ACCEPTED BY THE DONOR OR ON BEHALF OF HIM.

“The lease of immovable property is a transfer of the right to enjoy such property, made expressly or implied or in perpetuity for a certain period of time, in consideration of a price paid or promised, or in consideration of money, a share of crops, services or any other value.”

Under the present LAWS OF BANGLADESH, the deed by which the property will be transferred is required to be registered with the relevant Sub Registry Office. Non registered document has no legal value and the any party will not be able to enforce his/her right if the deed is not registered.

If the name of the transferor is not found in the latest Khatian or his/her name is not mutated, the Sub Registrar will refuse to register the transfer deed. Therefore it is mandatory to mutate the name of the transferor in the latest Khatian.

If you wish to know about the rquired steps to go through before buying any property in Bangladesh, go through the Article Below. This post deals with the questions like Why it’s important to verify the ownership of any property in Bangladesh? How to find the Ownership of a Land?

By choosing TRW Law Firm, clients can be confident that their land documents are in capable hands, backed by legal professionals who are dedicated to achieving the best possible outcomes.

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, 330 High Holborn, London, WC1V 7QH

Email Addresses:

INFO@TRFIRM.COM

INFO@TAHMIDUR.COM

INFO@TAHMIDURRAHMAN.COM

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817